While I would normally say that 2020 is not the best time to introduce a new credit card, the X1 is not your normal credit card and it is one that is actually perfectly suited to the modern age we are in. Find out all the details about this brand new credit card and how the reward program works.

The New X1 Credit Card

Link: The New X1 Credit Card (this is a reader’s link)

What is the X1 Credit Card?

First of all, this card is a completely new venture backed with the power of people from areas that definitely benefit a new card like this. The CEO and co-founder, Deepak Rao (former Group Product Manager at Twitter) has a good team backing this card to shake things up a bit in the credit card space.

It is a Visa Signature card, which means it has all the usual benefits of the Signature program. It also means it is accepted anywhere Visa is accepted. The card itself weighs 17 grams and is made of stainless steel. But, the real power of the card is the way the credit limits work and the reward program you can take advantage of.

The X1 Credit Card – Smart Credit Limits

When one applies for the X1, there is a soft credit pull to verify your identity. But, the heavy lifting of determining your credit eligibility is based on your future, not your credit past. This means the card’s limits grow as you move on in your career (they say up to 5X more than traditional credit cards use).

These credit lines are set based on things like an offer letter for your job, your pay stubs, or linking to your bank account. This way, X1 can offer you credit limits based on your salary and earning instead of your credit past. Plus, these increases will happen automatically when you link up or send those documents to them!

This does not mean that it is not for someone with a mid-tier income. All it means is that your credit line will be tied to your salary instead of credit history.

Here is what X1 says about this system: By looking at current and future income instead of credit score, the X1 Card can responsibly set smart credit limits up to 5 times higher than traditional credit cards and have limits rise automatically as cardholders advance in their careers. The higher limit also gives cardholders the opportunity to have a lower utilization rate, allowing them to increase their credit score faster.

X1 Card has no annual fee, offers the lowest interest rates of any card in its class and charges no late fees or foreign transaction fees. Its APRs range from 12.9 – 19.9%, and it has a balance transfer fee of 2%, the lowest in its category.

Did you notice the no fee part? That is no late fees, no foreign transaction fees, and no annual fee. This part sounds a bit like the Apple card but it is more than that.

Here is what CEO Deepak Rao has to say about the X1 credit card “With X1 Card, we set out to modernize the credit card for a new generation of cardholders,” said co-founder & CEO, Deepak Rao. “X1 Card doesn’t rely on the archaic credit score system to set limits and rates, its rewards program is the most generous offer on the market, and its built-in smart technology makes it easier to shop, save and spend with friends. Crafted with sleek stainless steel, the X1 Card creates a magical experience that feels both simpler and smarter than any other credit card on the market.”

The X1 Reward Program

First – They Listen!

Speaking of the Apple card, the X1 card kind of has some of the allure of the Apple Card with some of the reward ingenuity of the Uber card but it goes beyond both of those (in my opinion).

I had a chance to talk to Deepak this week and expressed my pleasant surprise about how their reward program was handled. There was an original idea of how the rewards would work but Deepak actually spoke with over 300 people to survey what they were looking for and then reworked the rewards program to make it much better than before and even more attractive for customers.

Imagine the big credit card companies actually making a big change just prior to introduction to make it more attractive! This tells you right away that the X1 folks are willing to listen to customers to encourage long-term customer loyalty.

The Way X1 Rewards Work

So, here is the straightforward earning structure of the X1 rewards program:

- 2X points on every $1 spent

- 3X points on every $1 spent for the year if you spend $15K+ on the card in that year

- 4X points on every $1 spent for a month for every friend you refer. If you bring in 10 friends, for example, you’ll get 4X points on every single purchase for 10 months.

That 3X point amount is a great way to encourage people to have this be a regular card in the wallet since it requires $15,000 of spending in a year. Basically, you will get 2x points on all spending but once you hit that $15,000, you will get an extra 15,000 points and 3x points on all spending going forward.

The 4X point level is a very innovative part of the program. There is no limit on the amount of friends you can refer so you could, essentially, get 4X point earning forever if you have enough friends to apply! This is a great way to encourage cardholders to both use the card and refer it since they will not get any benefit from referrals if they aren’t using the card.

