When earning points, I really prefer flexible points. When it comes to flexible points, there are a couple of programs that are on all the flexible point currency team. While I like to earn points in flexible currency programs, I also like to keep my annual fee cost to a minimum. What would the best cards for earning Flying Blue and KrisFlyer Miles be?

Best Cards for Earning Flying Blue and KrisFlyer Miles

To really maximize earnings for Flying Blue and Singapore Airline miles, you will need to use a couple of cards from a few issuers.

Cards to Consider

Citi Thank You Premier

For a while now, I have felt the Citi Thank You Premier receives very little love compared to other cards. It has a pretty strong earning rate, while keeping the annual fee manageable.

With many cards being offered as a top card, people definitely focus on a couple of cards. I think one of the more underrated cards for travel spend is the Citi Thank You Premier. It has a very strong earning potential for quite a few categories. I think you’d be hard pressed to say 3x on travel and gas isn’t a solid earner, in addition to 2x on dining and entertainment.

The Citi Thank You Premier also has no foreign transaction fees, which makes it a great option to use when traveling abroad. This card does come with a $95 annual fee, but it is waived the first year.

Thank You points transfer to both Flying Blue and KrisFlyer at 1:1. Citi does offer transfer bonuses from time to time, which could increase your transfer ratio.

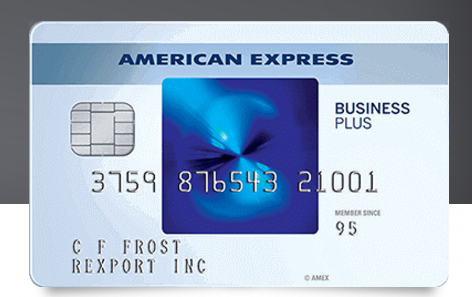

American Express Blue Business Plus

This is a new card released by American Express and even with my Love-Hate relationship with American Express, this is solid card. The Blue Business Plus earns 2x Membership Reward points on all purchases, on the first $50,000 spent each year.

It gets even better when you consider this has no annual fee.

When you start to compare this to other cards on this list, you could actually make a case this could be the only card you need, since some of the others on this list earn just 1x more on select categories and have an annual fee.

I’d say, if you were looking for only one card on this list and didn’t want to juggle a couple of cards, this might be your winner. I mean it’s pretty hard to argue against 2x on all purchases!

Chase Sapphire Preferred

I would say this is a less ideal card to use when compared to the cards above this one. Let me explain why this might be in your rotation, although it is inferior to the Blue Business Plus and Thank You Premier (for Flying Blue/KrisFlyer points).

The Chase Sapphire Preferred will earn 2x on dining and travel only. The reason to possibly consider this card is the fact you can pool your Ultimate Reward Points to transfer to Flying Blue and KrisFlyer. The other fee free Chase cards can earn at a higher rate, but the trade off is you need this card (or another premium card) to allow transfers to partners.

This could be in your rotation for a couple of reasons:

- Used as a main card for travel/dining

- Kept to unlock transfer options to Flying Blue/KrisFlyer

This if this as an intermediate card, you’re paying $95 to do that. You would need to run the numbers to see if that make sense for you.

Chase Ink Preferred

This is Chase’s newest business card, which I actually think falls pretty flat. The only category worth talking about is the 3x on travel purchases.

The key feature, like the Sapphire Preferred, is the ability to transfer to partners. There would be no reason to keep both the Sapphire Preferred and Ink Plus at the same time.

If you have this card, it would be a good choice to use abroad as it has no foreign transaction fees

The Chase Ink Preferred does come with a $95 fee, that is not waived the first year. Although it has a great benefit with cell phone protection.

Chase Ink Cash

In order for this to make your rotation for Flying Blue/KrisFlyer transfers, you will need either the Ink Preferred or the Sapphire Preferred. If you don’t have either of those cards, then this card will useless to transfer points to Flying Blue/KrisFlyer

The draw to this card is the fact it will earn 5x on your cable/phone bill and office supply stores (up to $25,000). It will also earn 2x on all gas purchases and dining. This is a great option to really earn Flying Blue/KrisFlyer miles.

The Ink Cash comes with no annual fee as well. If you have a premium Chase card, this should definitely be a card in your rotation.

Chase Freedom:

As with the Chase Ink Cash, you will need a premium Chase card to transfer your points to Flying Blue/KrisFlyer.

If you do have one of those, you will only use this card on the particular 5x quarterly categories. If you were to max out the 5x categories yearly, you would end up with 30,000 points (7,500 points per quarter) to use for Flying Blue/KrisFlyer.

The Chase Freedom comes with no annual fee and should definitely be kept for the long term if you have this card.

Rotation Options:

I think the ideal rotation would be to earn as many points as you can, while keeping the annual fees to a minimum. There are many different options with the cards above, but I outline a couple of them below.

A rotation can be simple, or they can involve multiple cards. It really depends on how comfortable you are juggling different cards.

All the rotations have one card in common, that’s the American Express Blue Business Plus. At 2x on all non-bonus spend, there isn’t another card that beats that.

Rotation 1:

- Citi Thank You Premier- Use for Travel and Gas

- American Express Blue Business Plus- Use Everywhere Else

This is a pretty straight forward and simple rotation. After year 1, it comes to $95 a year in annual fees, plus it is only 2 cards. For many this could be an ideal set up. Just using 2 cards and you’ll earn 2x to 3x on every transaction.

Rotation 2:

- Citi Thank You Premier – Use for Travel, Gas, and Dining

- Chase Sapphire Preferred- Only to unlock 5x categories from other cards

- Chase Ink Cash- Use for 5x Office Supply Store and Cable/Internet

- Chase Freedom- Use for 5x rotating categories

- American Express Blue Business Plus – Use for all non-bonus spend

Depending on how much you spend on the Ink Cash and Freedom, it could make sense to have the Sapphire Preferred only to unlock the transfer options.

This option will add an additional $95 to your annual fee cost, but it could be worth it depending on the amount of points you earn.

Rotation 3:

- Chase Ink Preferred – Use for travel

- Chase Ink Cash- Use for 5x at Office Supply Stores and Cable/Internet/Phone

- Chase Freedom- Use for 5x at rotating category

- American Express Blue Business Plus- All non-bonus spend

The Ink Preferred would only be used for travel and unlock the transfer partners. This is very similar to rotation 2, but your annual fee will only be $95.

Using Those Miles:

Earning the miles is part of the battle. Understanding how to use them is probably the more difficult part for people.

There are some solid articles out there, but MileValue has some pretty solid information on these programs. I would definitely take a look and research these programs, since this is a lot of information. Don’t just read these articles, make sure you read many articles on them.

MileValue Article on Flying Blue

MileValue Article on KrisFlyer

There are groups on social media that have a lot of people who are willing to help you learn as well. They might even know a trick you didn’t know.

I’m not a person who needs to squeeze max value out of every single point. The ability to earn points so quickly in both of these programs make it ideal to redeem for flights sooner. Which is why I am a big fan of these programs.

Conclusion:

Flying Blue and KrisFlyer are some of the easiest points to earn, since they are transfer partners with Chase, American Express, SPG, and Citi.

When you start stacking different cards from these programs, you can really earn a lot of points. Picking the right rotation is a key part to helping you reach your travel goals.

These are really good programs to help you travel for pennies on the dollar.

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!