The Hilton credit cards are currently at the highest rates they have been before. This means that if you are interested in Hilton hotels, you should definitely be checking them out. They run the spectrum of offering just points to offering things like points, free nights, travel credit, top tier elite status and more. There is a lot to choose from but I think this particular Hilton credit card offer is the most underrated and undervalued.

This Hilton Credit Card Offer is Underrated and Undervalued

The card I am speaking of is the basic Hilton credit card from American Express. While it may be the “basic” one in terms of benefits and annual fee, there is really nothing basic about the value you can glean from it. Oh, and I am not talking about the offer that is available through the public site, affiliate offers from other blogs, or referral offers from others. This offer is only available in one place and this is the offer you should be choosing.

What is the Hilton Credit Card Offer?

This card suffers from varied offers, depending on where you look. If you look on most blogs, you will see an offer that has 75,000 points. However, there is an offer that is much better than that and this is what makes this offer underrated and undervalued.

This offer comes with 75,000 points and a $100 statement credit. For a card with no annual fee and a minimum spending threshold for the bonus (only $1,000 in 3 months), that is a really good hotel credit card offer!

- A $100 STATEMENT CREDIT after your first purchase on the Hilton Honors American Express Card within your first 3 months.

- Plus, earn 75,000 Hilton Honors Bonus Points after you spend $1,000 in purchases on the Card within your first 3 months of Card Membership

- 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with a hotel or resort within the Hilton portfolio.

- 5X Hilton Honors Bonus Points for each dollar of eligible purchases on your Card:

- at U.S. restaurants

- at U.S. supermarkets

- at U.S. gas stations

- 3X Hilton Honors Bonus Points for all other eligible purchases on your Card.

- Enjoy complimentary Hilton Honors Silver status with your Card.

- You can earn an upgrade to Hilton Honors Gold status through the end of the next calendar year after you spend $20,000 in eligible purchases on your Card in a calendar year.

- No annual fee

- The bonus us not available if you have ever had this card before!

How to Get This Great Offer

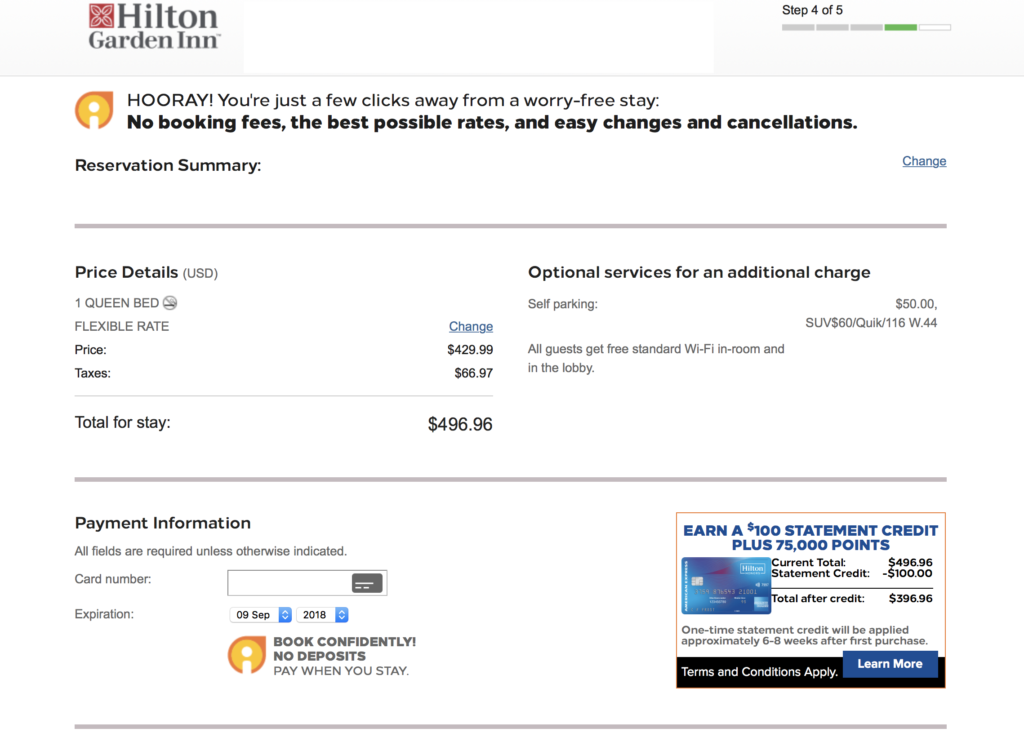

Start making a reservation and you will see this Hilton credit card offer in the lower right of your screen

Here’s the thing – there is no direct link to get this offer. The only way you can get it is to go through the reservation process at Hilton.com. Notice I said “go through” – you do not actually have to make a reservation! After you get to the page where you would input your credit card information, you will see a little box in your lower right hand corner with the offer. Click that and you can apply through the page that pops up!

