For those that do not know, there are two Chase Freedom cards – one is the card that has the rotating 5X categories every quarter and earns 1% on all other purchases and the other is the Chase Freedom Unlimited which earns 1.5% on all purchases.

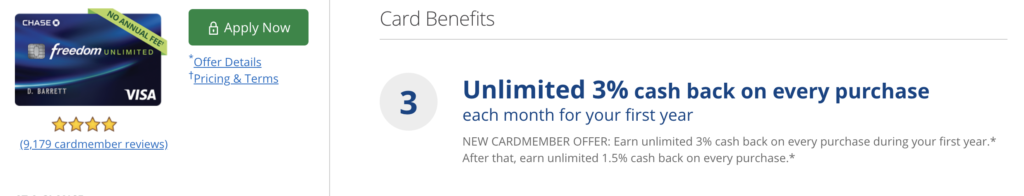

Chase Freedom Unlimited with 3% Back On All Purchases!

Link: Chase Freedom Unlimited with 3% Back

Note: It seems all affiliate offers and referral offers are currently still only offering the $150 sign-up bonus without the 3% so make sure you check and make sure the offer is for 3% back!

The Chase Freedom Unlimited had a regular sign-up bonus of $150 but there is a new offer out now that has no sign-up bonus at all – and it is far better than the previous offer! That is because, for the first year of card membership, you will earn 3% on all purchases with no cap!

Huge Potential!

That is potentially huge! Not only can you look at all purchases on that card as earning 3% cash back, you can also transfer those points to an Ultimate Rewards earning card like the Chase Sapphire Reserve, Chase Sapphire Preferred or the Chase Ink Plus/Preferred and they become the powerful Ultimate Reward points!

Here is some of the earning potential and redemption potential you could have with this offer. If you combine this Chase Freedom offer with a Chase Sapphire Reserve card, you will earn 3 Ultimate Reward points per dollar on all spending done with the Chase Freedom Unlimited.

Next, you can convert them to Ultimate Reward points by transferring them to your Chase Sapphire Reserve card. Once there, you could redeem them at 1.5 cents per point on straight travel redemptions through the Chase portal for a meaningful 4.5 points per dollar value. That is fantastic!

This special offer is available for new cardholders and it is only available for the first year. Also, it is subject to Chase’s 5/24 rule. I think this is a fantastic deal if you can put some great spending on it!

Also of note, there is a 0% interest period (15 months) with this card as well. This could be helpful if you have some large expenses you wanted to put on the card and pay them each month over the next 15 months (that way you would pay no interest).