This isn’t exactly a points and miles post, but for me it has everything to do with points and miles. That’s due in fact that I was introduced to this game when I was looking for a way to make my honeymoon a little cheaper. I’ve always been a frugal person, but I felt I became even more frugal once I graduated from pharmacy school. Why is that? The crazy amount of student loans I had, but two weeks ago I hit a big life goal.

Big Life Goal and a Giveaway

Background Story:

When I graduated pharmacy school in 2012, I had accumulated roughly $165,000 in student loan debt. Since I graduated from grad school the loans were higher interest rates (ranging from 6% to 8%) and unsubsidized. Now from what I have seen this isn’t as much as others, but that is still a ridiculous amount of debt to have. With a 6 month grace period, I started paying my loans in November of 2012.

A big goal for Kristin and myself is to pay off our loans as soon as we could. Setting ourselves free from our student loans seemed to be some dream, almost like finding AA Savers award seats 🙂

First Experience

Fast forward a few years to 2014, Kristin and I were planning our wedding. We were looking at honeymoon destinations and I became determined to somehow make our honeymoon cheaper for us. After googling for hours, I stumbled across a few blogs talking about points and miles. At first, I thought it was a gimmick, but after I started reading more (basically engulfed in it for months!) I decided I would give this a shot.

After looking, I ended up applying for the Chase Sapphire Preferred with a 40,000 point bonus. After paying for parts of the wedding and our Sandals resort (I wish I knew then what I know now, I could have saved so much more money!), we had a little over 50,000 points. I didn’t know much about transfer partners at the time, but I was pretty happy to have booked our airfare for a grand total of $15 through the Chase travel portal.

I thought it was pretty amazing we could fly for so little. Little did I think that it would turn into a passion.

Working on those loans:

Every month paying my student loan would be two steps forward and one step back. This was in part to the interest being half of my student loan payment. That meant when I had my $2,000 payment come out each month, $1,000 of interest would accrue. It was very frustrating to see this occur month after month.

After a couple of years, I was seeing more private companies offer people to refinance their student loans. If you are thinking of doing this, I would really do your research on the pro’s and con’s of this. We felt comfortable in doing this and after running the numbers it made better financial sense to do so.

While reducing our interest rate and being able to stay aggressive in paying off my loans, the number started to fall. When we could, we would throw extra money at them to try to speed up the payoff.

My Addiction Grows:

While trying to pay off loans, we (mostly me) had the urge to travel. I wanted to see more of the world, but while paying off my loans I didn’t want to spend a lot of money. I began to dig deeper into points and miles to learn more about them and making travel more affordable.

I started opening credit cards to earn bonuses. Hoarding points was something I was happy to do (that has since changed). I had grown my Ultimate Reward balance to almost 500,000 points at one time, then started to diversify to other currencies.

Little by little I would redeem some points here and there, but in early 2015 I burnt some points for a family vacation and my addiction grew even more. How awesome was it to do things for pennies on the dollar!

The more I redeemed the more involved in points I became. My ultimate goal was to find my airfare and hotel for $0 out of pocket. This gave me more money to pay towards my loans, while being able to see different parts of the world.

Hammering those Loans:

As we traveled more, we were still able to be super aggressive in paying down my loans. Both Kristin and I were working extra shifts, I began working at multiple pharmacies for a bit. Anything extra would just go right into our loans.

The effect was starting to become noticeable as the balance began to drop at a faster rate. It still seemed so far away, but every month it fell just a little bit more.

We set a goal of having my loans paid off by my 30th birthday, with a flex goal of having them paid off by December of 2017.

Earning and Burning

As the amount on my student loans fell, my point balances kept increasing. Living a frugal lifestyle and being smart on how, when, and where I accrued my points have kept our travel expenses (except for food, souvenirs, etc) extremely low since we started playing this game in 2014.

I think if you have paid attention to my travels/writing, I want to travel for as little as possible. This typically means coach flights instead of business class, but we have had a couple of business class experiences. I don’t worry about point values as much as others do since I can always earn more points.

Looking back when I first started, I remember saying if we used points we could travel once to twice a year and it would cost us very little. I might have undershot how many time a year we travel. We aren’t traveling all the time, but we average between 4-7 trips a year. Which I call pretty solid with our work schedules.

Hitting the Big Goal

Just a couple of weeks ago, we realized that we were in a position to pay off my loans. This didn’t seem real, but it was actually going to happen. When we made the last payment it was such a sense of relief.