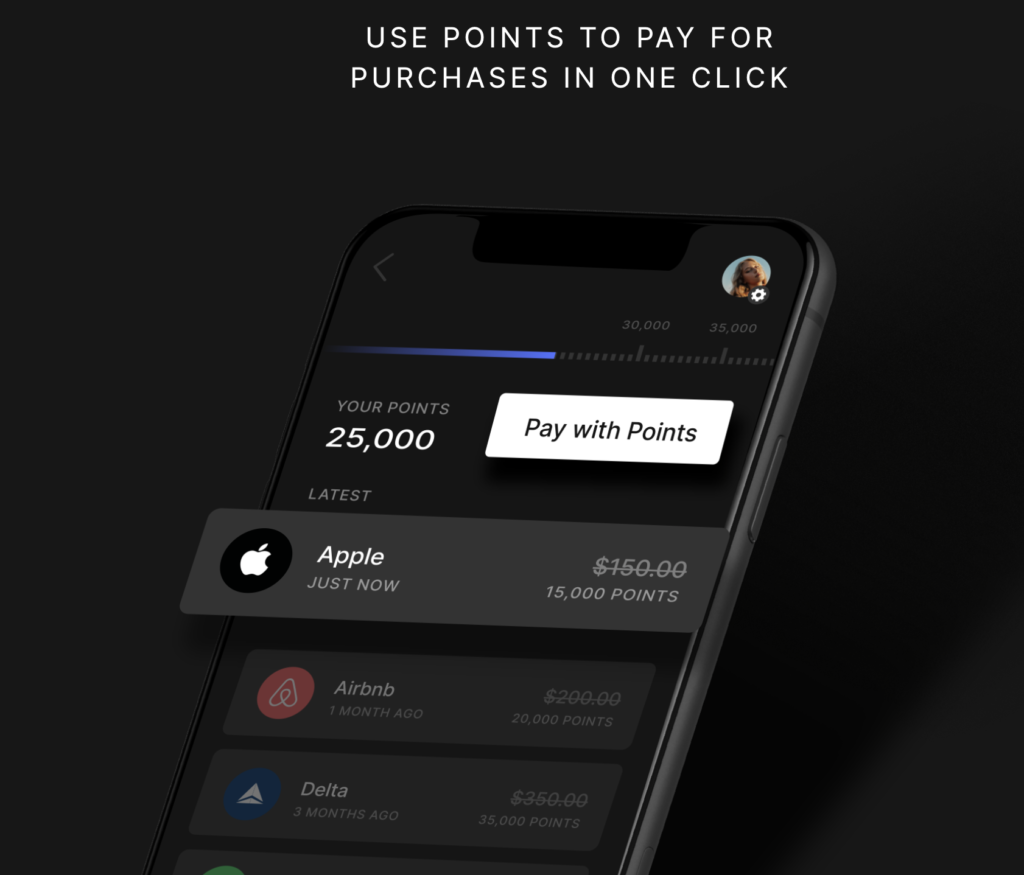

Redeeming the X1 Reward Points

The value of the points will adjust based on the vendor you will use them with. There are currently over 100 brands you can use them with and the base value is 1 cent per point and it will go up to 2 cents per point. That means that you are earning a straight 2% – 3% on all spending with the potential to get 4% – 8% on all spending.

Here are some of the vendors they have currently partnered with for reward redemption:

- Airbnb

- Adidas

- Alaska Airlines

- Allbirds

- Apple

- Bose

- Delta

- Etsy

- HotelTonight

- Ikea

- JetBlue

- Nike

- Nintendo

- Pelaton

- and many more

As you can see, there are some travel companies on the list so, at the minimum, you would be earning 2% on spending to use for travel. If you are referring friends, that is 4%. That exceeds the earnings on most categories by most cards and the X1 is offering that on all spending (in the months you refer a friend).

Plus, you have no annual fee!

Here is Where the X1 Gets Even Smarter

Ok, but that is not all the X1 has to offer. This is a credit card that very much relies on technology to put forth its worth in a crowded credit card space. Here are some of the things that the X1 can do for you.

