Sometimes with all of the published offers with credit card applications, some of the more behind the scenes cards and offers can get lost in the noise. So, I want to highlight some of these cards as credit cards to consider. I definitely think they should be strongly considered and I will tell you why in each post.

Credit Cards to Consider: United MileagePlus Business Card

Disclosure: I do not receive a commission for this card. There is no link to this card in the post because you need to follow the instructions to see the offer.

I posted this back in August but have had many people ask about United offers so I wanted to put it out again. Please note – I applied for this card using this method in November and all the miles have posted like normal. If you have maxed out the Chase Ink cards in your application cycle, consider adding this card. If you will need more miles before the upcoming devaluation (if you request a closing date this month, you should be ok), this could be the boost you need!

There is an offer for the United MileagePlus Business card that is (kind of) targeted to certain United customers. If you are targeted for it, I think you should definitely apply for it. Here are the reasons:

- Chase bonuses are normally once in a lifetime, so anytime you can get more points with a different card makes for a nice offer

- The targeted offer is for 50,000 United MileagePlus miles – conservatively worth around $1,000 in award flights

- If you are a big spender (over $25,000 a year on your personal Chase United card), you can now get another 10,000 miles bonus when spending $25,000 on this card as well (making for a total of 20,000 bonus miles when spending $50,000 total on the personal and business United cards in a calendar year)

The regular offer for this card is 30,000 United MileagePlus miles. Most people receive the targeted 50,000 mile offer – it is all in how you get to the application. 🙂

Here are the points about the card:

- 50,000 United MileagePlus miles after spending $2,000 in the first 3 months

- Annual fee of $95 waived for the first year

- First bag checked free on United

- No foreign transaction fees

- 10,000 bonus miles after spending $25,000 in a calendar year

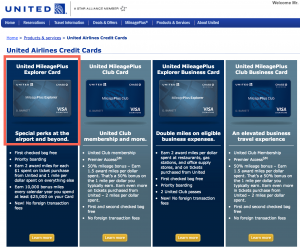

If you were to just go the United website and click on the business card or search for the “United MileagePlus Business credit card”, you would find a welcome screen for the card like this – showing only the 30,000 bonus miles:

Now, 30,000 United MileagePlus miles are very valuable, don’t get me wrong. But you should not settle for the 30,000 miles if you are targeted for the 50,000 miles! The difference is just about another round-trip ticket in the US!

So, here are the steps to see if you are indeed targeted for the 50,000 United MileagePlus miles on the United Business card.

1) Login to your United MileagePlus account

To make this work, you need to be logged in or else it will show you the offer above (after all, that is the point of “targeted’ marketing)

2) Select to Get Credit Card

3) Select the United MileagePlus Explorer Card – NOTE: This is the personal card, do not select the Business card!

4) Once on the MileagePlus Explorer landing page, select the Are You a Business Owner at the top right of the page

5) VOILA! You should now see the offer below! Go ahead and fill out the application.

This offer is a fantastic offer! For 50,000 United MileagePlus miles, you can get 2 round-trip tickets in the US or you can get a one-way to Europe in business class or you can almost get a round-trip to Europe in coach (requires 60,000 miles). I am sort of maxed out right now with my Chase cards 🙂 but after I am done with a couple of them, I will definitely move ahead to apply for this card.

[…] this worked for me Found this website that shows the screen shots of what to click on. After doing exactly what they described I was sent to the 50k business application page. http://runningwithmiles.boardingarea…/#!prettyPhoto […]

My husband, until recently, a 1K with United, has the older milage select plus card and the 50000 offer never shows in his account. Have you heard of this situation? Meanwhile, even our 14 year daughter gets written offers for the 50000 card. Do you think if he cancelled the current card he would get the 50000 offer?

Did they convert his mileage select plus to the new mileage plus business card? Does he get any offer in his account (for even 30K)?

I tried this with my wife’s account for fun and it still showed the 30,000 bonus miles offer. Have you tested this trick again recently?

I already have it, but it did show up for my wife and others.

Darn only 30k for me 🙁