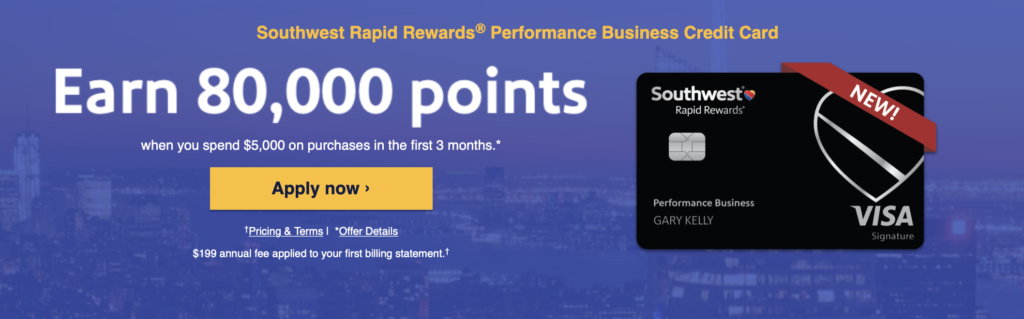

Yesterday, Chase and Southwest announced a new credit card with the largest public bonus yet – 80,000 points! It is a pretty impressive card for Southwest flyers but it will certainly not be a card that everyone will be getting. Let’s break down what it offers and if it is right for you.

The New Chase Southwest Performance Business Card

Link: Chase Southwest Performance Business Card

Here is what this new Southwest Performance Business card has to offer:

- 80,000 points after spending $5,000 in 3 months

- 9,000 points every year on your cardmember anniversary

- 3 points for every $1 spent on Southwest purchases

- 2 points for every $1 spent on social media and search engine advertising, Internet, cable and phone services

- 1 points for every $1 on all other purchases

- Four upgrades Boardings per year (when available)

- Inflight WiFi credits

- Earn tier qualifying points towards A-List status

- Global Entry or TSA Precheck fee credit every four years

- Annual fee: $199

At first glance, this is very much the business answer to the popular Southwest Priority card (with its $149 fee) that we first saw last year. It comes with the same upgraded boarding opportunities but subs WiFi credits for Southwest credit and Global Entry/TSA credit (seriously, did we need one more card offering this?!).

The Good Parts About the Southwest Performance Business Card

Is the Annual Fee Worth It?

The annual fee of $199 puts it at the highest fee of any Southwest card but you could make an argument for it coming close to paying for itself. With Southwest points worth about 1.5 cents each, those 9,000 points you receive each year will be worth about $135.

The upgrade coupons are worth between $30-$50 each so that would be another $120 on the low end. But, let’s face it – most people will only upgrade because they have the certificates and wouldn’t spend the money to upgrade otherwise. So, let’s call it $20 each and that puts us at $80.

Put those two together and you have about $215 in value for a $199 annual fee. Not too bad…

But then we get to the inflight WiFi credits – I was shocked to see that you will get up to 365 $8 credits per year! That means that every day you fly, you can get a statement credit for that $8 charge for WiFi. That is certainly one way to do it!

The Southwest Companion Pass

With Chase cracking down on customers getting bonuses again within 24 months and with the infamous Chase 5/24 rule in place, getting the Southwest Companion Pass through credit card bonuses has become very much a strategy game.

It takes the earning of 110,000 Southwest points (you still keep your points – that is just the amount you need to hit in a calendar year) to earn the Southwest Companion Pass for the year you are in and the next year. With this card at 80,000 points (plus the 5,000 for the spending), you would just be 25,000 points shy of getting the Southwest Companion Pass!

Many people could hit that with spending (if they did all their spending on this card) or with things like referrals for others to get cards (5,000 points each) or another credit card bonus.

The 80,000 Points

Those 80,000 points are a great way to get some good flying done! That is worth about $1,150-$1,200 worth of Southwest travel – not too shabby! If you fly Southwest, those points can really help you out quite a bit, especially since you likely have had all the other Southwest cards before!

The “Bad” Parts About the Chase Southwest Performance Business Card

While many of us love Chase cards, the bad part about this being a Chase card is that you are restricted to the Chase 5/24 rule. That means that if you have opened 5 or more new accounts with any banks in the last 24 months, you will not be able to get this card. That’s the bad news.

The possibly difficult news for some is that this is a business card. While in the past it was possible for even very small businesses to get Chase cards, Chase has really been getting a bit more strict with that as well so you will want to have a small business of some kind that is on paper – something to point to if they ask for much information.

Also, this card clearly says you cannot get the bonus if you have had “this” card in the last 24 months. Obviously, no one has had this card in the last 24 months so that is good that it only applies to this and not the other Southwest business card!

Summary – Should You Apply for the Chase Southwest Performance Business Card

This is an impressive new card to be sure! However, there is no end date on the bonus so I would suggest waiting until at least after October 1st to apply. That will put you in a position where you won’t need to hit the $5,000 in spending until after the first of the year which will let you have the Southwest Companion Pass for 2020 and 2021 (if you can get the rest of the 110,000 points needed next year).

But, if you are only an occasional Southwest flyer, I would suggest that you wait on this as well. There are other Chase cards (or other bank cards) that would likely give you a better value and you may become more of a Southwest flyer within the next 24 months! You don’t want to preclude yourself from getting this card when you are actually flying them more simply because you had to get it now because it was a good deal.

I like that Chase and Southwest improvised a bit with the WiFi credits – that was a nice move for regular Southwest flyers. Also, again, the 80K points don’t hurt!

[…] Read More […]

[…] Read More […]

Charlie, this may be a dumb question, but how do you get the $8 Wifi credit. Is it as simple as putting the $8 Wifi fee on your Southwest business card? Can I get the credit twice in one day if I am on two separate Southwest flights?

Hi, Tom, not a dumb question! It is a fee reimbursement that happens automatically when you charge that amount to that card. I have heard that it is a straight 365 credits so you could use two in a day.

Thanks Charlie! i will definitely bring my Southwest Business card with me the next time I fly Southwest (Normally I just use my Chase Sapphire Reserve because I luv ultimate rewards points)