As part of the programs of SPG, Ritz, and Marriott merging, the SPG cards will be transitioning. There were rumors that last night was going to be the last chance to apply for the SPG cards at their long-lasting bonuses of points. Doctor of Credit reported on a rumor that the new bonuses would be a statement credit instead of points. Well, the new bonuses are here and they are really bad!

The New SPG Bonuses Are Really Bad

The (Now) Old Bonus

For the longest time, the regular bonuses on the SPG Personal card and the SPG Business card were 25,000 points after meeting the minimum spending. On occasion, the bonus would jump to 30,000 or even 35,000 points also. There was one time that the SPG bonuses were for 2 free nights instead but they didn’t last that long. Unfortunately, the much loved bonus of points seems to be over. Which brings us to the new SPG bonuses.

The New SPG Bonuses

Link: SPG Personal Card | SPG Business Card

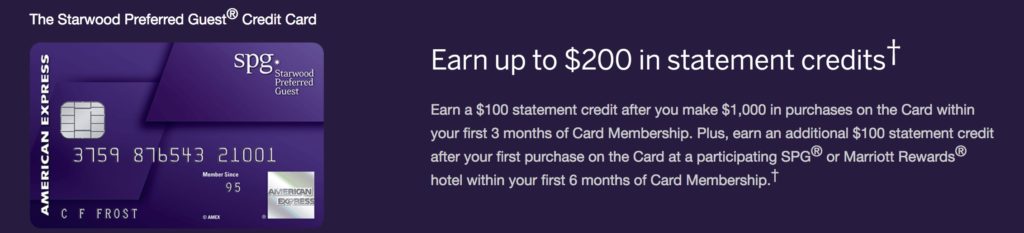

The new SPG bonuses are for statement credits but not in a lump sum. Instead, they are tiered and require purchases at SPG/Marriott properties to trigger part of the statement credit. Here are the offers:

- Earn a $100 statement credit after you make $1,000 in purchases on the Card within your first 3 months of Card Membership

- Earn an additional $100 statement credit after your first purchase on the Card at a participating SPG® or Marriott Rewards®hotel within your first 6 months of Card Membership

These new SPG bonuses are really bad and it has finally created a situation where there is no great reason to apply for the SPG cards. The only reason I can assume they have changed the SPG bonuses like this is to dissuade new cardholders while still offering a bonus.

Bad Earning Changes Coming

Don’t forget that SPG cards (after August 1) will transition to earning just 2 Marriott points per dollar. As of now, you earn 1 SPG point per dollar and those can be transferred to Marriott at 1:3 so these cards will suffer a huge hit for those that actually do spending on them, post-August 1, 2018.

Since Amex card bonuses are for once in a lifetime, I would certainly pass on these cards. Maybe, SPG and Amex will change it down the road or maybe allow the referral program to be the old bonuses.

This has to be a late April Fools joke! I wonder if part of the Amex/Chase deal to keep both cards gives Chase the exclusive right to offer bonus points for an application/upgrade…thus forcing Amex to give a statement credit. This is going to KILL Amex’s business and really upset a lot more people……especially the ones that will not be able to apply for a Chase card once it is announced due to the 5/24 rule. (I will likely just move from Amex to Chase for JUST my MR/SPG hotel stays as the rest of the earning make this a “sock drawer” card.

I have some thoughts on what Amex may do with these cards but I think you may be right on the Chase part of the deal. With the SPG card being such a staple of the Amex portfolio for a long time, I think Amex is really going to push hard to make the new versions a huge hit.

Hahahahahaha, lame.

I’m wondering if it’s something like what @Christian suggests…otherwise why would Amex put out such a ridiculous offering? I’d be embarrassed if I were Amex. Though that raises the question, why did Amex even bother having an affiliate card deal if it’s going to be so pathetic that I can’t imagine it will get a lot of traction. Sure, some folks who don’t know better will still apply I guess but, wow.

I think they may start rolling out some special offers to those with the cards to entice people to sign up for this offer (and increase their new members before the plug gets pulled on these).

Plug Pulled – $100 statement credit on Business and $200 on Personal ($100 spend and $100 hotel spend credit) – pretty lame. My guess is they want to slow those cards. Amex wants to steer people to the new premium card. They may work harder on the Business card later too….but for now my guess is they want to push ALL biz to the high end card.

Charlie – -one thing all bloggers keep forgetting to account for when comparing apples to apples is the Free Night up to 35,000 points. Essentially if you spend less than 35,000 per year on your card you are earning more points per year as we didn’t get the night credit before. So that reduces the pain. Sure it reduces earning power if you are high spend or like to take your points to the airlines….but that is the way it is. The Sign Up is lame -but basically Amex got to keep their cards in place, offer a free night, and get the High End Market.

Also their business has really improved – 4x on gas and other bonus categories. Again if you have them you get them.

I think you need to compare apples to apples.

You make some excellent points. I haven’t actually weighed in yet on the value for current cardholders going forward (was doing some crazy travel when this was all announced). I am doing a post and will be breaking down the free night as well. While it is great, I am never a fan of category restricted anniversary nights since I value the flexibility of points. But it will still be a win over now!

Didn’t mean to come off too harsh – just hadn’t thought of the Free Night myself. It was Marriott’s spin on it.

I hear you — plus my wife’s card has an anniversary of 7/23/18 and the new award night doesn’t kick in until 8/1/18. If anniversary before 8/1/18 you get the free night on your NEXT anniversary. Amex is going to have to grovel to keep this card open, throw me some points or something. 8 days requires some understanding.

I have 2 business cards opened to get the 35,000 (earned 50,000+ with referral and spg spend) for over 100k in SPG. Jumped while I could. I will keep one for Gas and see the award chart to see if $95 worth the room. Will see what kind of Staycations I can get out of it…typically how I would justify a single night.

@nick you mean $17,500 since its 2x points and Im pretty sure marriott low end hotels will be in this free night category.

and their business has not improved, they are removing the complimentary Sheraton lounge access

the new AMEX card sucks period!

[…] No more 25k Amex SPG card offers, I deleted them from the list of the best card offers available with my links. The new offers are REALLY really bad! […]