Smart Features

By just using one click on the app, the X1 card will let you cancel subscription payments. This is something that some credit card companies had said they would put out – but it was more an alert system than letting you simply cancel these payments quickly.

Taking it even further, the X1 has a ton of flexibility with virtual credit card numbers. Here are some interesting uses and information on the X1 virtual credit cards:

- Create virtual credit cards with an expiration period you want

- Great for signing up for trials and not wanting to get charged if you forget to cancel

- Also great if you want to make sure that certain payments never exceed a set date

- Create virtual credit cards to give as gifts

- This is a nice use – you can create a virtual credit card to send to someone and load it up with as much money as you want (which is basically just going to charge your account when it is used up to the maximum amount)

- They can use it online anywhere Visa works

- You can create as many virtual credit cards as you want – quickly and easily through the app

The X1 also has an auto alert when a refund is issued on the card. To my knowledge, only American Express lets you know when a a refund hits your account while other credit card companies will just show it on your statement. So, it can be nice to get alerted when the refund happens instead of trying to remember to check for it.

There is also an incognito mode where you can shop and not have any of your personal information tracked.

How to Get the X1 and Should You?

One of the reasons X1 changed their rewards program and dropped the annual fee was due to the amount of premium cardholders they talked to that expressed their dissatisfaction with paying high annual fees, especially without a lot of travel. X1 has shown they are willing to adapt to their market to provide a rewards structure that is beneficial to many so you can expect it to adapt as time goes on as well.

At this point, X1 has opened up a waiting list. If you want to apply through a reader’s link, you and they can eventually get 4X points per month. 🙂 They are looking at using an affiliate channel at some point so if you do not see this on a bunch of blogs right now, you probably will eventually!

So, there is not an application just yet – just a waiting list. Eventually, you will be able to sign up and then start using the card! I am looking forward to trying out the card to see how it works in some of my non-bonus category spend and to really take advantage of the virtual credit card numbers. I know Citi has this but X1 is making it even more simple with their take on tech.

Whether you apply for this card or not, I really do like that X1 is taking on the big banks in a way that can only help to push forward innovation in rewards and the advancement of tech in the old way of doing credit card systems!

Discover offers alerts for credit postings. On Visa or MasterCard this function depends on your bank.

https://x1creditcard.com/r/Y9qxbKk

Where do you sign up?

Use link and add school and employer info to move up on the waitlist! Then move up 100 spots and get 4x points for a month for every referral!

https://x1creditcard.com/r/hyLUxyv

I’m going to assume that part of their revenue model is that they’ll sell your information (contact info, employment/history, salary info, etc.) I’m not interested in giving that much information to a credit card company, but that’s just me.

Here’s a referral code if needed: PylgHgh

This link works for 4x points above normal sign-up: https://x1creditcard.com/r/sSn5Rcm

Hey guys,

You can use my Promo to get ahead in the waitlist

https://x1creditcard.com/r/iDINVh8

https://x1creditcard.com/r/rAwi7xx

To get yourself a free month of 4x points, you can use my referral code.

Use promo sign up code 2TOHnuy for 4x points for 30 days 🙂

2Lj2WvI bonus code

MQgY6se works for 4x points

How to apply for one?

You can join the waitlist as of now by clicking this link

https://x1creditcard.com/waitlist

Use signup bonus code Yeqczh9 to get 4X bonus points during your first month of card usage.

2Lj2WvI bonus code

Here’s another bonus code: https://x1creditcard.com/r/M4jI2yW

Use this link for 4X Points on the first 30 days.

https://x1creditcard.com/r/ZuzUKfA

Or apply code ZuzUKfA as a Bonus Code.

Use this link to get moved up:

https://x1creditcard.com/r/EgZJkV0

https://x1creditcard.com/r/X8CENhb

Use link and add school and employer info to move up on the waitlist! Then move up 100 spots for every referral!

https://x1creditcard.com/r/hyLUxyv

x1creditcard.com/r/nMRS88V

4x points for your first month of spending

x1creditcard.com/r/AmNtfYV

WORKING BONUS CODE: 0mmTomX

Signup using my referral link: https://x1creditcard.com/r/e3vhj8C

Or when signing up through the normal X1 form you can use this Signup Bonus Code: e3vhj8C

Signing up with either of these two methods earns you 4x Bonus Points the first month!

