Several years ago, credit card issuers were issuing new cards and the points that with them like crazy. People that had less than optimal credit scores were able to get in on these offers that before were not so attainable. Credit card issuers were even bending over backwards to “make things right” when offers were not as good as other offers that were available.

Is American Express Getting Too Bold – Even Cocky?

Courtesy of Shutterstock

But that was years ago! Over the last couple/few years, credit card issuers began tightening up on many things for customers. American Express, especially, has been taking a hard stance at current and future customers. They are even behaving in ways that were not even potential responses from them years ago.

What Do I Mean?

Before we look at current behavior, let’s take a look at a couple of things from the past few years.

American Express Sending Out Checks – The Old Days

Several years ago, American Express retained a company to check their books to ensure they had paid out on the bonuses they were supposed to have paid on. As a result, many people received checks from Amex for points that they determined were not issued when they should have.

This includes points for bonuses that were not the ones tied to the application but that had been offered publicly at the time! This was done, most likely, due to fines that Amex was forced to pay for claims that they had been involved in deceptive marketing.

Matching Other Offers – The Old Days

Until the last couple of years, card issuers were actually really good about matching new customers to other offers that were available. For example, several years ago there had been a 100,000 point offer for the American Express Platinum card. One blogger chose to write a post about applying through his affiliate link (with its lower offer) and then call in to ask to be matched to the 100K offer.

American Express was matching tons of people to that offer – while paying out the affiliate cash to a blog with a lower offer! That is something that would never happen today!

Flexibility with the Spending Calendar – The Old Days

There were even many cases where credit card issuers were allowing a little flexibility if a customer missed the 90 day/3 month requirement on spending. Many times, customers would call in if they found out that they had messed up the date and ask for mercy and it was given them.

Forget that now! They hold that line now!

Bringing Us To Today

Now we are in the anti-churning (yes, since I am no longer a credit card affiliate, I can use the “churning” word!) phase with credit card issuers. This means no repeat bonuses on a card ever (American Express) or at least for a long time even for cards in the same family (Chase and Citi).

American Express Freezing Points

American Express has gotten quite bold with customers lately by freezing points when they suspect that points were earned through manufactured spending (what they call “gaming”) or even when the customer has referred another customer and earns the bonus points (this is a recent example at Travelling the World).

This happens with American Express to many customers where the points get frozen and the customers are given precious little information – only something like they need to conduct a review of activity and it will take several weeks.

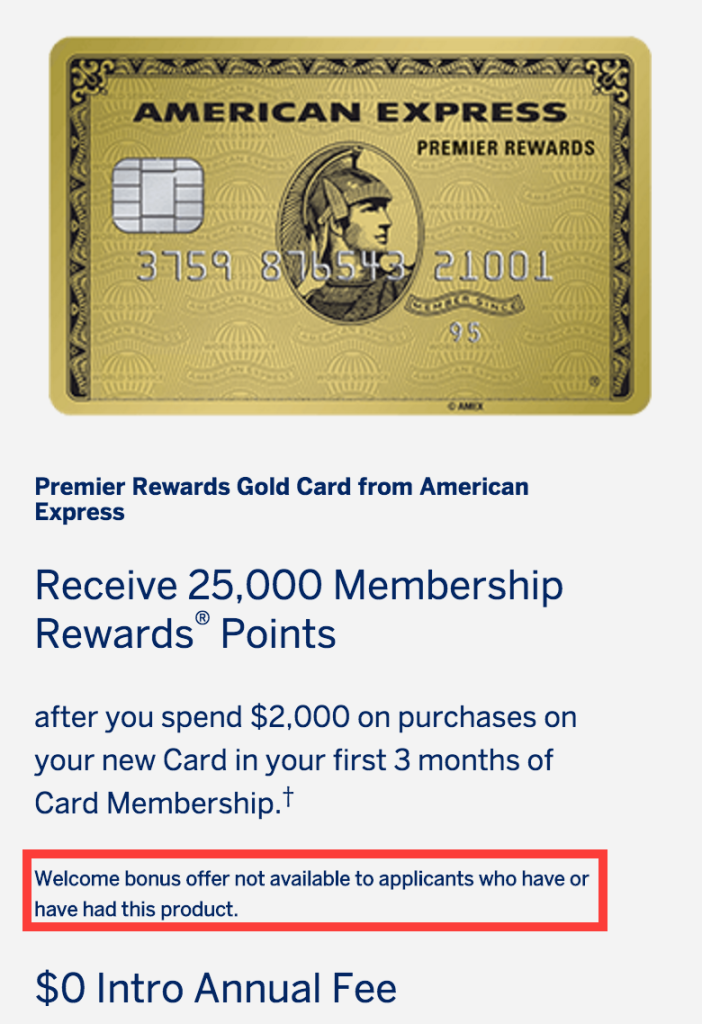

Ignoring Their Own Application Language

Apparently, even when an offer does not have this language, Amex still feels they can deny a bonus

American Express has had the once-per-lifetime language in their credit card applications for a while now. However, every once in a while, there will be an application link (or even a direct e-mail offer) thad does not have that language in it. Savvy credit card customers take screen shots of the page showing the absence of that language before applying.

