A little bit ago, I wrote about the last of the Hilton point cards to hike up their sign-up bonus. There has seriously never been a better time to earn Hilton points and with the large number of recently-matched Hilton Diamond members, I thought it would be good to put them all on one page so you can pick one/all to get the Hilton points you need for your travels.

Pick Up 230,000 Hilton Points & 2 Free Nights With These Cards

Disclosure: I do not receive a commission for any of these links in this post. If you would like to apply for a card and support the site, please use the link above or go to the Credit Card tab. Thank you for your support!

Hilton has the unusual relationship of being partnered with both American Express and Citi. This is not something other airline/hotel programs do but it gives Hilton members a unique angle to pick up as many points as possible. Since each bank as their strengths/weaknesses, it is really nice to have the option. As you read through this, take note that the point cards (the no-fee Amex and Citi cards and the Amex Hilton Surpass card) are all limited-time offers. The Citi Hilton Reserve with its 2 free nights has had that bonus for a long-time so keep this in mind if you are trying to figure out which cards to get first.

American Express Hilton Surpass – 85,000 Hilton Points

This is the top Hilton/Amex card available so it does come with an annual fee and one that is due up front – $75. But, you are getting the most points out of all the cards with this offer so spending $75 to get the 85,000 points is not bad.

– hilton surpass 85,000 points

- Earn 85,000 points after spending $3,000 in 3 months

- Earn 12 Hilton HHonors Bonus Points for each dollar of eligible purchases charged directly with a participating hotel or resort within the Hilton HHonors portfolio of brands‡

- Earn 6 Hilton HHonors Bonus Points for each dollar of eligible purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations‡

- Earn 3 Hilton HHonors Bonus Points for all other eligible purchases on your Card‡

- Enjoy complimentary Hilton HHonors Gold status with your Card. ‡

- Annual Membership Fee: $75 (not waived the first year)

- Not eligible for the bonus if you have or have ever had this card

- Earn Hilton Diamond status by spending $40,000 in a calendar year on this card

American Express Hilton Card – 70,000 Hilton Points

– american express hilton 70,000 point link

Earn 70,000 points after spending $1,000 in 3 months

Earn 70,000 points after spending $1,000 in 3 months- Earn 7 Hilton HHonors Bonus Points for each dollar of eligible purchases charged directly with a participating hotel or resort within the Hilton HHonors portfolio of brands

- Earn 5 Hilton HHonors Bonus Points for each dollar of eligible purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations

- Earn 3 Hilton HHonors Bonus Points for all other eligible purchases on your Card

- Enjoy complimentary Hilton HHonors Silver status with your Card.

- Earn Hilton HHonors Gold when you spend $20,000 in a calendar year on this card.

- Annual Membership Fee: $0

- Not eligible for the bonus if you have or have ever had this card.

Citi Hilton Visa – 75,000 Hilton Points

– citi hilton 75,000 point offer link

- Earn 75,000 Hilton points after spending $2,000 in the first 3 months

- Earn 6 Hilton HHonors Bonus Points for each dollar of eligible purchases charged directly with a participating hotel or resort within the Hilton HHonors portfolio of brands‡

- Earn 3 Hilton HHonors Bonus Points for each dollar of eligible purchases at drugstores, at supermarkets, and at gas stations‡

- Earn 2 Hilton HHonors Bonus Points for all other eligible purchases on your Card‡

- Annual Loyalty Bonus – Earn an annual loyalty bonus of 10,000 Hilton HHonors Bonus Points at the end of each calendar year in which you spend $1,000 or more on stays within the Hilton Portfolio

- Enjoy complimentary Hilton HHonors Silver status with your Card.

- Annual Membership Fee: $0

Citi Hilton Reserve – 2 Free Nights

Like the Surpass card, this is Citi’s top Hilton card and also comes with an annual fee up front. This one is for $95.

– Citi Hilton Reserve 2 Free Nights Link

- Earn 2 weekend night certificates each good for 1 weekend night (standard room, double occupancy) at select hotels and resorts within the Hilton Portfolio after you make $2,500 in purchases within the first 4 months of account opening

- 10 HHonors Bonus Points per $1 spent on hotel stays within the Hilton Portfolio

- 5 HHonors Bonus Points per $1 spent on airline and car rental purchases

- 3 HHonors Bonus Points per $1 spent on other purchases

- Enjoy complimentary Hilton HHonors Gold status with your card

- Annual Membership Fee: $95 (not waived the first year)

- Earn Hilton Diamond status by spending $40,000 in a calendar year

Adding Up The Numbers

So, here is how it adds up if you are interested in going for all of these cards:

- You will pay $170 in annual fees up front

- You will need to spend $8,500 across these cards in the first 3 months (the Citi Reserve is actually $2,500 in 4 months so it may be better to wait on this card until the last month for the bulk of the spending)

- You will have Gold status (from two cards – the Surpass and the Reserve)

- You will receive 230,000 Hilton points and have 2 free (weekend) nights at Hilton hotels

