This past weekend, the Hilton Surpass card from American Express again experienced a hike. This year, it was to 80,000 points. That is a lot of hotel points, especially if you plan to use them at the lower to mid category Hilton hotels. But, there may be some that do not want to open a new card, even for a nice offer like that. Fortunately, you can upgrade your current American Express card – and still get 50,000 points!

Upgrade To Hilton Surpass For 50,000 Points

Let me say first, if you go this route, you will not be able to take advantage of the extra 30,000 points of the current offer. But, we will look at some reasons later why you may want to go the upgrade route.

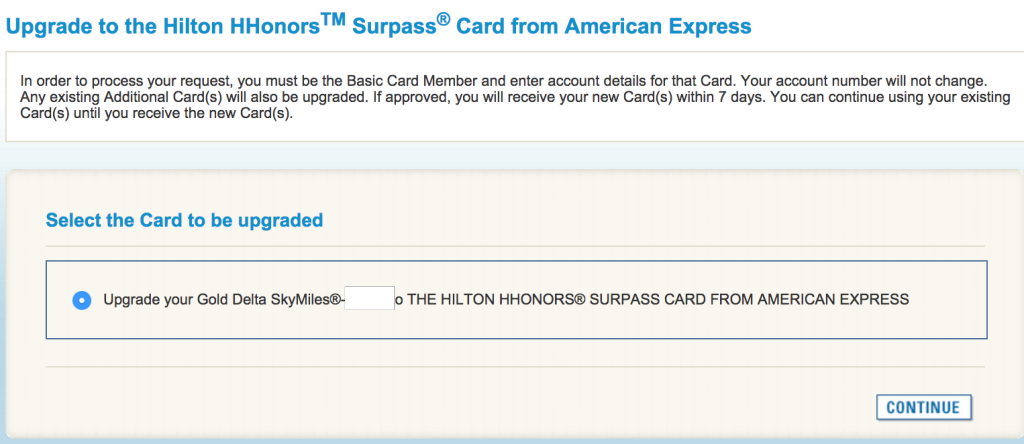

It is very easy to upgrade a current American Express card to the Hilton Surpass card and get 50,000 points. Also, it does not have to be a regular American Express card that you are upgrading from – the Delta Skymiles Gold Amex works for upgrades as well. It may work with other cards (such as the Amex SPG or Amex Delta Plat) but I did not receive offers from those cards. It could be because they were in the same account as the regular American Express Hilton card.

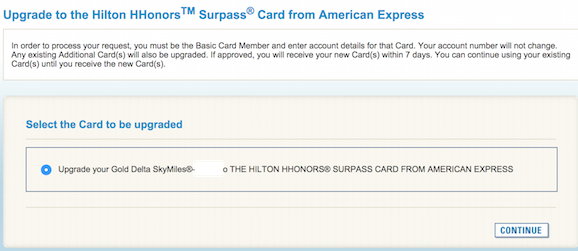

To upgrade, you need to visit this American Express website – here – and enter your username and password of your account (or you could enter your card number you wish to upgrade from). Once you are in, it should offer you a box similar to the one below indicating which card is available to upgrade to the Hilton Surpass card.

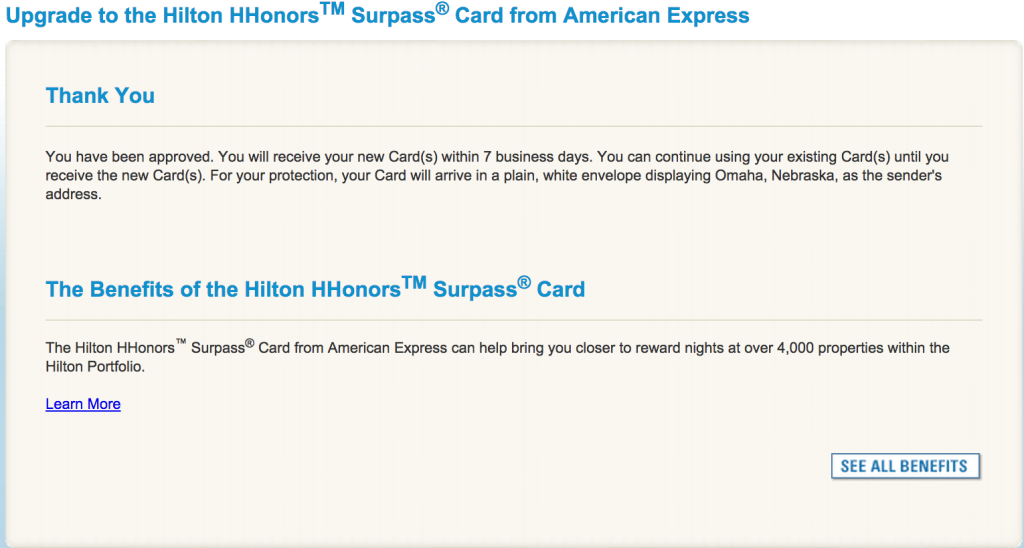

Just click to Continue and it will give you an option to add an additional card user. Click to continue again and it will submit it. It should come back within 5 seconds with an approved message.

