Next week is the next round of stimulus payments that go out as part of the America Rescue Plane. This means millions of Americans will see more money landing in accounts then. But, it is also the last chance to make any changes to it for your final payment or to make sure you get it if you have not already.

New Stimulus Money and Last Chance to Get Your Payment This Year

Link: IRS FAQ for America Rescue Plan

The America Rescue Plan passed earlier this year came with an increase in the Child Tax Credit and began making half of those payments in July. These payments have been going out on the 15th of each month since then and will have the last one on December 15.

The amount is $250 per month for children aged 6-17 and $300 per month for children aged under 6 for each month from July – December.

New This Month and Important Update!

Link: IRS Portal for Updating Income

The IRS has launched a new portal this month that will allow you to update your income for the Advance Child Tax Credit. If you are making more than you had in 2020, you will want to update it before the final payment to make sure you get the appropriate amount and you do not end up having to pay it back next year.

At the same time, if you are making less than you did in 2020, you can update your income to make sure you receive the proper amount for December. It is too late to do it for November but at least you can make sure that your final Advance Child Tax Credit of the year is correct.

If you have not received anything yet this year and you are eligible, specifically low income families (even if you normally do not file a return/have any income), make sure you sign-up using this link before November 15!

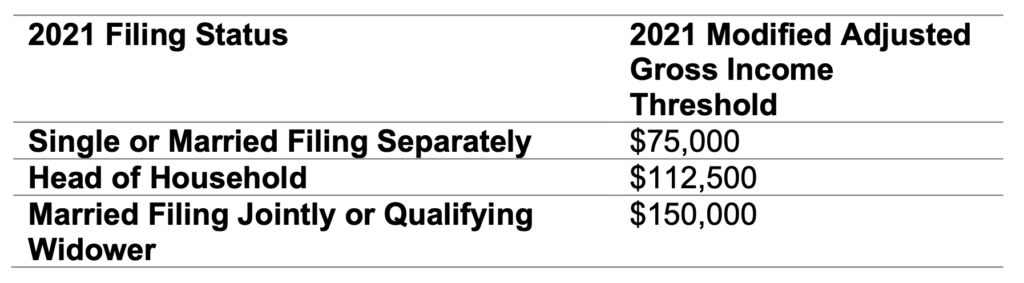

This is important – if you have had an income change this year that puts you above or below the amounts below (as shown in the table below), you should update using the portal above to make sure you get the correct amount next month.

Here is what the IRS says on this:

If you are eligible to receive advance CTC payments, you can provide us an estimate of your 2021 income in the Child Tax Credit Update Portal (CTC UP). You can use this online portal to estimate the income you plan to report on your 2021 tax return. We will use that income estimate to recalculate our estimate of your 2021 Child Tax Credit and the amount of your monthly advance Child Tax Credit payments.

Consider providing us an estimate of your 2021 income if either:

- You expect your modified adjusted gross income in 2021 to be higher than the threshold below.

- Your modified adjusted gross income in 2020 was higher than the threshold below.

Low-income families can still sign up

It’s not too late for low-income families to sign up for advance CTC payments.

The IRS urged any family not already receiving payments who normally isn’t required to file a tax return to explore the tools available through IRS.gov. These tools can help determine eligibility for the advance CTC or help them file a simplified tax return to sign up for these payments as well as Economic Impact Payments and the Recovery Rebate Credit.

The deadline to sign up is November 15, 2021. People can get these benefits, even if they don’t work and even if they receive no income.

Families who sign up will normally receive half of their total Child Tax Credit on December 15. This means a payment of up to $1,800 for each child, under 6, and up to $1,500 for each child, ages 6 to 17.

Bottom Line

Not only is November 15 the next date for payments for the Child Tax Credit Advance payment but it is also the deadline to update with your information if you are eligible but have not received any payments yet. It is also the deadline to make changes to your income if your 2021 income is above or below the threshold amounts listed above.

November 15 will see millions of Americans receive $250 or $300 per eligible child but there are others that may be eligible and have not done the required portal entry yet. Here is your reminder to take care of that!