The credit card market changes quite rapidly at times with the offers. Some offers can be incredibly generous while others slide towards stingy. For the most part, we get a middle range that is full of most credit card offers.

The Best Credit Card Offer Around Right Now? The Chase Sapphire Preferred 80K Offer

Link: Chase Sapphire Preferred 80K Offer

However, I think this is the best credit card offer around right now – when talking about personal cards. It requires more spending to take advantage of the full offer but it is actually giving you a very decent return on that spend with the bonus.

It is the public offer for the Chase Sapphire Preferred with 80,000 Ultimate Reward points after meeting the minimum spending (I first wrote about this a couple of weeks ago). Yes, the Chase Business Ink Preferred (application link) also offers 80,000 points for only $5,000 in spending, but that is a business card. If you want the best personal card offer right now, I think it is this one.

-

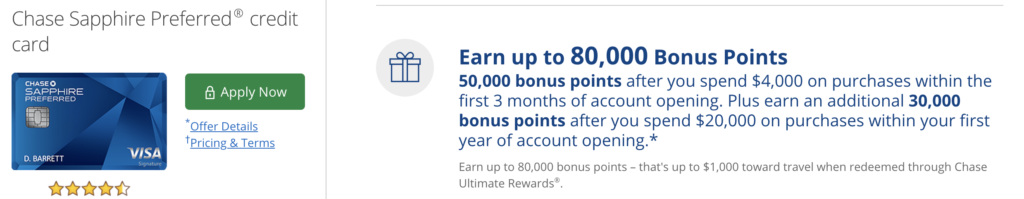

Earn up to 80,000 Bonus Points

- 50,000 bonus points after you spend $4,000 on purchases within the first 3 months of account opening.

- Plus earn an additional 30,000 bonus points after you spend $20,000 on purchases within your first year of account opening

- 2X points on travel and dining – Earn 2X points on travel and dining at restaurants- from airfare and hotels to fine dining and cafés.

- Plus, Earn 1 point per dollar spent on all other purchases.

- 25% more in travel redemption – Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards. For example, 80,000 points are worth $1,000 toward travel.

- Annual Fee: $95 (waived the first year)

- Notes:

- This card is subject to the Chase 5/24 rule

- You can only have one Chase Sapphire product at a time

- You can only get one Chase Sapphire bonus within 24 months

Analysis – Best Ever Chase Sapphire Preferred Offer

This is an awesome offer for two reasons – it is the highest, publicly available offer ever on the Chase Sapphire Preferred and its simple structure. It is great because you can get it and stop after the $4,000 spend and have the same 50,000 points you would have with other offers, but if you wanted to go for it, you could do the additional spending for the extra 30,000 points.

Meeting the $20,000 spending in one year is not really that big of a deal in terms of putting your spending on this card. In reality, you are only spending $16,000 extra (since you need to spend $4,000 for the first bonus anyway). That means you will be earning 2.87 Ultimate Reward points per dollar if you meet the total spending requirement. That is the best deal around right now for earning Ultimate Reward points on non-bonus spend.

If you are eligible for it (ie. have not had a Sapphire bonus in 24 months and do not currently hold a Sapphire product), definitely considering going for it! It is an excellent deal!

A Great Deal!

As I wrote about before, I think Chase offering this deal only through their public page is a brilliant move as they are passing the extra points on to the consumer instead of through referrals (friends) or websites (affiliates). This means it is really a win-win for you.

There is a lot you can do with 80,000 Ultimate Reward points! Since you need to spend $20,000 in the first year to get that (an average of $1,666 per month), that will end up giving you a big total of 100,000 Ultimate Reward points (more if you spend in bonus categories). At the bare minimum, that is worth $1,250 in travel redemptions through Chase. That is like getting a 6% return on your spending for $20,000!

If you transfer to partners, you can get a lot more out of those points in value also! This is an incredibly generous offer with no annual fee the first year.