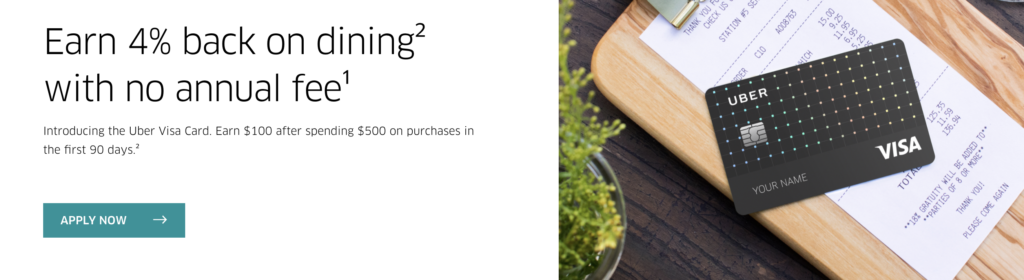

The new Uber credit card, which I feel presents some interesting things other issuers could learn from, is now accepting applications! If you are interested in a solid, no-fee card with pretty good cashback on popular categories, check out this card.

The New Uber Credit Card Is Live

Link: Uber Credit Card

As a recap, here are the details about this new Uber credit card.

- Earn $100 after spending $500 in the first 90 days

- 4% back on dining

- 3% back on hotel and airfare (including vacation rentals like AirBnB)

- 2% back on online purchases (not made through third-party wallets like Apple Pay, Samsung Pay, etc)

- 1% back on everything else

- Up to $600 in cell phone coverage

- a $50 credit for certain subscription services after spending $5,000 in a year

The new Uber credit card’s category bonuses

Potential Point Transfers?

This is one that popped up last week and was confirmed to View from the Wing by Barclaycard. He had this to write “However Barclaycard confirms to me that “we are exploring other travel redemption options for 2018, like point transfers, that could be used for Uber and some of our other card products.”

This is great news indeed, especially for a no-fee card! However, there is no knowing at this point what those transfers would look like. If I had to guess, I would say that the points earned on the Uber card would transfer at a ratio less than 1:1 to travel partners. Remember, Barclaycard now has a nice, tidy little group of airlines that they are co-branded with so it would not be surprising to see them negotiate to have transfers to them. They are:

- American Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Lufthansa

That would give access to oneworld airlines and Star Alliance airlines so that would be a great start! Again, my guess would be that they will not be 1:1 but we will have to wait and see what 2018 brings us!

Cell Phone Coverage

This is a nice one! If you pay your total monthly cell phone bill with your Uber credit card, they will cover you for up to $600 in “insurance coverage against theft of, damage to or involuntary and accidental parting of your cell phone not otherwise covered by another insurance policy.”

It is also a nice play by the Uber credit card to get one of the higher, repeating payments for most Americans monthly – one that would normally earn 5 points per dollar on something like the $95 annual-fee Chase Ink Plus or the no-fee Chase Ink Cash.

Of course, I just dropped my iPhone last night and have a nice crack down the front of it. 🙂 At least I have AppleCare – besides, I don’t think the Uber card would cover me since my monthly bill is only $9! 🙂

The Uber credit card has a lot of positives going for it, especially since there is no annual fee involved! If you are looking for a new credit card to add and don’t mind potentially being over 5/24 for Chase a while longer, give it a shot!