Airline credit cards are growing a bit stagnant (further notes on that in another post!) in their efforts to keep customers long after the miles have been spent. I have written before about different benefits that should be offered to replace the over-used Global Entry reimbursement one and some readers had good ideas on that as well.

This Would Be an Awesome Airline Credit Card Perk

I thought of an idea this week that I thought would be an awesome airline credit card perk. We will probably never see it but one of my earlier posts about airline credit card perks drew quite a bit of attention from one credit card issuer so, who knows?! 🙂

Refund of Airfare When Lower Price is Found

Southwest leads the airline industry in the customer-friendly area of change fees – as in, Southwest has no change fees. For other airlines, it could be hundreds of dollars to change a ticket. If the customer finds that a ticket has dropped in price after purchase, there needs to be a significant price drop to make it worthwhile to pay the change fee and re-ticket the ticket for the cheaper price.

Yes, you can buy a refundable ticket or one with no change fee but you are going to be paying many times more for that ticket and that is not really a good way to save money on your ticket purchase. Instead, this type of an airline credit card perk could go a long way to making things easier for customers. Here is how I would see it working.

This Credit Card Perk from the Customer’s Side

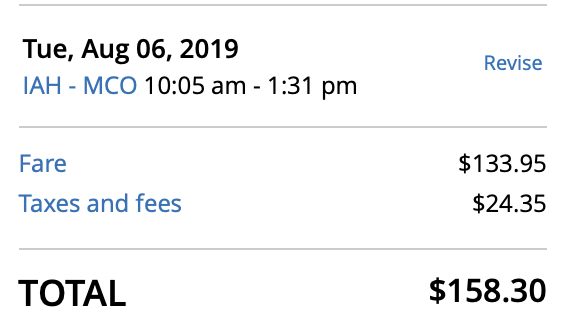

Let’s say the perk would have a limit of $300 – $500 in refund power and the refund would have to take place within something like 90 days of ticket purchase. So, a customer buys a ticket from United (using the United Airlines credit card, of course) for travel from Houston to Orlando. This ticket, if purchased today for August, would cost $159.

So, the customer uses Google Flights to set an alert on that flight and if the ticket price drops to, say $109, in around 40 days, the customer fills out a form or calls United to have the ticket amount refunded. That refund of $50 would count towards the annual limit of (say) $300.

This would encourage the traveler to buy a ticket when the price is something they are willing to pay but would give them peace of mind if it is still a bit higher than they want to pay, knowing that they can get a refund on the difference if the price drops.

It would also give the customer more of a benefit to fly with United when they have the United credit card, knowing they can keep checking to see if they can get a refund after they have purchased the ticket.

This Credit Card Perk from the Bank/Airline’s Side

We know we are never getting a credit card perk unless there is some benefit to the airline, right? 🙂 So, here is how it could benefit the airline and issuer.

First of all, the United credit card does offer the first checked bag free but that requires you to use the United credit card to purchase the ticket. I think that is not enough of an incentive to get the customer to use the credit card to buy the ticket if they would rather earn transferrable points with something like Amex (with the Platinum offering 5X points on airline purchases) or using something like the Chase Sapphire Reserve to get the $300 in annual travel credit to cover the ticket cost.

From that, we know that it is important to the airline that the customer uses their airline card for such a purchase. With this “perk”, it would force the customer to use the airline credit card in order to be eligible to get a refund if the price drops.

This “perk” would also give a reason for the customer to purchase the ticket directly from the airline, instead of from an online travel agent like Kayak or Orbitz. Again, this is something the airline likes as they don’t have to pay anything to the OTA if you buy direct from them.

Another thing is that unless it was an automatic refund when the price dropped (which the airline would never do), customers still need to call in to get the refund processed. Not every customer will do this and not all customers will track their ticket price so the airline would not be issuing a ton of refunds in the end.

Finally, the airline wouldn’t actually be “losing” money with such a perk anyway. Airline ticket prices are something that the airline controls and if they have already sold a seat, issuing a fare difference to a credit card holder as part of the benefit of keeping that customer and earning the spending on that card would really end up being a win for the airline.

Summary

Orbitz used to have something like this that worked like this – if you bought a ticket and the price dropped later, you would receive a fare difference refund if another passenger booked that same ticket at that price. I got back $400 on one ticket because of that!

This could be an answer for airlines in how to encourage their customers to actually use the airline travel card with the airline as well as give incentive to keep the card past year 1. While I doubt we will see it anytime soon, airlines are going to be looking for something new at some point as they are driving customers away with their cutting of perks and benefits now.

What do you think about this “perk” of an airline credit card and how you would change it to be beneficial to customer and airline?

There are any number of perks that could be implemented, but because of the me-too mindset that besets the bank-airline-complex will never come to be. For example, why not have cards that offer %age reduction in award-reinstatement fees depending on AF & time-frame (for example, on the United Club card give me free award-reinstatement if done more than 90 days out, or 25% reduction if done under 7 days). Or waive booking fees done over the telephone either entirely or partially? Or have the card give you a tiered bonus on all butt-in-seat miles earnt over the course of a calendar year. Etc, etc..

Great ideas, UK! Hopefully, the issuers will start to feel pressure from cardholders that realize the cards don’t provide value to justify the annual fee year after year and make substantive adjustments.