Yet, there are times that Amex will deny the miles or points citing that the language exists – even when presented with the proof that it did not (granted, the customer could have taken that screenshot from another customer from a different date or edited the photo but Amex does not even suggest that this has happened).

This week, Mile Nerd had a post about this happening to him (as well as this happening to many others). Even after filing a CFPB complaint, Amex still stood their ground.

Ridiculous Offers

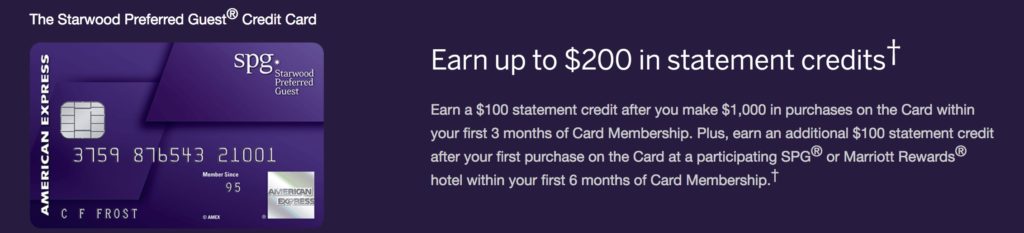

A horrible offer by Amex – compounded by the fact that when a customer takes it, they can never get another SPG offer.

Why in the world does American Express think they can make an offer so miserable to the public – when that would make that customer unable to get future offers that are actually worth it? This is, really, ridiculous behavior on the part of American Express. Look at the current SPG offer for proof on that!

They have offered some pretty sad offers before that no one should ever apply for – something they would never have done a few years ago. Even if they did, it wouldn’t have mattered because you could actually get an offer again back then!

Other Situations

If you read through various forums and sub-reddits, there are many other customers that complain about how the credit card issuers have stuck it to them in various ways – even when following the rules that the credit card companies themselves lay out.

Weeding Out Affiliates

Credit card issuers have also been shoring up their public face by dropping many of their affiliate partners (like this blog) due to not wanting to assign more compliance agents to read everything for accuracy (while allowing airline attendants to make claims about credit cards that are so far from reality without halting that in-flight pitch to correct this behavior).

This means that credit card issuers are choosing instead to work with large blogs (some that their partners own now) or large sites (like Slickdeals) that they can deal with more directly. It means that there are more blogs today that are writing about credit cards without affiliate links than there were before, simply due to the fact that the card issuers have dropped them. Some of that has been due to conversion performance while others have been due to the partners using language (like churning) that credit card issuers do not like.

For one example, there was a post at The Points Guy a couple of weeks ago about how to avoid paying your annual fee on your credit card (basically, how to avoid the way credit card issuers make money on many cards). That post lasted about all of a couple hours before being taken down. No mention of it – just gone. That could have happened for a variety of reasons but I know from having dealt with issuers through affiliates myself – credit card issuers hate that kind of a post as it takes money away from them.

Years ago, I was able to write a post that was very negative about Amex – while being an affiliate. It appears that this is definitely no longer the case. Just one more thing that shows that American Express feels more bold in how they deal with affiliates and their public.

Takeaway

Of course, there are those in our credit card rewards’ community that push the envelope with card issuers – even stepping over the line. But, American Express has been acting quite boldly in their behavior against many customers – not just the ones that cross the lines. I understand that Amex needs to watch out for customers that are costing them a lot of money. But, don’t hit all your customers, Amex!

Hopefully, American Express stops doing some of their freezing of accounts and even backs off of their once-per-lifetime stuff.

Courtesy of Shutterstock

Seems like the easiest solution is to contact Bachuwa Law aka TPOL to get this resolved. Even after all I have written on Frequent Miler, consumers still file grievances with the CFPB. What a waste of time!

Good to know! Put another comment in with your law site for readers to be able to visit.

I’ve had multiple cases resolved by CFPB. In fact, every time I’ve made a complaint, including one last month RE AMEX, it has been resolved by the issuer doing what I asked. It’s a great way to get these problems fixed.

I can personally attest to Bachuwa Law’s value. American Express reneged on an offer and Alexander Bachuwa got them to make it right in arbitration. I actually got greater value than if the offer had been honored.

Thanks, Christian! Good to know!

Been with AMEX for 30+ years. Same business platinum card for last 5 years. Tried to transfer points a few month back and had account frozen. Called in and given very little info.

I filed a complaint with Better Business Bureau. Account unfrozen and apology letter within 1 week.

Here’s a positive data point. My wife applied for a Gold Premier Rewards card after being offered 50k points for spending $2k. The offer was shown in “Amex Offers” part of our accounts page. She had already had the GPR card up until 2016. Well, we hit the bonus last week, and the points appeared in her account within 2 days of hitting the bonus.

[…] Is American Express Getting Too Bold – Even Cocky? – Running with Miles […]