You can use my bonus code for 4x Points : 03CgkMr

Here is the sign up link with the bonus code:

https://x1creditcard.com/r/03CgkMr

4X for 30 days bonus code.

fr7VZkc

https://x1creditcard.com/r/v6w4V2C

Get 4x extra bonus points

Join the waitlist here & earn 4x bonus points.

https://x1creditcard.com/r/v6w4V2C

Promo code pdZ69w3

for 4x Bonus code: u6OESDb

You can join the wait list at https://x1creditcard.com/waitlist

You can use sign-up code Kmc33GK for immediate 4x points for 30 days

Additionally, you can move up the wait list by answering a few questions after sign-up

You can join the wait list at https://x1creditcard.com/waitlist

Additionally, if you use sign-up code Kmc33GK, you’ll get immediate 4x points for 30 days

Lastly, you can move up the wait list by answering a few survey questions after signing up (school and employer). And you can progress forget for everyone your refer. Hope this helps!

You can join the list at https://x1creditcard.com/r/K1T6X70 and get 4x points for the first 30 days

https://x1creditcard.com/r/Y6CQ1SY

You can use my link for 4x points the first 30 days

https://x1creditcard.com/r/gYFRxlI

PROMO CODE!

https://x1creditcard.com/r/moVsoiJ

Hey guys, if you’re looking for a signup bonus code, this one worked for me to get 4x points for first month. Signup bonus code: Z3OxcG8

Get 4x bonus points for the first 30 days by using this code.

fjD0xMT

Or follow this link.

x1creditcard.com/r/fjD0xMT

Thanks

Get 4x!

Use my bonus code!!!! u6OESDb

You can use my link or code

https://x1creditcard.com/r/6dPSm1J

6dPSm1J

get 4x points for 30 days by using my code and answering just a few questions (where you went to school and your employer).

https://x1creditcard.com/r/3pGSI37

PROMO CODE: WORKING 4X POINTS FOR 30 DAYS

https://x1creditcard.com/r/l1AK9KW

Enjoy x4 !

Credit Gang

https://x1creditcard.com/r/OnMrCN4

You can get your sign up bonus here

https://x1creditcard.com/r/Wsr2Fk7

https://x1creditcard.com/r/KcAWeU2

use this link for signup bonus

https://x1creditcard.com/r/nbw4Dt6

This is working code

This linked worked for me to get the 4x points for 30 days!

https://x1creditcard.com/r/kIwI7AY

Bonus code to earn extra 100 points

TywHZdo

Here’s the link.

x1creditcard.com/r/xbBbL9j

fell free to use my promo code, too:

https://x1creditcard.com/r/2LFdSgG

thanks,

https://x1creditcard.com/r/nLWYsms

Here’s the best code: A8Gr86I

https://x1creditcard.com/r/mRU7lbq

Use this link for 30 days of 4x points!

Promo code for 4x points for 30 days: Pg8dJXb

To receive 4x points use this link: x1creditcard.com/r/qzpRM2D

https://x1creditcard.com/r/8OXsK7u

My referral code.

qzDABGq

https://x1creditcard.com/r/qzDABGq

Signup using this referral link: https://x1creditcard.com/r/AhTBKQh

Or when on the X1 site, use this Signup Bonus Code: AhTBKQh

Signing up with either way earns you 4x Bonus Points as well as a 200 position advancement on the waiting list right afterwards!

Signup using this referral link: https://x1creditcard.com/r/RVFcCej

Or when on the X1 site, use this Signup Bonus Code: RVFcCej

Signing up with either way earns you 4x Bonus Points as well as a 500 position advancement on the waiting list right afterwards!

Signup using this referral link:

https://x1creditcard.com/r/8rGVn0T

Promo code – 8rGVn0T to skip position

Signing up with either way earns you 4x Bonus Points as well as a 500 position advancement on the waiting list right afterwards!