Last week, I wrote about the brand new X1 smart credit card that opened up for waitlist applicants. Well, there were a lot of people to sign-up! To put it into perspective, at present, I am just over 1,000 in line and I think that there are over 150,000 right now! Just through my site, thousands of people signed up. But, there are still questions about the X1 credit card – especially if it is really too good to be true.

How the X1 Credit Card Will Make Money

Link: All About the New X1 Credit Card

The X1 Process

The X1 credit card will eventually open up to the people on the waitlist for applications. The X1 card will not run the applications like traditional credit cards – instead of the cards we are all familiar with, the X1 card will do a soft pull on your credit report to verify your identity and then use any document you want to send them to approve you and give you a credit line (things like an offer letter or your paystubs).

Before last week, the X1 card was set to charge an annual fee and the reward structure was far different than it is now. But, the people behind the X1 credit card, specifically CEO Deepak Rao, talked to many people to survey them what they would like in a card, especially during this period of no travel (for cardholders that have cards like Amex Platinum and Chase Sapphire Reserve).

The current reward program was adjusted in its earnings (the partners have stayed the same) to adapt to what customers wanted from such a credit card. Now, we have the straightforward 2X on everything, 3X on everything when you spend $15,000 in a cardmember year, and 4X on everything in a month when you refer someone.

So, How Will the X1 Credit Card Make Money?

No annual fee, no late fee, no foreign transaction fee, and a low 2% balance transfer fee – how will the X1 credit card make money to be able to afford such valuable award credits as their model is right now?

For instance, since every point is worth at least 1 cent, this card will, at the lowest end, earn 2 cents per dollar spent (when redeemed at partners). With most interchange fees (the cost to the merchant for swiping a credit card) not even covering that reward amount for X1, it is a good question as to how X1 will make money with it.

Also, it is possible to earn up to 4X which would make it even harder for them to earn money on someone at that level. So, again, how will X1 make money?

Interest Rates

All credit card companies make a bundle on their interest rates. This is the amount that cardholders will pay if they carry a balance on their credit card past the card due date. The X1 variable interest rates are 12.9% – 19.9%.

This credit card will be a huge target for the Generation Z market. One of the things that makes this card different than other cards is the credit limit being based on the current and future income range of an applicant instead of their credit history. It means that people coming out of school and getting jobs will (potentially) get much higher credit lines than if they tried applying for some other card.

That credit line could make many young, new cardholders feel comfortable charging up more on it and just paying the interest as time goes by. Not every Gen Z applicant will be like this but it would fit in with a lot of that range of the market. So, X1 will be able to make some good money off of their interest rates – far more than they would be paying out in rewards to the person carrying the interest.

Low Acquisition Cost

Most credit cards have to offer a nice sign-up bonus to attract customers to get the card. When this happens, it takes a while for the credit card company to make back their acquisition costs on an applicants. For example, most cards could take 2-3 years for the bank to start making money on the customer. With the Chase Sapphire Reserve, it took 4 years – which means Chase is just now finally starting to make money on many of the early adopters!

For the X1 card, they are working hard to keep their acquisition costs low. While they will (eventually) offer an affiliate program that will pay partners for successful applications, at present, all they are doing is offering people a month at 4X spending for every person who signs on the waiting list through their link – and eventually gets the card.

That isn’t as much money as a sign-up bonus or even most affiliate payouts, So, right off the bat, the initial acquisition cost is low because X1 isn’t paying anyone to market it or paying out on a sign-up bonus.

This low acquisition cost puts them in a strong position to start making money on many customers right away. Even with customers earning 2X points, there will be enough people that will start carrying balances and X1 has financial backers to fund this card’s startup.

Upsell to Other Products

The CEO of X1 told me that they want to build a market of customer loyalty and they want to, eventually, offer upsells on other financial products. This may be things like a more premium card (that could go after cards like the Amex Platinum or Chase Sapphire Reserve) or some other products that would appeal to the X1 customer base.

But, at the start, X1 wants to build that customer loyalty and with some of the smart features they have, that could help lock those customers in since there are not other cards that offer all of those things together. This makes it easier for customers to just stick with the X1 portfolio.

Information

The X1 card is a tech play in the credit card space. For companies like this, the data that can be obtained from financial transactions can be a huge source of income down the road.

This is one thing that companies pay millions of dollars for – finding out the spending habits of a demographic. It influences advertising as well as positioning for products that customers tend to get often (Amazon does this with their warehouses now). With X1 having the tech backing and platform they have, the potential value on the information can be huge.

The Rewards Themselves

While the reward structure is great, there will be many customers that will not always use them or will just let them sit. This means that X1 is not paying out on any of those rewards as long as they are just sitting in a customer’s account.

