To see the latest, updated offer on this card and others, please visit this page.

When it comes to miles and points, we are all mostly into the game to try to rack up as many miles and points as possible to create greatly reduced travels. For most of us, we would never think of using flexible points for cash statements or gift cards – horror! 🙂 Yet, this particular card, the Chase Freedom, is actually marketed as a cash back card – and it is a good one – but with the potential for points as well!

Chase Freedom $200 Bonus Offer Drops Tomorrow

– Application Link – Chase Freedom $200 Bonus After Spending $500 In 3 Months

Minimum $200 Value

The Chase Freedom, though it is marketed as a cash back card, earns points that can be converted into full Ultimate Reward points by simply having a Chase Sapphire Preferred, Chase Ink Plus, or Chase Ink Bold as well. By having one of those cards, this $200 bonus offer turns into 20,000 valuable Ultimate Reward points – and for only spending $500 in 3 months!

The normal offer of $100 is still a pretty decent deal. I mean, it is a sign-up bonus that is giving you a 20% rebate on your required spending! But, this increased bonus of $200 gives you a 40% rebate on your spend if you decide to take it as cash back.

If you combine it with your Ultimate Rewards account, it could see potential redemption value much higher. If you were to transfer these points to Southwest Airlines (an Ultimate Rewards transfer partner), you would receive around $350 in redemption value on Southwest! And, of course, these points could also be transferred to the other partners as well, partners like United, Hyatt, Singapore Airlines, Marriott, British Airways, etc.

Quarterly Bonuses

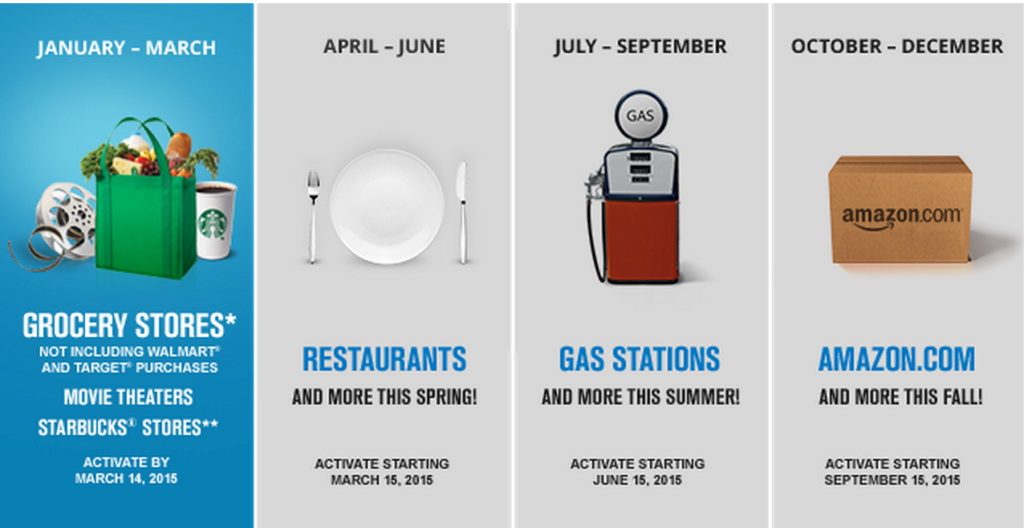

The sign-up bonus is really just the beginning of this card. You also receive 5% cash back on rotating categories each quarter (up to $1,500 spent in those categories each quarter). The categories for 2015 are:

- January – March – Grocery Stores, Starbucks, and Movie Theaters

- April – June – Restaurants (and more coming)

- July – September – Gas Stations (and more coming)

- October – December – Amazon (and more coming)

A Keeper

Finally, the card has no annual fee. That makes it a great and permanent addition to your wallet. If you only use it for spending in those bonus categories, you will earn great value from the card on an annual basis.

I had the card a long time ago (before I really got into miles and points) and had actually closed it so I was able to open another Chase card a while back. I finally got it back again this week, wanting to get in at the $200 bonus level (though I will be using them as Ultimate Reward points because of the other UR earning cards I have). If you have had it in the past (having received the bonus at least 24 months ago) and do not currently have it, you can reapply now as well!