The other day, I wrote about (and somehow did some horrible math, which has now been corrected!) what I consider to be an undervalued Hilton offer. It is for the no-fee Hilton American Express card and is 75,000 points and $100 statement credit. For a no-fee card to give you any money is pretty nice but then you also get Hilton points worth at least $375 to boot! That is a really great, not-much-talked-about Hilton offer.

New No-Fee Hilton American Express Card Offer of 100,000 Hilton Points

But, if you would rather have the points than the cash, there is another offer that you can get. This offer trades out that $100 statement credit and gives you 25,000 additional Hilton points instead for a total offer of 100,000 Hilton points – on a no-fee card. However, there is not a simple link to get it (more on this below).

How to Get the 100,000 Point Hilton American Express Offer

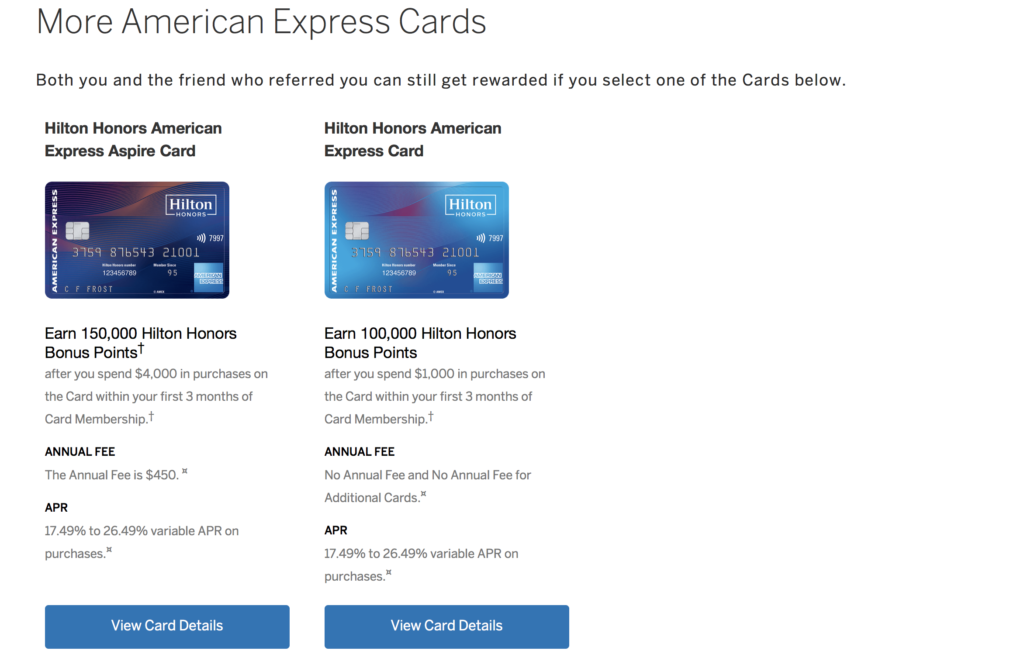

To get this offer, you would need to click this link (which is a referral offer from my account – I receive 20,000 points if you are approved, thank you!). After that, scroll to the bottom of the page and you will see the no-fee card offer there. It offers 100,000 points, which is 25,000 points higher than the public and affiliate offer and trades out the $100 for 25,000 points on the other offer (as I detailed above).

Which Offer to Choose?

Personally, since it is possible to buy Hilton points during sales for .5 cent each, I would rather have the $100 statement credit. However, there are others that would rather have the points so I wanted to showcase this offer as well. Here are the details of this offer:

- Earn 100,000 Hilton Honors Bonus Points after you spend $1,000 in purchases on the Card within your first 3 months of Card Membership

- 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with a hotel or resort within the Hilton portfolio.

- 5X Hilton Honors Bonus Points for each dollar of eligible purchases on your Card:

- at U.S. restaurants

- at U.S. supermarkets

- at U.S. gas stations

- 3X Hilton Honors Bonus Points for all other eligible purchases on your Card.

- Enjoy complimentary Hilton Honors Silver status with your Card.

- You can earn an upgrade to Hilton Honors Gold status through the end of the next calendar year after you spend $20,000 in eligible purchases on your Card in a calendar year.

- No annual fee

- The bonus us not available if you have ever had this card before!

Again, I would choose the offer with the statement credit but if you would rather have the Hilton points now and you can get more than $100 in value from them, this offer is really a pretty good offer as well!

#1 I tried your link several times, even in an anonymous window, and it never worked. It just showed the AmEx page with a bunch of javascript errors.

#2 What am I missing? I don’t see how the $100 offer is better than this extra 25k points. I can easily get more that $100 value out of 25k HH points. OTOH, I cannot buy more than 25k HH points for $100.

#3 “The bonus us not available if you have ever had this card before!”

Here is the real beef: do the suits at American Express really not believe they are POing their most loyal customers by playing this game? We have seen the offer on this card go from 50k -> 75k -> 75k + $50 -> 75k + $100 -> 100k points… in under a month.

Even before today’s newest offer, I was seeing complaints all over the travel BBs from people who signed up for one offer and watched a better offer come out before they had even received their new AmEx card. The customers are really furious about this, but AmEx refuses to fix their mistake by simply matching their own offers.

Literally, even I could do a better job with this than they have done. They may as well call this the “gaming that Chase does NOT play with its customers” offers.

1. That is strange – I just tried it myself, in multiple browsers and windows, and it worked ok? I will put a different link in and maybe that one will work for you.

2. It is a balance for me – the $100 offer is one that I don’t get anything for and this one I do get Hilton points for. So, automatically, I lean more towards NOT recommending the offer that gives me something. On the other hand, the difference would essentially be 5,000 points (if you used the $100 to buy Hilton points at a discount). I can easily make up that gap so it comes down to – what would I prefer more at the time of getting the card? If someone does not have an immediate use for the points, we know that Hilton likes to change up award rates at their leisure so it could be worth more to have the cash than the points (if you are just getting them for some award down the road).

3. I am 100% with you. I cannot believe they behave like this. I understand having differing offers based on the channel people apply through (personally, I think it is a good idea for Amex having the better offer available through personal referrals since they get to pay with points instead of paying affiliates with cash). But, the offers should all change at the same time so people know right away what their options are.