Last week, we saw American Express put some tech blocks in to prevent cardmembers from loading (new) Amex Offers to multiple cards. Of course, many people were not happy about this latest development devaluation of a key feature of Amex cards and the reason many people kept multiple Amex cards.

Why Amex Offers Are Still Great Deals

Courtesy of Shutterstock

Reading comments and messages, both here and on other blogs, it is definitely easy to see that many people are thinking that this latest move by Amex is one that will cause them to close some cards. Depending on how much people were scaling these offers, I could definitely see that.

At the very least, this new change should make each person that uses Amex Offers weigh their different cards to see if the actual benefits of the card alone will make it worth keeping it (because many people used the savings from Amex Offers to offset the annual fees).

This Change Hurts These Offers the Most

This change definitely affects the Amex Offers that are for small amounts – like the $5 off on $25 or more at SwimOutlet.com. Those are pretty much worthless now (well, they are worth $5 but not great anymore).

Why Do I Think Amex Offers Are Still Great Deals

So, why do I think Amex Offers are still great deals? Saving the same offer to multiple cards was never a feature of the offers or something that American Express pushed. They allowed it but reps would always insist that the offer could only be loaded to one card per account. Rather than a feature of the program, I think we should see it as a undisclosed benefit that lasted a lot longer than we thought! 🙂

Targeted Offers Have Gotten Better Over Time

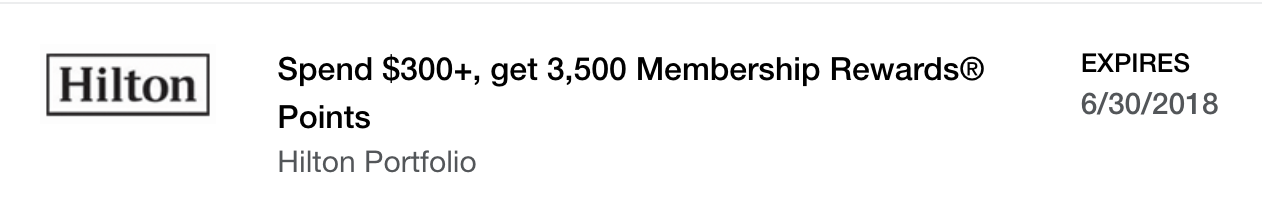

The Amex Offers themselves were unchanged by this block. There are still over 100 active Amex Offers available and some of them are pretty good. But, one thing we have seen over time is that Amex has actually made some really good Amex Offers available as targeted offers.

This was likely due to the fact that the partner offering the deal offered a cap on the budget for the offers and it was so good that they knew it would be saved to accounts in a matter of hours if it was offered to everyone. Rather than doing that, Amex instead targeted certain kinds of cards and accounts with those offers.

This Change Could Open Targeted Offers For More

These targeted offers have been very good! When a partner is able to choose to target accounts, it allows them to offer a greater value for those targeted customers. Now that Amex has closed the door to adding the same offer to multiple cards, it should open the door to better and more Amex Offers being made since the budget for the various offers will not be used up by the same customers.

It Could Also Cause an Increase in the Deal Amount

We have seen this with targeted Amex Offers and I am fairly certain that it will happen now with general offers as well. Imagine this, I know many customers that have access to over 20 American Express cards that they have been saving these offers to over the years. If the offer is, for example, $30 back on $300 or more at Best Buy, that single customer is able to hit that for a total of $600 back (if they spent $6,000).

That eats into the budget pretty quickly that Best Buy and Amex have established! By limiting it to one card per customer, they could do one of two things – target more customers or increase the offer (which would encourage more people to do the spending in the first place).

Even if that does not come to pass, there are still plenty of great Amex Offers. Many of these could help you recoup your annual fee in a single offer so there is still great value to be had. We are now just limited on the scaling opportunities.

Moral of the post? Don’t throw that Amex card away just yet! 🙂 We could see some really nice offers coming that are more widely targeted or that offer more of an incentive.

To the trolls that refuse to adjust to the new realities of the program and will just want to complain that they think I am an “Amex shill,” I have no relationship with Amex and am not an affiliate. So, you can just move on! 🙂

I agree. I think the savings I’ve gotten from Amex Offers through the years clearly makes the annual fee more than worth it!

While I think that they are still a good deal I think it is less likely to hold multiple AF cards for them since it can only be attached to certain cards. While they are sometimes targeted to specific cards I don’t think it is worth keeping 3-4 cards to maybe get that one good offer you would miss out on.

I do think it will lead to closure of cards that were borderline keepers before and for sure closures of cards (like the Green card) that were only useful for Amex Offers.

Is it better to close accounts or downgrade to no-fee accounts? I’m thinking of the impact to credit reports. Are there any other considerations? Thanks.

There are no no fee charge cards. Green card has got to go.

[…] Why Amex Offers Are Still Great Deals – Running with Miles […]