It is an interesting thing to watch the changing landscape of credit card rewards. I had this post on my mind for a while, but it had a different title – “What Issuers Could Do That Would Help the Customer And Save Money.” But, then Chase went and made a move last week that kind of proved my point so now we are at this title! 🙂

Chase Made a Brilliant Move That Other Issuers Should Copy

What Chase Did

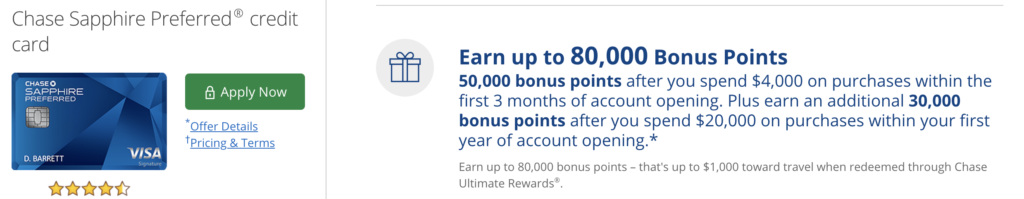

Last week, Chase changed their public offer on the Chase Sapphire Preferred to the best ever offer – 50,000 points after spending $4,000 and then another 30,000 points with an additional $16,000 in spending. While it is not unusual for issuers to offer an increased offer, it is a bit more rare for issuers to have the best offer on their public page and not in any affiliate or referral channels.

The History of Credit Card Issuers and Blogs

Let’s take a little look back down the road of credit card rewards. A few years ago, affiliate marketing by credit card companies began taking off. Back then, it was a pretty easy threshold to meet to get direct affiliate links for credit cards. When this happened, it helped blogs and other websites promote the credit card offers that were available and to show readers how they could put those points to advantage for “free” travel.

Over time, credit card companies began tightening up a bit on affiliates. They began assigning compliance departments to the blogs and each blog that had an affiliate relationship had at least one person that would read every single post on that blog to make sure it was in compliance with the rules for credit card companies and practices.

Still, there has been a ton of digital ink used to write all about the various credit card reward programs and how to maximize the promotions and points. Now, there are a few big blogs that still have direct links to banks like Chase while everyone else uses indirect links through affiliate companies that act more as middlemen (and even that group is getting smaller).

What Credit Card Issuers Should Start Doing

Here is something that could work great for credit card issuers and also customers – a rare combination!

Make Public Offers The Best Offers – With a Twist

Credit card issuers already have all the blog posts throughout the internet describing how to use credit card points to the max – they don’t need the affiliate channels to help create that content anymore.

What a Credit Card Offer Costs an Issuer

Let’s take a look at what it is costing banks to offer certain bonuses with the example of the Chase Sapphire Preferred:

- 50,000 points for the new customer – a minimum cost of $500 for Chase

- $150 – $250 payout for the affiliate (blog/website)

- Total cost for a new customer – a minimum of $650

Keep in mind that this is on a card with the annual fee waived the first year so, unless the new customer pays interest or late fees, the only money Chase is definitely going to get back on that investment is the fees on credit card processing – around $40ish for a payout of a minimum of $650.

It works out much better for credit card issuers if they could move some of that affiliate payout to a better offer for the customer in exchange for more spending.

The New Public CSP Offer – Good for Chase and Customers

So, the current public offer on the Chase Sapphire Preferred is 50,000 points after spending $4,000 and another 30,000 points after spending an additional $16,000. That means that Chase is going to get about $200 or more in transaction fees in exchange for the minimum of $800 that they are giving to the customer. And, that higher spending requirement puts the customer in a more likely situation to pay a late fee or interest.

Make The Regular Offers Part of the Affiliate/Referral Channels

Of course, the banks are never going to dump affiliates or customer referrals – nor should they – because they are the ones that help keep the noise around about the various products. Without the affiliate/referral channels, credit cards do not get the same exposure that they do if they are in those channels.

So, keep the offer of 50,000 points for the Chase Sapphire Preferred in the affiliate channel and in the personal referral program. This way, Chase is still paying about the same amount but they have standard offers available everywhere but on their website where they have the same offer but with a much better extension in exchange for more spending.

Takeaway

Credit card issuers have long offered different offers in various markets – in airports, on airplanes, on blogs, on the airline website, on the issuer website. They could start offering the best offers only on their own websites and then offer the different, lower offers through all the other channels.

This type of strategy would give the issuers more money back. Remember, not all cardmembers use their points like we do! Some leave them in the accounts forever, some redeem for gift cards or products, and some people never meet the spending requirement. If they are paying affiliates or referrers, that is money or points that go out as soon as the customer is approved for the card.

So, credit card issuers, the ball is in your court! Chase made a great move and I think it is one that should be copied by other issuers.

Agreed!