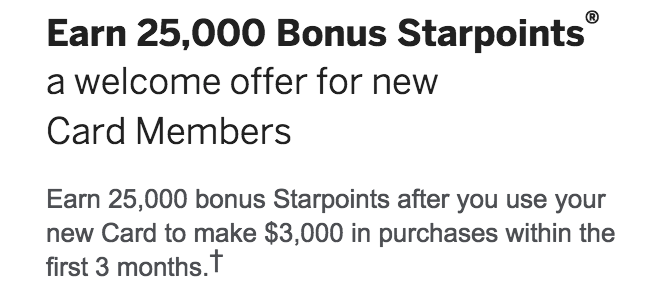

The news made the rounds yesterday that the much-loved but also somewhat stagnate SPG Amex card offer has finally shifted its spending requirements to fall in line with most other cards. In the past, the card would give 10,000 Starpoints after the first purchase and an additional 15,000 Starpoints after spending $5,000 in 6 months.

SPG Amex Lowers Spending

– SPG American Express Link (I do not receive a referral for this link)

Now, the new spending requirement (for the personal version) is to spend $3,000 in 3 months to get the full 25,000 Starpoints. So, they have done away with the initial 10,000 Starpoints after the first purchase and lowered both the spending and the time required to meet it.

Differences Between Old And New

From a consumer standpoint, the change does makes it easier to track the spending since it is to be done in 3 months and averages out to $1,000 per month on the card. However, the old system was good for a couple of reasons – one is that you would get 10,000 points quickly (from the first purchase) and the other is that it made for a nice card to lump in with other applications. Since most cards require spending within 3 months, it was easy to concentrate on those cards and then use the last 3 months of the 6 month period to hit the $5,000.

Why You May Want To Wait

But, none of those reasons are why you should probably wait to apply (since this is the new offer and not likely to change back to the old system). The reason you should wait has to do with Amex’s customer-unfriendly policy of one sign-up bonus per lifetime on the personal cards. That means that if you have ever had this card and the bonus before, you are ineligible to get the card’s bonus again. You can get the card again but you will not receive the sign-up bonus.

This is a big deal because Amex does roll out a bonus increase at least once per year from the 25,000 Starpoint offer to 30,000 points. That increase is more significant than increases on cards like the Chase Ink Plus (currently at 60,000 points from 50,000 points) because there are no category bonuses for spending with the SPG Amex card. That means to generate that extra 5,000 points that the increased bonus offer gives you, you will need to spend an actual $5,000. With a card like the Chase Ink Plus, you can generate an extra 5,000 points by simply spending $1,000 at office supple stores (because it pays a bonus of 5X at office supple stores).

Will Amex run another increased bonus offer? My opinion would be that they will and that we will likely see it in the next couple of months (if it runs according to the past increases). Even if they don’t, unless you need these Starpoints quickly, I would hold off for a little bit just in case. Not only can you only get one sign-up bonus per lifetime (for personal cards) but you can also only have 4 Amex credit cards per account (charge cards like the Platinum card are not included in that number). If you are receiving value from your current Amex cards, you may not be willing to cancel one of them right now for the SPG card.

But, What About The Business Card?

– SPG American Express Business Link (I do not receive a referral for this link)

As long as it has been 12 months since you had the card, you can get the bonus again on business cards

The good news is that this one-bonus-per-lifetime rule does not apply to business cards. So, you could get the SPG Amex business card as long as it has been 12 months since you last had it. If you are wanting to wait to see about the increase to 30,000 points on that card as well, that may be a wise move. But, at least you will not be banned from getting the bonus next time if you get it this time (only with the business card).

One more thing about the business card – it is currently under the old bonus plan. You will receive 10,000 Starpoints after your first purchase and the additional 15,000 Starpoints after spending $5,000 in 6 months.

Summary

The SPG Amex cards are great for their flexibility. But, just be careful applying for the personal version as you can only get the bonus once in a lifetime. The changes to how you earn the sign-up bonus is really not something that should make you rush to get the card. It would be worthwhile to wait a little to see if the bonus increases to 30,000 points again this summer as it has in the past.

Thanks for the honest analysis, unlike some bloggers who rushed to immediately push the card. I’d known about the possibility of the higher signup bonus coming down the line, but I wasn’t sure if this was a substitute. I see no harm in waiting a while to apply.

Thanks for the comment! To be honest, I do not like the new spending model. Like I said in the post, being able to spread out the spending made it much easier for many people instead of lumping it in the more standard 3 months. I betcha they changed it because they disliked giving out the 10,000 points for nothing when there has to be a lot of people that do not meet the spend beyond getting the initial 10k.

Not *customer unfriendly* but churner unfriendly….& I say it as someone who hit 4 executive cards last year. 🙂

Can’t blame them from cracking down on folks like me even though I am very small churner.

Haha, definitely churned unfriendly! :). But it is also unfriendly to the average customer who had a SPG card years ago and now has started to stay at SPG hotels again and would like to get the card and bonus. It hurts that person way more than it hurts us.