Last week, we received the terrible points news that United is following in the steps of Delta and scrapping their award chart. In its place, they will have varied award pricing with no minimum and no maximum. Yes, somehow, this is better for the customer. Right…

What Is Chase Going to Do About These Two Untied Credit Card Perks?

There are many problems with such a change and they are going to affect many people. They are also going to affect things with Chase, at least as far as a shakeup of what perks to offer to retain customers of their credit cards.

United Credit Cards with Saver Availability Perk

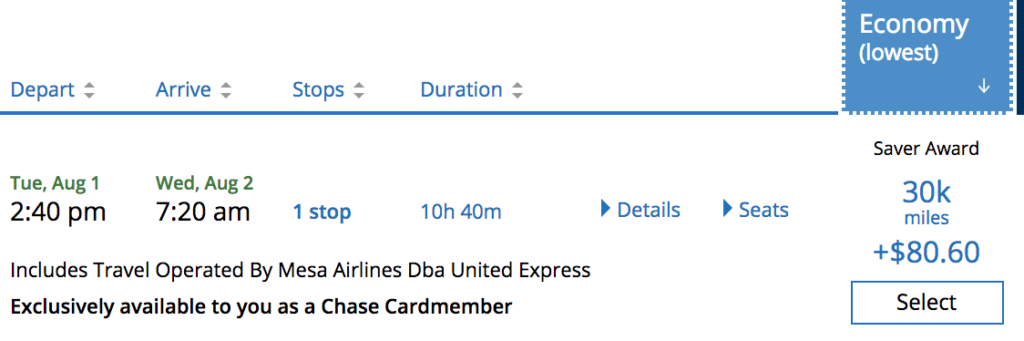

One example of award availability made accessible by the United credit card

This is a perk I have talked about for a while that makes booking with United for awards both great and very frustrating. Having a United credit card can open up additional award space on United flights that you will not see without a card (or elite status).

For me, this is a key reason to keep a United card around. I book enough award flights with United in the course of a year that it is worth the annual fee to have access to flights on the days I need them rather than have a beautiful international trip planned and then be stuck because of a stupid, short, regional flight that United restricts space on.

Well, going forward in the post-November 15th world of United awards, this won’t be an issue anymore. With United scrapping award charts and making awards variable, there likely won’t be a particular bucket that cardholders and elite members get to pick from.

With this being a key benefit on many United cards, what is Chase and United going to do to replace this with something meaningful for current and future cardholders?

I do know this – it better not be something like additional Club passes or an airline discount of $100 in exchange for $10,000 in spending, etc. I would like to see better availability with partners as a feature but I doubt we will see that.

United Club Card’s Feature of No Close-In Booking Fees

If you have the United Club card (with its $450 annual fee), you get United Club access, which is nice. I mean, if you are going to pay for United Club Membership, you are probably better off just getting this credit card instead!

But, one of the features that I have loved and talked about before was the no close-in booking fees when booking fees from the United account tied to the cardholder. As that fee costs $75 per person from a non-elite account, that can be a huge cost-saver!

What Is the Close-In Booking Fee?

If you try to book an award within 21 days without elite status and without this card, you will have to pay that $75 booking fee. The problem is that many great awards often pop up within 2 weeks of departure. That means that you may need to pay that fee at times. If you do it a few times per year, it can pay for your annual fee.

Bye-bye, Close-In Booking Fee!

Well, that fee is going to be gone with the new changes so there is one more way that United will be following Delta (probably the same way Delta does it as well – award prices go up within 21 days so need to charge more money!).

What will Chase and United replace this major benefit of the United Club card with? One of those features, earning 1.5 United miles per dollar, is already killed if you have the Chase Freedom Unlimited card (a no-fee card) so they have to do something.

I would like to see them offer something like 4 free award redeposits/changes per year. If not, they better come up with something far better to keep those members when that big annual fee comes up again!

Summary

With the changes coming November 15 to United, how will that impact your United cards? I do know this – earning miles on an airline card has been far from a good idea for a long time and now United gives everyone a reason to not spend on those cards again (unless they need the elite waiver). So, this is very much Chase’s problem as much as it is United’s. What are they going to do to replace these two benefits that will be purged with the new award changes?

Good questions! Hopefully their response isn’t just a big middle finger!

It’s United following Delta’s lead. Of course the response will be a big middle finger. You’re expected to be loyal to them, not them be loyal back to you. If they thought differently, they wouldn’t have done this with zero notice for the customer.

you will see that it’s not really november… Search now for availability to/from Europe any time in June / July… You will see that flights like FRA – EWR are 70k pts, but there are routings that fly XX – FRA – EWR and cost only 55k points… Similarly, EWR – BOS – LIS – TLS is 30k points, but EWR – LIS is 50k or more on the same date. This implies that the change has already been made.. these are all “saver category” economy awards. It’s crap that they want you to take additional stops, and the exact reason for which I don’t fly AA. I don’t want to spend 30k on a domestic economy flight (or 40k now sometimes) but I also don’t want to fly JFK – CLT – MIA – TPA to get from NYC to TPA…

close-in fees goes away in name only. they can slap on a $100 close-in & you wont know just because it is not called that anymore. the magic of non-transparency.

I don’t see why expanded Saver couldn’t continue. Today, those are just a certain number of Everydays discounted to the Saver price point. Delta still has buckets, with a “leap” in price; United could just keep a certain number of seats from “leaping” for cardholders. That’d effectively be a discount on the mth through nth seats (m and n being different for different flights).

Some blogs have observed that on routes that have already gone dynamic — those going for less than saver levels — Chase cardholders & elites get a consistent 1,000-mile discount, which seems to replace the expanded availability benefit.

Wow. I would’ve thought the XN benefit would be unchanged. After all, there will still be XN and X buckets in the future and XN already had variable pricing before the latest change (e.g. 10k and 12.5k domestic flights).

The 1k “discount” is more troubling, as it is one step closer to individual price discrimination. If award prices follow UA’s buy up program, elites can look forward to paying double what kettles do!

[…] What is Chase Going to Do About These Two United Credit Card Perks? by Running With Miles. I do wonder how much Chase is consulted on changes like United have made. […]

You haven’t needed to pay an annual fee to get expanded inventory of saver flights. I downgraded to the card with no annual fee and I still get expanded inventory.

[…] do something about United’s decision to go all dynamic. At least the bank must address these: What is Chase Going to Do About These Two United Credit Card Perks? It’s having more award availability available to cardholders and the elimination of the close […]

Add in restrictions on club access when not flying United, Delta or American and the clubs cards additionally devalue later in 2019 as well.

Great point.