Last month, people started noticing their American Express Premier Rewards Gold cards carrying new benefits, specifically 4X Membership Reward points at supermarkets and dining credits. Now, American Express has formalized these benefits and rolled them out with a refreshed card – the new American Express Gold Card. Not only does it retain these new benefits but it also comes with an increased annual fee.

New American Express Gold Card Is Live

Link: American Express Gold Card(to get the 50,000 point offer, make sure you click that referral link, select to view Personal Cards, and then select the card from that following page – see more details in this post).

This card is positioned to be an attractive option for the person who likes earning increased points on supermarket shopping and restaurants. This increased bonus category even beats out the very popular Chase Sapphire Reserve on dining by offering 4X Membership Reward points.

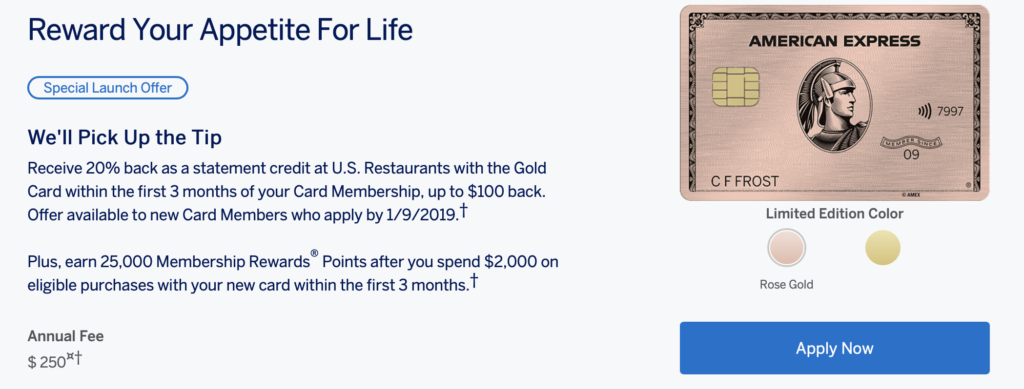

- Receive 20% back as a statement credit at U.S. Restaurants with the Gold Card within the first 3 months of your Card Membership, up to $100 back. Offer available to new Card Members who apply by 1/9/2019.

- Plus, earn 25,000 Membership Rewards® Points after you spend $2,000 on eligible purchases with your new card within the first 3 months. See this post for how to get 50,000 MR points instead!

- Earn 4X Membership Rewards® points at US restaurants.

- Earn 4X Membership Rewards® points at US supermarkets, on up to $25,000 per year in purchases.

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- NEW $120 DINING CREDIT- Earn up to $10 in statement credits monthly when you pay with The Gold Card at participating partners. This can be an annual savings of up to $120. Enrollment required

- $100 AIRLINE FEE CREDIT– Select one qualifying airline and then receive up to $100 per calendar year in statement credits when incidental fees are charged by the airline to your American Express® Gold Card account.

- Annual fee: $250

- Can select a Rose Gold or traditional Gold colored card

The New Card Perks

It will also come with $120 in dining credits per year, spread out as a $10 max credit each month. These are good for Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House and participating Shake Shack locations. So, if you wanted to stop in at the Cheesecake Factory every month, you could get a “free” slice of cheesecake with this. 🙂

For the first 3 months for new members, you will also be able to take advantage of a statement credit of 20% back on US restaurant purchases, up to $100 back. This is American Express really trying to get new members used to using this card for dining!

But, all of this comes with an increased annual fee – $250 per year up from $195. The bad part is that the annual fee is not even waived for the first year for new members.

Analysis

It also comes with a 25,000 point bonus after spending $2,000 in 3 months. Personally, since you can only get one sign-up bonus in a lifetime from Amex, I would hold out on this card until they either waive the annual fee or give out more points as a bonus. As it currently stands, getting 25,000 points for a $250 annual fee is really not a great deal (though you do get statement credits for dining, airline, and the new bonuses as well).

HT: Frequent Miler

Hi Charlie,

Thanks for the update. Do you know if current Premier Rewards Gold members will get the new perks( Restaurant/Supermarket) increased points?

No problem! Yes, they will be getting them as well.

The 25,000 point bonus is weak… I will pass…

They should do a tiered bonus structure.

$2,500 in spending = 25,000 points

$5,000 in spending = 25,000 points (50,000 total)

$7,500 in spending = 25,000 points (75,000 total)

$10,000 in spending = 25,000 points (100,000 total)

in 3 months of course…

That would be good and something I would definitely appreciate! I think they like to keep most of those big spending bonus tiers for business cards but it could definitely help to make their card more of a daily driver.

is this considered a new product?

While it is new, Amex has this to say about who is not eligible for the bonus – Welcome offer not available to applicants who have or have had this Card or the Premier Rewards Gold Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Will these new benefits apply to gold cards issued through a platinum card account?

It doesn’t look like it. When I looked at the website to add an AU, it didn’t show any of the new benefits.

Amex’s various monthly credits (uber, dining) do nothing for me. I have never eaten in these restaurants or used the food services. I have never used Uber and Uber Eats doesn’t extend to my town. I’m sure some people can benefit from these credits, but they just drive up the annual fee for me.

I’m just now venturing into MR and got the PRG a little over a month ago with a targeted 50K points bonus offer with the annual fee waived the first year.

I just checked and the new benefits show up on my account. Looks like somehow I lucked into getting the better product (the new gold card) but getting a higher signup bonus + a waived annual fee for the first year.

A monthly food credit at Cheesecake Factory. Who is there target customer? I have never met that person.

ME ! Eat weekly at Cheesecake factory(around the corner where I stay). $120*2(Wife has 1) per year is GOLD 🙂

There is a larger (50k vs 25k) signup bonus for referrals… might be worth sharing your personal link if so:

50K Points

$2000 over 3 months

20% back at restaurants up to $100

Annual fee not waived

Here is my link that you are free to share if you don’t have the card yourself:

http://refer.amex.us/NATHAUx88Z?xl=cp15

I wonder if I can downgrade my American Express Platinum card to this New Gold card. I would rather have the lower annual fee and for me, the benefits are not that much different.

You can downgrade it but if you have never had the Premier Rewards Gold card before, I would actually say to apply for this Gold card instead of downgrading. If you downgrade, you won’t be eligible for the sign-up bonus (if you had the PRG before, then you aren’t eligible for the bonus anyway so just go ahead and downgrade).

I am coming around to this card. My Gold Card was converted over be fore I knew it. The Grubhub option looks interesting. Liking the restaurant and supermarket options.