Note: Any card that you have opened or changed in the last 12 months will not be eligible for an upgrade. You must wait a period of 12 months before changes can occur.

Earning the 50,000 Points

To get the 50,000 points, you will need to spend the same $3,000 in 3 months that you would if you went for the 80,000 points. You will also be assessed an annual fee of $75 (since this is an upgrade, you will receive a prorated amount of the card you are upgrading from) within 45 days.

This card comes with Hilton Gold status so it is a nice perk to add to your new account.

Why Upgrade Instead Of Open A New Account?

Already Received A Sign-Up Bonus

Earlier this year, American Express changed their policy to allow you to receive a sign-up bonus once per lifetime. That is really an unfriendly policy to cardholders who may have held a card sometime in the past and now wish to open a new card to take advantage of different travel patterns. If you cannot receive the sign-up bonus, there is really little reason to sign-up for most cards, especially since this one comes with an annual fee of $75.

But, upgrading a card does not carry that same policy. If you have held the American Express Hilton Surpass in the past, you can upgrade and get the 50,000 points instead. It does not matter if you have already received a bonus on the Surpass before – an upgrade allows you to receive this 50,000 point offer.

Maxed Out The Amex Limit

American Express allows you to have a total of four credit cards (does not include charge cards) per account. Some have been able to get more since this policy was put in place, but it is a policy that stops many at four. If you had four before the policy went into affect, you are fine.

So, if you have the maximum of four cards, which is not too hard to believe, you would most likely be denied for a new American Express Hilton Surpass card. You would then need to call in and close one of your accounts and have them resubmit the application for the Hilton Surpass to get it. It is always possible to cancel a card preemptively, but there is still no guarantee you will receive an instant approval on the card.

By upgrading a current card to the Hilton Amex Surpass, you do not have to call in and you can simply trade out one card for the Surpass. This is also helpful if you have a card coming up that has an annual fee that is higher than the Hilton Surpass card. Upgrading allows you to stay within the Amex limit.

No Hard Pull Depending

This one is somewhat up for debate. When I have upgraded before for offers such as this, I did not get a hard pull on my credit report. Some people have mentioned that they have received a hard pull for the upgrade. From various things I have read, it appears that, if there is a hard pull, the process is to do a soft pull during the upgrade. If you are approved, it then does a hard pull but backdates the hard pull to the date the original card was opened.

A hard pull is what shows up on your credit report that other creditors will see when running a check on your credit report. It shows that you have made a request for credit. A soft pull is more of an identity check and the soft pulls can only be seen by you.

So, the chances are very good that upgrading through this offer will only do a soft pull (since you are only changing products and not getting any additional credit). That has been the case for me in the past. Worst case, they would only do a hard pull if you are actually approved for the card upgrade. If you are denied, it will not show up on your credit report as a hard pull.

If you have been through this process before, I would be interested to know what your experience was with the soft pull/hard pull. Feel free to comment below.

Summary

While 50,000 Hilton points will not get you as much as it once would, it is still a decent offer to upgrade a current card and not have to worry about opening a new account (for the reasons above). These 50,000 points will cost you the $75 annual fee, but you will get Hilton Gold with the card (which can be valuable since it gives free breakfast).

If you have already received the Hilton Surpass bonus once before, this upgrade is a nice way to fill up your Hilton account with 50,000 more points for use down the road.

[…] may also check out this post on Running With Miles. It mentions that you can upgrade your existing Amex card to Surpass, and get 50,000 Hilton points. […]

@runningwithmiles

interesting.

i want to upgrade my SPG personal to this hhonors surpass.

i clicked your amex link, logged in, error:

“We are unable to process your request for a product change at this time. Please call the number on the back of your card.”

-any ideas?

-does my SPG have to be 12 months old before i can attempt upgrade to surpass?

thanks!

just reread your post and saw

“Note: Any card that you have opened or changed in the last 12 months will not be eligible for an upgrade. You must wait a period of 12 months before changes can occur.”

my amex ‘everyday’ is 12 months old, but no offer to upgrade. is the ‘everyday’ not upgradable to surpass?

thanks.