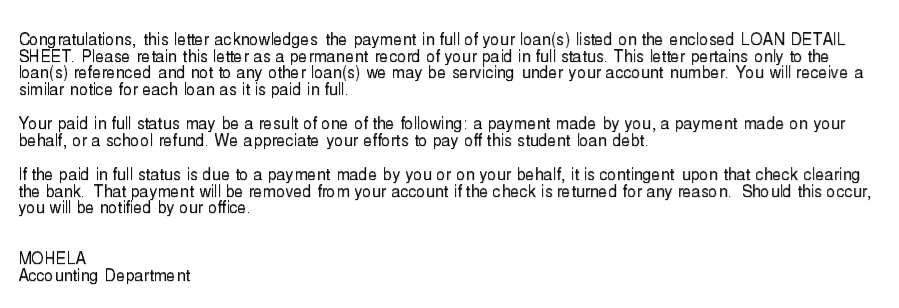

Just the other day, I received this letter in my email regarding my student loans.

This just put a big smile on my face, know those dreaded student loans were history!

Continuing in the Game

As I mentioned earlier, this post had nothing to do with points/miles. Having student loans and trying to travel can be extremely difficult, because they can take up a large chunk of your income.

At the same time this has everything to do with points and miles, because I was determined to find a way to travel for less. What started off as a passive hobby, quickly became an annoying habit for family and friends to hear (still is, although they benefit from it too). Now many people turn to me asking me for help, probably like your friends and family do with you :-). There are plenty of people who are better at the redemption side than myself, but I have a pretty good handl on what works best for me.

Being frugal is part of who I am and traveling for less definitely fits that mold for me. I will look for the best deal, stack deals on top of themselves, and find different ways to save money/travel for less. I’ll even go out of my way to save money and/or earn extra points. Kristin loves it when I say we are headed to Staples for agift card :-). Being active in the credit card game is truly an enjoyable passion for me.

Give-A-Way

Since starting the points and miles game, I have been very fortunate to see some pretty amazing things. While being able to incorporate traveling, we made it a point to be free from out student loans. To celebrate, I will be giving away a $25 Amazon Gift Card, but to enter you must meet these requirements:

- Follow me on Twitter or Like me on Facebook

- Leave a comment with a life goal you were able to hit, while still being able to travel

- Put a link in your comment showing you have done step 1.

I will pick a winner May 24th and reach out to them to give them their $25 Amazon gift card.

Conclusion

Seeing the world, while trying to achieve other financial goals is possible. It feels good to finally pay off my student loans, it is a goal we set and completed. Just like the credit card game, we had a goal and figured out how to do it the best way we could.

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Congrats on hitting your goal! Points and miles have enabled me to achieve life goals that would have been very difficult otherwise – visiting friends in foreign countries, taking a family of 5 on vacation. Thankful for this hobby. Big fan of this blog. https://twitter.com/DAB_1769/status/864899757193519106

Hey David,

Thanks! There is so much to be thankful in this game. It’s great to hear you went to visit friends in other countries.

Thanks for reading! I appreciate it!

Dustin

Ah, it’s inspiring to hear. I’m in medical school and while my traveling has slowed down a lot I can really relate to juggling loans and recreation. I managed to pay off my loans from undergraduate while backpacking through Europe via a lot of frugal choices and some online tutoring. This was significant for me because firstly it feels good but also because in a way it validated that I could have great experiences while still being productive. Getting into the points and miles game really made the entire thing possible. I’m going to be super indebted after medical school but I’m really looking forward to dealing with that quickly and stockpiling miles to enjoy plenty of travel down the line. No running though, nope.

http://imgur.com/a/Z9Rha

Hey Kyle,

First, good luck with the rest of medical school! That’s great to hear you paid off your undergraduate loans while seeing Europe. That’s definitely awesome!

I can only imagine what your student loans will be like after med school. Hopefully, when you do start paying on them, there will be some programs to let you pay via CC with no fee 🙂 Hey one can always wish, right?

Thanks for reading! I appreciate it!

Dustin

Congrats! That must feel great! We have been able to save for a down payment on a house while still traveling – now just to find the perfect house! 🙂 https://twitter.com/retire_with_me

Hey Liz,

That’s great! It must feel good to have saved enough for a house!!

Thanks for reading! I appreciate it!

Dustin

i would like to hit my goal of owning my dream home. i follow you on twitter https://twitter.com/heavensent2272

Hey Amanda,

That’s a great goal!

Thanks for reading! I appreciate it!

Dustin

We were able to save for a down payment on our house while still taking family vacations.

I follow you on twitter: https://twitter.com/HollieJ222

Hey Hollie,

That’s great! It must feel very good to travel and reach a huge goal of buying a house!

Thanks for reading! I appreciate it!

Dustin

For me it’s much smaller steps but, I feel like they are leaps and bounds. I just recently had major surgery that I have been waiting on for 11 years. I had to wait long enough for my kids to be able to sustain themselves a bit more plus, help me out when needed.

Followed via https://twitter.com/MichelleCat5

Hey Michelle,

I hope surgery went well!

Thanks for reading! I appreciate it!

Dustin