If you are one of the millions of people that will be vacationing in Greece this year, chances are pretty good you are going to grab some Euros from an ATM. If you do, make sure you keep an eye out for the new option on many ATMs that “helpfully” offers to charge you a specific amount.

Watch Out for Dynamic Currency Conversion at ATMs in Greece

What Is Dynamic Currency Conversion?

If you have traveled abroad from the US, no doubt you are familiar with dynamic currency conversion – the process if not the name. How this typically happens is a vendor may ask if you want to be charged in the local currency or a fixed amount in US dollars. The idea is to “help” you by knowing exactly how much that purchase will cost you in your home currency.

However, this system is not a nice way to help you out but more of a way to uncharge currency conversions and making some extra money on tourists. This is why it is always a good idea to ask to be charged in the local currency instead of your home currency when on the road. And, of course, always use a credit card that does not have foreign transaction fees to save even more on fees!

To read more about Dynamic Currency Conversion, check out this page.

Why Dynamic Currency Conversion Can Be Very Bad with ATMs

With credit cards, the rate of currency may vary a bit from when you actually make the purchase due to the length of time it takes for the charge to actually go through. While most major currencies do not fluctuate strongly enough to make that big of a difference, when you do check your statement, you may find that the final charge is different from what you thought it would be.

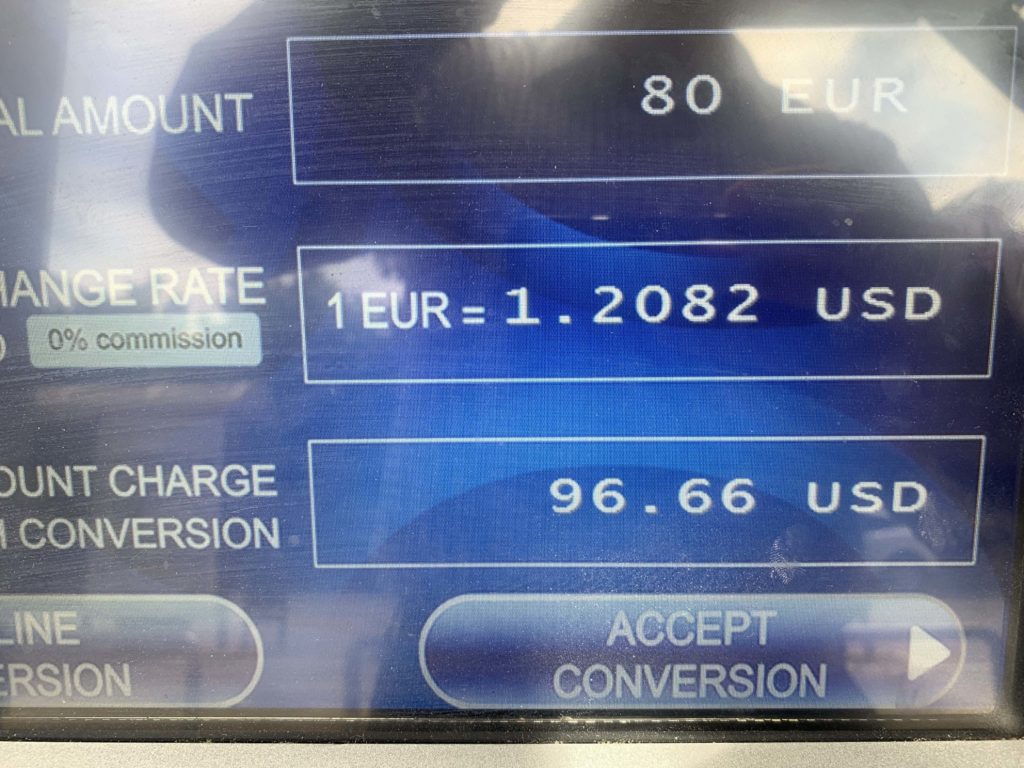

Sorry for the bad photo! On this day, the actual currency was 1€ to 1.13 USD.

However, with ATMs, it can be much more unfriendly. That is because when you withdraw your money, it is taken from your bank account immediately. Some banks may charge fees for this while others may not. In my bank’s case, I pay a 1% fee on foreign withdrawals. That really isn’t that bad and actually is better than even converting dollars to Euros at a place like Western Union.

A few months ago, many ATMs and banks in Greece now have dynamic currency conversion in place and they actually try to make it appear as if it is a gift for you! The truth is, depending on fees from your bank, it can actually be very bad!

Travel Tip: Load the XE app or similar on your smartphone so you always know what the actual exchange rate is at anytime!

In my most recent case, the extra fees that would have been assessed by the dynamic currency conversion (even withdrawing the 1% I currently pay) equaled a 8.3% uncharge on the withdrawal! That is certainly not a small amount! If you were to withdraw for 500€ at the current exchange rate today, that would be about $565. With DCC at ATMs, the charge would be $607 – a difference of $42!

In my experience, many ATMs actually try to convince with you TWO sequential screens that you should do this – do not do this! Unless your bank is charging an even larger amount for the currency conversion at an ATM (which I doubt), just go with the local currency amount.

So, if you are traveling to Greece this summer and you do not want to pay extra with the dynamic currency conversion at ATMs, just hit the button to the left of the screen to “DECLINE” – and then be prepared to hit it again when they try to hard sell you.

Summary

Before going to a different country and withdrawing money, it is always good to see what kind of fees your bank will charge and what blocks they may have in place. One thing for sure – do not take the DCC amount that the ATM tries to convince you of!

It’s not just Greece. Those non-affiliated blue and yellow ATM’s are around lots of places in Europe, and they offer terrible rates anyway, but with DCC it’s actually much worse, which is pretty impressive.

These are actually bank ATMs. I’ve seen it (just in the past two months) at Piraeus bank, National Bank, Eurobank, and Attica. I wasn’t sure it was in other European countries with that same spreading or not.

I’m traveling in Greece right now, and the worst culprit are the ATMs called Euronet. I was jet lagged and stupid, and didn’t decline the currency conversion, which I normally do. That was because the Euronet ATM made it seem like it wouldn’t give me money unless I agreed. Boy, was I surprised when I saw that it cost me 120euros to get 100 euros. Never again!

I did an Internet search and found out that a lot of people are complaining about them. And it turns out that Euronet is actually a US company based in Texas. They have a distinctive blue and yellow format, and the signage is highly visible – even from the road while driving. They now have over 700 machines in Greece alone, as well as many other countries.

My advice is to always avoid them!

Sorry, I remembered wrong – they are based in Kansas, not Texas.

And I just read that Amsterdam is cracking down on Euronet.

[…] Read More […]

Just happened to me in Seville Spain at Caixa Bank. First they charge 4 Euros for the withdrawal, and then they would have gotten an extra €8 if I had used their conversion scheme. Schwab reimburses me for the 4 euros, but the whole thing is outrageous.

[…] Read More […]

Why are you paying 1% to withdraw money from ATMs?

That is what my home bank charges on foreign withdrawals.

[…] Read More […]