The US Bank Altitude Reserve was US Bank’s attempt to get into the premium credit card market (I mean, who doesn’t need another metal card?). It offers some standard perks (like some kind of lounge access, hotel perks with the Luxury Hotel Collection, Global Entry reimbursement, travel credits, etc) while also offering a very intriguing benefit – 3X points on purchases using mobile wallets.

But, there is one part of the new US Bank Altitude Reserve that does not compete with other premium cards and is a bit of a disappointment if you want to use this high fee card for your travel.

How the US Bank Altitude Reserve Does Not Compete with Other Premium Cards

I applied and was approved for this card on day one (you have to have a relationship with US Bank already, it can be another credit card) and was excited because some of the reselling I do involves a retailer that does not have a portal bonus but does offer Apple Pay. Being able to get 3X points on my large purchases for reselling sounded really good to me!

Of course, so did the 50,000 points after meeting the $4,500 minimum spending threshold! Those 50,000 points can be redeemed for travel at the rate of 1.5 cents per point, yielding a sign-up bonus value on travel of $750.

The Points are Limited In Redemption Ease

But, the points themselves work a little bit like other points from US Bank cards – you can only redeem for what you have the points to cover. For example, if you meet the minimum spending using something like Apple Pay, you would wind up with the 50,000 points plus 13,500 points from the spending (3x $4,500 for mobile payments) for a total of 63,500 points. That would be worth $952.50 worth of travel redemptions booked through the US Bank travel portal. Pretty nice, right?

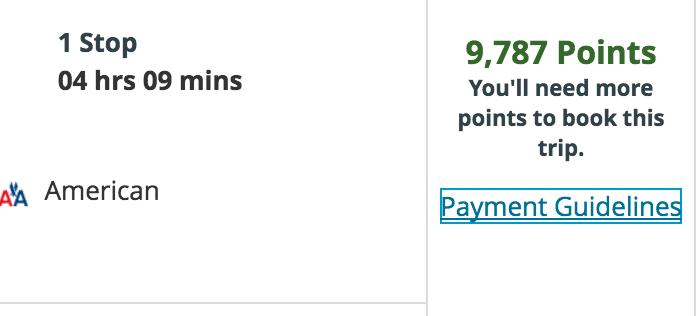

Must Pay Completely with Points

Except for one big thing – if you are trying to redeem for a flight that costs $1,000 (with your $952 worth of points), you are out of luck. You will need to buy points to get to the point that you can redeem completely for the flight. You cannot use points as a partial payment for your redemption. That is a huge negative for me! With other cards (Chase Sapphire Reserve, American Express Platinum, Citi Prestige), you can use the points as partial payment which really helps if you either don’t want to use all of your points on that redemption or you do not have enough to make it work.

There are many times that I use my Ultimate Reward points with the Chase Sapphire Reserve as a partial payment, normally to cover what an award ticket would have cost if there had been availability – and then I pay the other part using the credit card. This helps give flexibility in how I use the points and when I want to redeem them.

But, with the US Bank Altitude Reserve, you are stuck with having to pay it in full for your travel. Here is what US Bank says about the redemption guidelines for travel:

“Payment Guidelines

When redeeming points for air tickets, the first ticket must be covered in full by redeeming with points before any additional tickets can be purchased. If you do not have enough points for a single or multiple tickets, you have two options:

- Option 1- Purchase additional tickets in full by paying for them on your Rewards credit card

- Option 2 – Purchase additional points to be used to redeem for the additional tickets by calling 844-357-2015.

Hotel and car reservations must be redeemed in full with points, or can be paid in full by using your Rewards credit card.”

In my case, I like to use points like this for redeeming for things like Turkish Airlines business class (since I can usually get them at lower prices departing from Europe) because it is actually cheaper to do that than to redeem United miles (if I was to transfer Ultimate Reward points to United). But, it does mean that I will need to spend more to get the points I need to cover it in full if I want to use my US Bank points for such redemptions.

In a way, US Bank has made a calculated move – they do not offer transfer partners so you are locked into redeeming for things like travel or merchandise/gift cards and you will need to earn more points to always be able to drain your account completely of points (if you redeem for travel). That means you will need to keep spending on this card instead of just holding it for benefits.

Takeaway

The US Bank Altitude Reserve really didn’t start out as a Chase Sapphire Reserve killer at all and with a somewhat hamstrung redemption policy for travel, it will never replace card redemption options like are available with the Chase Sapphire Reserve, American Express Platinum, and Citi Prestige.

Still, for now, I look at the 3X earning with mobile payment to be something that will make me keep spending on it. But, once that is messed with or devalued, I will drop this card fast.

Do you find the redemption guidelines for the US Bank Altitude Reserve to be restrictive?

Yes, Charlie, it’s a sad awakening for us. USBank, like Citi, like that other bank with Alec Baldwin & Jennifer Garner ads, obviously have “made a calculated move” to maximize marketing potential and minimize fulfillment costs. Oh, sigh. I had hoped they were designing their programs to maximize consumer value.

I, too, got one of those metal things. Enjoy the challenge of beating them at their own game. Could be a short game for me, too.

P.S.

Speaking of lounge access, have you found out yet how to get Priority Pass access with Elevate? I need to call their (so far very helpful) phone line to find out.

US bank is very select about there credit products you blogers who have these relationship with these mega banks should hold these banks feet to the fire by finding the impossible credit formulas for approval on there cards just a thought thanks

Thanks for the comment but I do not have any relationship with US Bank other than as an indirect affiliate (meaning there is a middleman that handles cards and I do not have contact with Us Bank).

[…] One great feature of this card is that you can cover the cost of your ticket beyond $500 with cash if you don’t have enough points for it. And you can cover that cost with any credit card. This is contrast to cards like the US Bank Altitude Reserve which require you to cover the whole cost of you…. […]