I am a big fan of Hyatt, they are definitely my favorite chain hotel. Over the last few months, I have decided on a new credit card strategy and even discussed why I will not be re-qualifying for Hyatt Diamond status. Even though American Express isn’t a transfer partner to Hyatt, there is a way to use Membership Rewards at Hyatt.

Using Membership Rewards at Hyatt and a Give-A-Way

Earning American Express Points:

I think I enjoy earning American Express points more than any other point currency. This is due to the fact they are so easy to accumulate!

American Express will allow you to apply for one charge card and one credit card on the same day. This means if you applied for one, you might as well apply for the other. It is only going to cost you one hard pull.

There are some large sign up bonuses as well for their cards. Some of these you need to go incognito to find, but it is worth your time to do so! Some bloggers won’t tell you about the better offers, so be sure to do your homework!

- The Premier Rewards Gold is 50,000 points for $2,000 spend

- The Green Card is 25,000 points for $1,000 spend

- The Gold Card is 25,000 for $1,000 spend

- The Everyday Preferred is 30,000 after $2,000 spend

- The Everyday is 25,000 after $2,000 spend

Between those, you could have 155,000 points for a total of $8,000 spend. That is a lot of points that will help reduce your cost. With all of these bonuses, you’d earn over 19 points per dollar, far better than any daily card.

Looking for alternatives:

Ever since Chases has imposed their 5/24 rule, getting approved for Chase cards (Ultimate Reward points) has become even harder. Since Chase has made it harder, it has become slower to earn Ultimate Reward points for Hyatt stays.

There are ways around the rule, but overall if you are over 5 cards in the last 24 months, you are wasting your time. I know I stopped entertaining their cards after I was denied for the 70,000 United offer.

This will not stop me from applying for cards! There are too many good bonuses and ways to redeem to stop for one bank. If they don’t want my business, someone else will. My travel doesn’t rely on one bank, neither should yours! 🙂

Remember, I am perfectly fine with redeeming for “sub-optimal” value if it means my trip is less. American Express will allow you to redeem against charges and that’s around 0.7 cents per point. Typically I try to redeem my points for no less than 1 cent per point.

That said, I was just searching through the American Express site and saw you can use Membership Rewards at Hyatt. I would be totally for this, I’m not sure how many of you are though.

If you are happy reducing your cost and can stomach redeeming at less than “ideal” value, then this option could be for you. Although many wouldn’t want use their “precious” Membership Reward points at Hyatt, I think this is a viable alternative.

Options at Hyatt:

As I mentioned before, you can charge your Hyatt stay to one of your American Express cards, then use your points against that charge. I wouldn’t do that, since there is a better option.

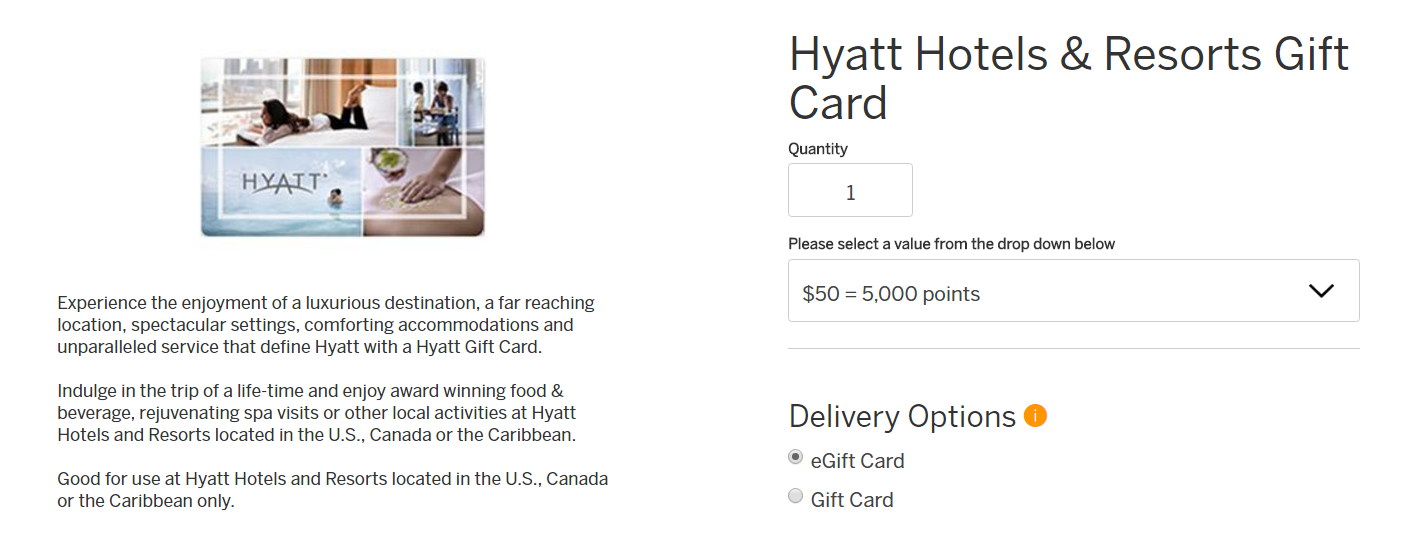

Redeem your Membership Reward points for Hyatt Gift Cards.

