Chase is really upping their game on their Ink cards with their highest offers ever on two of their cards – the Chase Ink Business Cash and the Chase Ink Business Unlimited. Not only are these their biggest offers, but Chase actually dropped the minimum spending amount to help you get to those points easier!

Best Ever Offers for the Chase Ink Cards

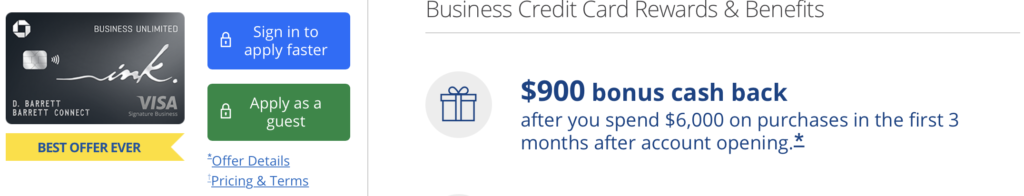

Links: Chase Ink Business Unlimited | Chase Ink Business Cash – $900 or 90,000 points with each one!

The links in this post are either referral links that earn me points or affiliate points that net me a commission – either way, thanks for using my links!

There are three different Chase Ink cards (which are the Chase small business cards). One of them is the Chase Ink Business Premier that comes with a nice 100,000 Ultimate Reward point bonus but requires $10,000 in spending in the first 3 months and has a $195 annual fee.

The two cards we are talking about today are the Chase Ink Business Cash and the Chase Ink Business Unlimited. Both of them have zero annual fee and come with $900 cash back bonus after spending just $6,000 in 3 months. Even better, if you have a Chase Sapphire Preferred or Reserve or a Chase business card that earns Ultimate Rewards, you can use that $900 cash back as 90,000 Ultimate Reward points instead – meaning this bonus just became a whole lot more valuable!

This is the best ever offer that these cards have had, normally requiring $7,500 in spending to earn 75,000 points. But, today, it got much better for anyone that has been wanting to add a small business card to their wallet and pocket a whole lot of points or cash back!

The Offer

- Spend $6,000 in the first 3 months

- Earn $900 cash back (or, 90,000 Ultimate Reward points if you have an Ultimate Rewards earning card you can transfer those to)

- Zero annual fee

So, these cards look and sound identical – what’s the difference? The difference is in the earning. The Chase Ink Business Unlimited earns 1.5% back on all spending. The Chase Ink Business Cash earns 5% cash back on the first $25,000 spent each anniversary year on these purchases:

- Office Supply Stores

- Internet, Cable, Phone services

You earn 2% cash back on the first $25,000 spent each anniversary year at gas stations and restaurants.

So, which do you pick? Personally, unless you do a lot of spending in those above categories, I think you go for the Chase Ink Business Unlimited. It makes the earning much simpler and if you do any dining, your other cards offer even better returns (depending on the card you have). The 2% on gas is nice with the Cash card but I think you need to spend a lot on gas to overcome the 1.5% earning on the Unlimited card for everything.

The nice part is – for the bonus, it doesn’t matter since they are the same exact thing! If you decide you want the other one later, you can always do a product change to that one.