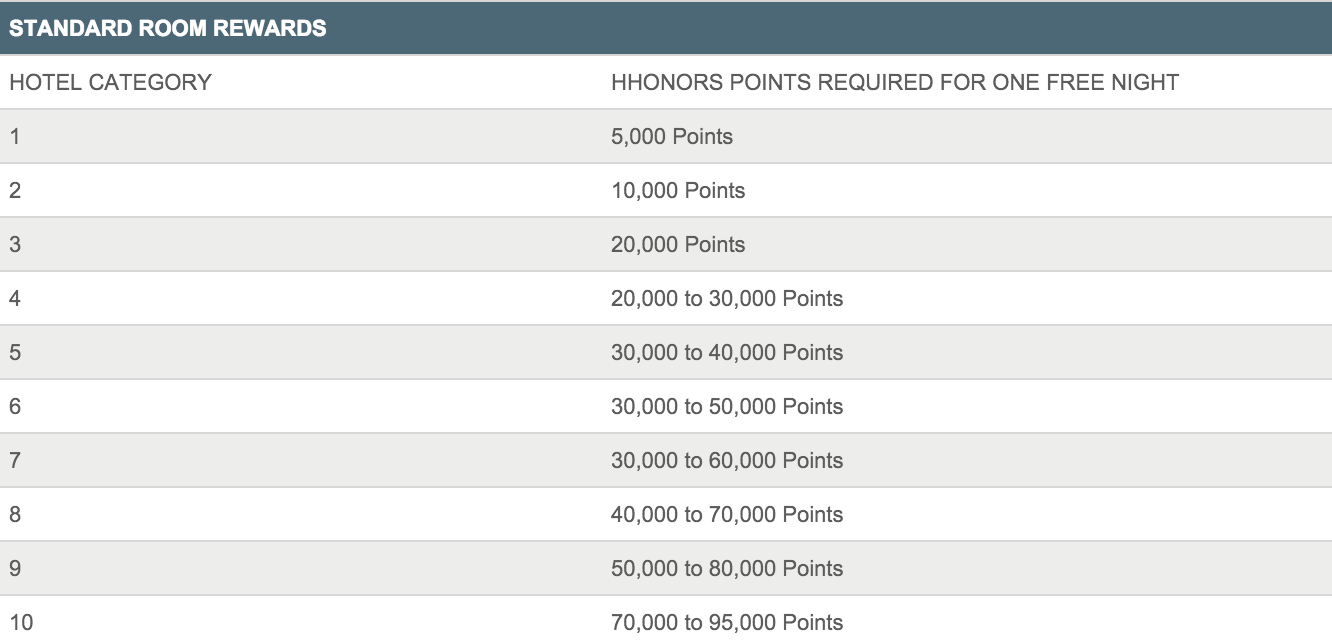

- The points are enough to provide anywhere from 46 nights at Category 1 hotels to 2.5 nights at Category 10 hotels in peak season for those locations (3.2 nights at the non-peak end of the Category 10 hotels)

If you still needed more Hilton points after collecting all of those, the best card to use would be the Amex Hilton Surpass for restaurants, supermarkets, and gas stations (you will earn 6 points per dollar), and the Citi Hilton Reserve for airline and car rental (5 points per dollar).

Application Strategy

As I said, the Citi Hilton Reserve has offered those 2 free nights for a long time and they are not going anywhere. Also, they are only good for a 1 year period from the date of issue so you need to have a use in mind to get the most value. With the other 3 cards, you could apply for one of the American Express cards and the Citi no-fee Hilton card on the same day. A little bit later, you could apply for the other American Express card.

Personally, given how frequently the Surpass bonus comes up, I would go in this order:

- Apply for the Citi no-fee Hilton Visa and Amex no-fee Hilton card same day

- A few days/more later, apply for the Amex Hilton Surpass

- Apply for the Citi Hilton Reserve whenever you know where and when you would use those 2 nights

In fact, you don’t even have to apply for the Reserve card at all right now. The big thrust would be for the increased point offers and the Reserve is just to show you could get 2 extra nights as well. But since the Surpass also comes with Gold status, there is no real need for the Reserve unless you want those 2 nights right now (or within the year).

Also, do not forget that American Express limits you to 4 credit cards total – business and personal. Charge cards do not figure in that count but if you apply for these 2 Amex cards, that will count towards your limit of 4.

Summary

The Hilton cards enjoy a nice blend of two issuers and two cards with each of them. That translates to big rewards for us! Of course, Hilton’s award chart is very expensive at the top but there are a lot of quality properties around the world in the middle and lower categories. A hotel requiring 40,000 points per night would be a hotel you could book almost 6 nights at with all of these points (actually, it would be more if you had 5 nights in a row as the 5th night is free). There is a lot of value to be had and hopefully you will be able to take advantage of it, especially if you have joined the Hilton Diamond ranks.

Thanks for this post. The Hilton Amex cards would count towards the four Amex cards you’re allowed to have, yes? So people might want to consider which four Amex cards they want to have before applying for both. Would you consider them among the top 4 Amex cards? Also, might be good to note that the Citi cards need to be spaced out with 8 days between them.

That is right – and thanks for the reminder! I meant to add that in there and will do so now.

You can cancel them to open new ones if you need to so that shouldn’t be too much of a problem. Remember, charge cards do not count towards the total.

for citi apps, won’t we need to wait after 8 days or so to apply for a 2nd or another cc?

could you private message me about the currently best MS techniques to meet this spend?

thank you

evan