It kind of makes sense that you will have to work for a minute or two if you want the best offer! If getting $100 is worth a minute or two of your time, then this is definitely the offer for you.

Analysis

For anyone just getting started with Hilton credit cards, this is also a great card for you. Most reward credit card newcomers tend to shy away from the reality of annual fees, especially on a card that they have not even really gotten to use that much yet. With no annual fee and 75,000 combined with a free $100, the basic Hilton card from American Express is probably the most underrated and undervalued hotel card out there today.

Sure, 75,000 Hilton points is definitely not like 60,000 Hyatt points but it is still possible to get some nice value out of those points. Whether you use them at lower tiers or use them for a single night that is going for $700, this Hilton credit card offer could get you some serious value – with minimal spending and no annual fee.

your math is wrong. the cost to buy 50000 point should be $250

Stupid me! Don’t know what I was thinking- thanks!

In your “comparing the offer” section – How is 50,000 Hilton points only $100? Where can I buy at this rate?

50,000 Hilton points would cost $250 at 1/2 cent each. I know Hilton points are low value but to say they’re worth only 1/5 cent each is not a common valuation.

If you’re saying that the Ascend card comes with 50,000 more points, but does not come with the $100 statement credit, then I see where this is coming from, but it doesn’t make it true that “this would be about equal to the offer above”.

The Ascend card is clearly superior if we’re valuing at 1/2 cent per point, even with the $95 fee.

You basically get 75,000 points ($375) + $100 = $475 at a cost of $0 for the “basic” card.

Or you can get 125,000 points ($625) at a cost of $95 = $530 for the Ascend card.

That’s not a large difference, but it is $55. Caveat of course is the extra $1000 in spend, but also you get Gold status. So I think the question to the reader should be whether that extra $1000 is worth $55 + Gold in their particular situation.

I have actually edited that part out. No clue what happened to the math in my brain there – I could just hear my father shaking his head pretty hard with that so thanks to you guys for catching it before he saw it. 🙂

I usually enjoy your posts, but today, this felt like a hard sell to earn your affiliates with AMEX/Hilton.

With the underground devaluations going around on the entry tiered properties, I hardly find any value when all the original 5k and 10k properties are rising up in prices up to 20k.

I understand that is a no AF card, but it counts 1 active slot out of the 5 in AMEX. So unless a reader has no absolute need for other AMEX cards, this might be great for the increased sign up bonus. As for my opinion, would appreciate deep insights especially for a brand that sudden devalue its points without announcements..

I had the opposite reaction. I highly doubt the OP get’s any compensation from a sign-up only available through a reservation. To get paid one would need to click through an affiliate link. I think the OP is sincerely believes this offer represents a good value.

If you value Hilton points at .5 cents the total bonus value would be $450 which is pretty awesome for a no AF card.

Thanks, Ivan. You are right, I don’t get anything for this offer and just know that it is very superior to every other offer on this card that would see on just about any other blog! 🙂

Glad you enjoy some of them – I realize not all the posts appeal to everyone!

First of all, I get nothing from American Express or Hilton for this card anywhere on my site. You will see this card being advertised on other blogs and most will only be pushing the offer with the points. By signing up with one of those, you are throwing away $100.

This card has good value for anyone The is getting started with Hilton or who has had other Hilton cards in the past. I honestly wouldn’t worry about it taking up a slot because you can upgrade it at a later time to the Ascend for a big amount (sometimes for the same amount as the signup bonus). Plus, you can always close it. I don’t see it as being a big deal to fill a slot with it, especially since most of us have had many of the Amex cards available.

Do you happen to know if being an authorized user counts toward the Amex count? I have 4 Amexs of myown and am an AU on my wife’s 1 (and she’s an AU on all 4 of mine). If the AU counts toward the total, I’d be maxed out already.

It does not! So you are good to go!

Umm….75,000 Hilton points would be valued at about $300 by most. Not sure I see the value here.

No, that’s not true. They can easily be worth .5 per point. If you aren’t able to find that anywhere, you are not doing it right! Getting $475 for straight value on a card that requires $1,000 in spending is about as good as you will find for a no-annual fee card. If that does work for you, you don’t need to apply!

I agree this is a great offer, but it took me about 10 reservation tries on the Hilton site before this offer came up.

I was going to apply for the Ascend, but this a better offer, because once you get this one, there is always a referral to the Ascend, but if you get the Ascend first, there would be no referral to this offer.

Wow, really? I got it each time I had tried it. Maybe they are trying to make it more difficult to reach now?

That was the same exact path I had taken to the old Surpass card. Course that was also when you could downgrade and repeat again and again. 🙂

Great point!

How would you later upgrade or get referred from this card to the Ascend?

There are offers in your Amex account from time to time that will give you an offer to upgrade to the Ascend. They are normally located near the Amex Offers section.