Redemptions are:

- $50 for 5,000 points

- $100 for 10,000 points

- $250 for 25,000 points

- $500 for 50,000 points

If you look at other gift cards for hotel options, Hyatt seem to be one of the very few to offer a 1 cent per point redemption on hotel stays. I find this quite interesting as Hyatt partners with Chase, but I won’t complain. Other hotels such as Marriott, hotels.com, Four Seasons, and even Hilton (who is a transfer partner of American Express) are all around 0.7 cents redemption for gift cards

Now I know what some of you will say, I can get at least 2 cents with my Ultimate Reward points. Although I won’t disagree with you, once you hit 5/24 and Chase cuts you off, you need to find other ways to make those stays cheaper, if you prefer Hyatt.

Not only would you reduce your cost at Hyatt, you would also earn points on those stays.

If you were to consider this avenue, just from sign up bonuses alone, you are going to have over $1500 in Hyatt gift cards.

Reasons to Consider this Option:

Now I fully understand that not everyone will do this, nor agree with this. If you haven’t started earning Membership Rewards for whatever the reason, this could be a reason for you to start expanding your credit card portfolio into American Express (if you haven’t already).

I think is important to diversify “currencies” for your travels, especially if you prefer an airline or hotel that isn’t part of your primary point plan. As banks continue to tighten up and make it harder to earn multiple sign up bonuses (there are a few exceptions), being creative is necessary.

Give-A-Way:

I wanted to say thank you for all the great comments and feedback I have received since I have started contributing to Running With Miles. It has been great interacting with many of you, and I hope to continue those interactions in 2017. Interacting with people and answering questions is probably the main reason I decided to get into blogging.

To say “Thank You,” I am giving away 2 United Club Passes and a $20 gift card to Amazon.

To enter the Give-A-Way:

- Follow me on Twitter or like me on Facebook (put link in the comments showing you have followed)

- Let me know which prize you’d prefer (I don’t want to give you United Passes if you’d never use them!), but feel free to say both!

- Leave a comment in the comments, Twitter, or Facebook on a credit card you’d like to see reviewed, 2 credit cards you’d like to see compared, or a topic credit card related. (Credit cards are definitely my favorite topic)

I will select 2 winners on 1/2/2017 and reach out to you to make sure you receive your prizes :-).

Conclusion

I think everyone knows about Chase transferring to Hyatt. Many of us are hitting that glorious “5/24 rule,” but I don’t think you should be sitting on the sidelines to fall below it. We just need to be a little more creative and look for alternatives to reduce the cost of our travel.

I think redeeming your Membership Reward points for Hyatt gift cards, is an acceptable use for your points. Especially if your hotel of choice is Hyatt.

This isn’t a complex way of redeeming your rewards, but since it typically falls under “sub-optimal” redemptions, it isn’t often talked about.

Thank you for a great 2016, and I hope all of you have a great New Years!

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Thanks Dustin. (Club passes) would love to see a post on rationale when deciding to renew or cancel card.

Thanks for the giveaway, both would be great! I follow you on Twitter and just liked you on facebook https://www.facebook.com/Wallerswallet/ I’d like to see a post on earning a Southwest Companion pass when you already have one of the cards. Thanks again 🙂

Thanks Dustin! United passes for sure!

Following you on twitter (@jeffchao1986)

I’d like to see a post on strategies to get annual fees waived for credit cards. Seems like they’re waiving them less and less now.

I’ve followed you on twitter. Would love the amazon gc please, thank you!

Passes and gift card both good. Can use them myself or give as a gift.

I would like to read info on no-fee Amex cards that earn MR points.

Thank you!

I BLV HYATT G.C. GOOD ONLY IN STATES ! –PLUS MANY HORROR STORIES OF HYATT GC BEING DRAINED B4 HAVE A CHANCE TO USE THEM

Hi, Justin. Just followed you on Twitter (I’m @cswriter). If I win I’d like to have the United passes since I have access to other types of lounges but never get to visit United clubs.

Post topic I’d like to see: pros and cons from your perspective of having Arrival+, Flexperks or other travel “rebate” points cards as opposed to conventional airline miles or transferrable points.

Thanks for the giveaway! I’m following you on Twitter (@mrd4430) and would be happy with either prize.

I follow you on Twitter (@pishachs). Either would be amazing .

I’m following you on Twitter ( @rossruns ) and Facebook. I’d like the Amazon gift card. I’d love you to cover a topic about whether you have any impacts to your credit report by signing up for all these different credit cards?

I’d like the club cards, but I don’t do social media. Sigh.

Great post, and thanks for the honesty regarding the incognito application options.

I am following you on twitter (@mangojasmine).

I would like either passes or gift cards.

I am an Amazon/Ebay seller, and would love a comparison of Amex business cards to maximize business expenses.

Happy Holidays!

I just followed you on Twitter. The $20 Amazon gift card would be really nice.

I would like a review on the BofA Alaskan Airlines card.

Thanks Dustin! United passes for sure!

Following you on twitter (@hashimhalawami)

I would like both. Thanks to you, been out and about a lot.

I’m a follower on twitter, https://twitter.com/wallerswallet. I would like to hear your thoughts on how the merger will affect the value of Virgin and Alaska credit cards. Would love to win the Amazon card because already have my own United passes!

Thanks for all your tips AND Happy New Year. The United passses would be great!!

I don’t think that Hyatt is still in the AmEx Membership Rewards gift card program.

Most of the hotel chains in the program are at the 0.7 exchange rate. Morton’s, Flemings, Seasons 52, and Fairmont Hotels are at 1.0.

Mandarin Oriental is at 0.85.

The absolute worst is getting an Amex gift card.

I just checked several Amex accounts, and I don’t see Hyatt there at all. Bummed…. I was so excited about this article :(.