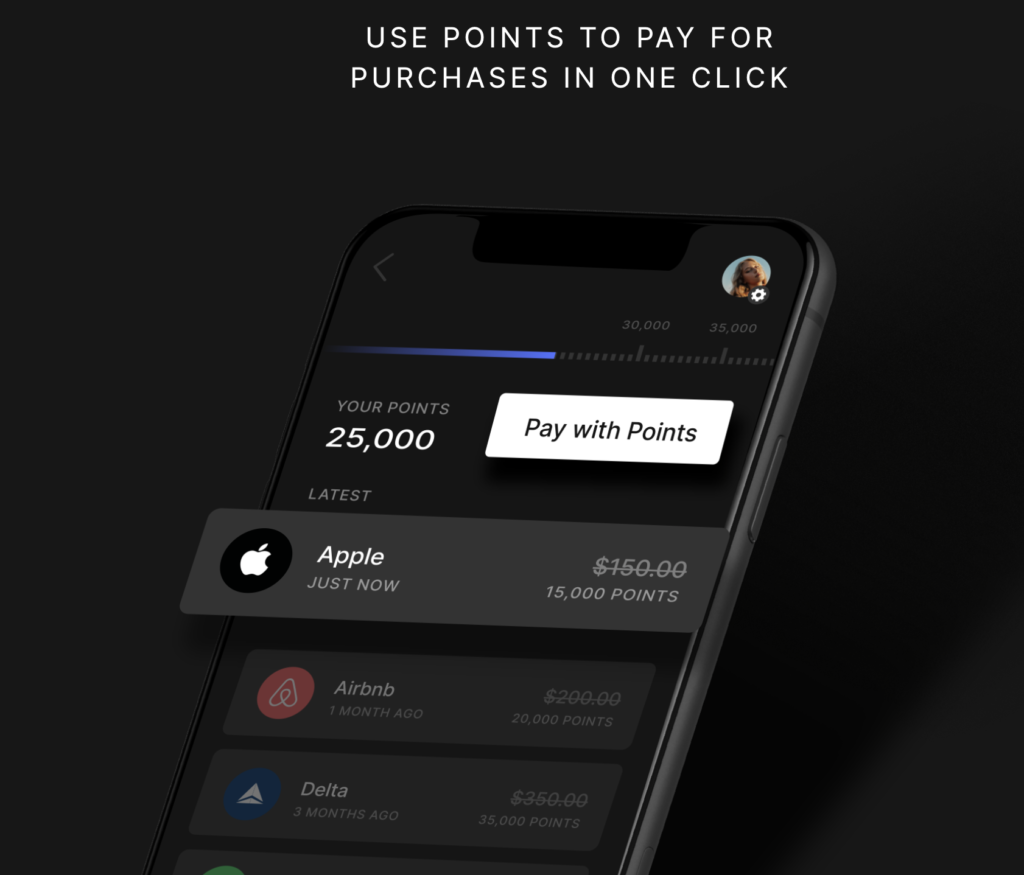

Even for the redemption, X1 may have some deals in place with certain vendors (likely the ones that are in the higher redemption brackets) to get those credits at a discount. Since customers need to spend at those vendors to get the rewards applied against the purchases, X1 can use this to work out a deal with vendors to encourage customers to use their card at those retailers.

Bottom Line

Many people are wondering if the X1 credit card is too good to be true. While it may seem so at first blush, hopefully this post shows you how the X1 can make money so maybe it will be as good as it sounds!

The people behind the X1 card are not novices in the tech space – they have raised money and they do know what they are doing (even someone that will be handling their affiliate program is someone with a good deal of experience in that space) so they definitely want to be around for the long-haul.

The one wildcard – to me – will be the cardholder that knows how to really rack up rewards. From my conversation with Deepak, I can say that he is aware of the practice of manufactured spend and they will be able track this. I cannot say what this will mean for the customer who is buying thousands of gift cards in a month when they earn 4X points but the crew at X1 are not oblivious to this. I would imagine you will see some language in the card application that will shed some light on that.

But, for the market that this card should be very popular in – Gen Z users – I think there are many ways that X1 will be able to be successful. I hope they are, and not just for the reward program. Some of their tech moves are things that would be great to see adopted by other credit companies as well so it is nice to see the old envelope on perks get pushed a little bit.

Please do not leave your referrals in this post. I have allowed many in the other post if you want to try there but I may restrict them at some point since there are so many.

I was wondering about the spread. In theory if I got a credit line based on income, it would be in the millions. I have to pay estimated taxes every quarter but the one there’s a spread on is January estimated taxes. In theory, I could overpay my January estimated taxes by millions with 1040ezpay which charges 1.89percent to pay with a card. Then if I’m at a 4 percent month, make a 2.11 percent spread assuming I can file my taxes early and get my refund