By now, over 159 million Americans have received their share of the $2 trillion stimulus package passed a couple of months ago. However, many millions are still waiting. I have received thousands of e-mails and comments from many of you wondering where your money is. So, here is an update with the most recent information.

Where is Your Stimulus Money? The Latest Information to Help You

4 Million Americans Are Receiving the Money on a Prepaid Debit Card – Many Have Thrown It Away

While most of the payments have been issued with direct deposit, checks are going out to millions of others. However, for 4 million people that had their returns processed by the Andover or Austin processing centers and did not have their bank information on their most recently processed return, prepaid cards are going out to them.

To find out more about those cards, check out this post.

But, many have thrown these cards away thinking they were spam or garbage. If you should have received it (or think you may have), here is what you can do. Call 1-800-240-8100 for a FREE replacement (option 2 from main menu). This is the number and option for a replacement card. This will only be if you had already received the card, but it can be hard to know for sure if you were to have received one (I had a family member receive one and they did not have their return processed by either center and their banking information was on their recent return).

Get My Payment Says You Have Been Paid Already?

The Get My Payment tool, while it has been improved, has not been reliable for everyone. Still, if you the tool now says that your payment has gone out but you have not received it yet, you can contact the IRS. Be warned – even though they have staffed this number with more reps, the wait time could be long.

Call 1-800-919-9835 to find out what happened with your payment and to have them let you know where it is at.

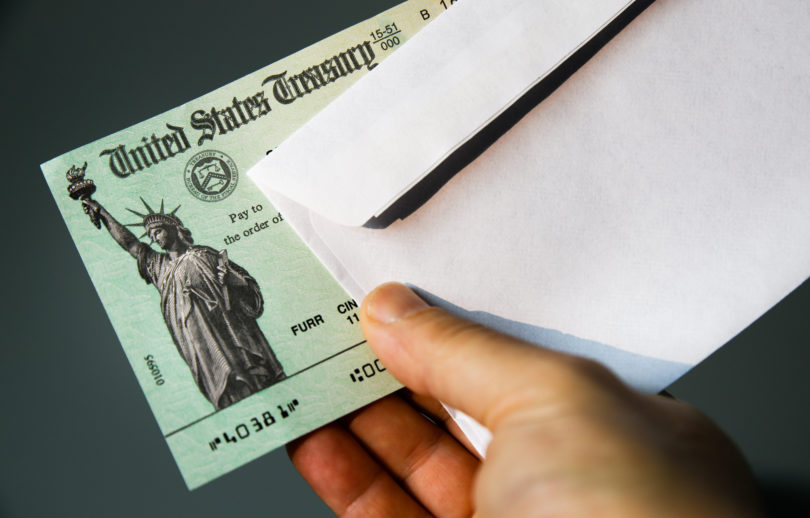

If You Are Receiving a Check, Here is When You Should Receive It

For everyone else, here was the previously published schedule on when the checks would be mailed.

- $10,000 – $20,000 | May 1

- $20,000 – $30,000 | May 8

- $30,000 – $40,000 | May 15

- $40,000 – $50,000 | May 22

- $50,000 – $60,000 | May 29

- $60,000 – $70,000 | June 5

- $70,000 – $80,000 | June 12

- $80,000 – $90,000 | June 19

- $90,000 – $100,000 | June 26

- $100,000 – $110,000 | July 3

- $110,000 – $120,000 | July 10

- $120,000 – $130,000 | July 17

- $130,000 – $140,000 | July 24

- $140,000 – $150,000 | July 31

- $150,000 – $160,000 | August 7

- $160,000 – $170,000 | August 14

- $170,000 – $180,000 | August 21

- $180,000 – $190,000 | August 28

- $190,000 – $198,000 | September 4

What the Treasury Department Says for Those That Still Need to Take Action

Individuals who do not normally file taxes and have not received my Economic Impact Payment.

Individuals who do not normally file taxes and have not yet received their Economic Impact Payment should use the Non-Filers Tool. Americans who did not file a tax return in 2018 or 2019 can submit basic personal information to the IRS so that they can receive payments. This tool will remain available until October 15 and anyone who registers by October 15 will receive their payment by the end of the year. The Non-Filers Tool can be found here.

Individuals who do file taxes, and believe they are eligible for an Economic Impact Payment, but haven’t received one.

Individuals who do file taxes, and believe they are eligible for an Economic Impact Payment, but haven’t received one will be able to claim their payment when they file their 2020 tax return.

If you need the payment sooner, you may call the IRS Economic Impact Payment line at 800-919-9835. Call volumes are high, so call times may be longer than anticipated. (same as I said about the Get My Payment Tool)

Individuals who think their Economic Impact Payment was incorrect.

Payment amounts vary based on income, filing status and family size. If you filed a 2019 tax return, the IRS used information from it about you, your spouse, your income, filing status and qualifying children to calculate the amount and issue your Payment. If you haven’t filed your 2019 return or it has not been processed yet, the IRS used the information from your 2018 return to calculate the amount and issue your Payment.

If you did not receive the full amount to which you are entitled, you will be able to claim the additional amount when you file your 2020 tax return.

Individuals who have dependents and did not receive the $500 per dependent

If you did not receive the full amount for a dependent to which you believe you are entitled, you will be able to claim the additional amount when you file your 2020 tax return.

Here Are Some Other Articles To Help

You may want to check out some of the other articles I have written about the stimulus payments as well. Hopefully, they (or the comments and answers) may give you some help so you won’t have to wait on hold.

- Stimulus Money for SSI Recipients: What You Need to Know

- What Happens if You Didn’t Get Your Stimulus Money Yet?

- Here is When You Will Get Your Stimulus Check

- Stimulus Money Problems? Here is Why You May Not Have Received Your Money

- Is the IRS “Get My Payment” Tool Not Working? This May Help

Im on ssa and i haven’t. Got my first stimulus check yet im trying. Fimd out why i ain’t got it

The irs is playing gaming with my wife and I. The get my payment said that our check was mailed April 24. After 4 weeks we called the irs (june 9) and they told us if the check hadn’t been cashed they’ll send a new and we’ll have it in six weeks. (July 21) Six weeks later called again. We where told that we didnt get the check that get my payment said was mailed. Because they never put one in the mail on the Aug 24. Now get my payment get says we’re getting one and no date of when. Irs says 30 more days. But there sending out money to familys that didn’t get the money for their dependants. ( witch is good) but my family of three (me my wife and my 9 year old) havent gotten a dime. The last time my wife called them (not sure july 28-30) she was told why did you call you where told to wait.

My girlfriend that I used to live with put me down as a dependent without my permission I am 31 years old and in no way dependent on her. Since she did that it says I’m not eligible for the impact check. How do I fix this?

Definitely call the IRS number to ask about this. Not only is this wrong, but it is also tax fraud on her part so you should be able to get it sorted. I don’t know if you will get the last check but you should be able to get the next one if you can get it fixed.