The year 2019 was filled with many things but one of the things for many of us travel-loving, elite-chasing, mileage-earning people that has really stepped forward is the death of actual frequent flyer programs.

The Death of Major US Frequent Flyer Programs

Frequent Flyer Programs Are Now Big Spender Programs

Just the name – “frequent flyer” – indicates that the program would be about those who fly frequently and earn miles based on that, right? Well, it actually hasn’t really been that way for some time anyway but this year the major programs (American, Delta, and United) kind of sealed it that way anyway.

Fortunately, we still have the holdout of Alaska Airlines and their Mileage Plan. We also have the revenue-earning programs of Southwest and JetBlue, not the best programs for great elite perks and aspirational awards, though.

For a while, airlines have been more about the spending than the actual flying. Due to their tightly knit partnerships with credit card companies, massive amounts of their award miles are sold to those companies who in turn use those miles to sign-up members and reward them based on their general spending. That isn’t airline spending but any spending at all.

But, now they really are all about the spending and, in turn, they want to charge members more for award flights. A lot more. While this did not all happen in 2019, some big hits came this year that really started putting the actual “frequent” flyer part of the program down.

Delta Air Lines

New in 2019

- Increase of “standard” business class awards to Europe by 50%

- Loss of Medallion Qualifying Dollar waiver on Amex Delta Gold card

- Increase on annual fees for all Delta credit cards

Delta stopped publishing their award chart a while ago and we knew that this would mean that the award prices we were used to paying under the previous charts would also become a distant memory. This came about in the form of the base Delta One (business class) cost for a flight to Europe to go from the more standard 70,000 miles to 105,000 miles – one way. That is just shy of what they used to charge for a roundtrip! Now, granted, their business class product has improved but that still hurts.

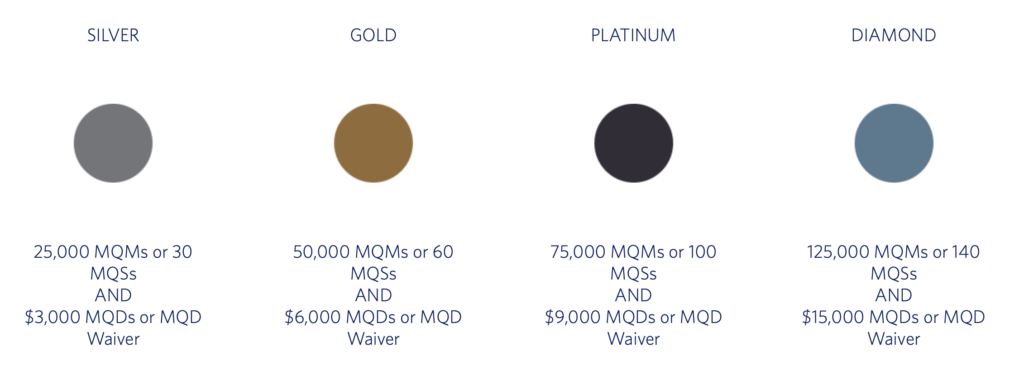

They then went after their credit card offerings. Delta, like other airlines, does not only require that you fly a certain number of miles but that you also must spend a certain amount on your tickets. You can get around their high dollar amounts in two main ways – flying partners (which do not pass on the actual ticket cost for Delta’s tallying) or getting a waiver by having and using a Delta credit card. Spending $25,000 in a year on that card (on any purchases) would waive the minimum dollar amount you had to spend on flying.

This year, they announced that their lowest annual fee card, the Delta Gold card, would lose that ability to spend for the waiver. Now, if you want a waiver on the minimum amount you need to spend on airfare for elite status, you need to have at least the Platinum card. Annual fee? $250 as of January 30, 2020. Of course, it will continue that you need to spend $250,000 on such a card to get a waiver on the spending for Diamond Medallion status.

While Delta has made no secret of their goals at status being tied to actual spending, what hurt a lot this year was their “enhancement” of their co-branded credit cards. They eliminated the award miles that would be earned on hitting certain thresholds and that was a big blow to the people that actually spent money on the Delta Amex cards. Now, those people will still need to spend to earn the waiver but will not earn any bonus miles for that spending.

Upsides?

The only good part about Delta changes is their frequent mileage award sales – but in coach. Still, these are great ways to bounce around the US or even over to Europe or Asia at a much lower cost in miles than it would normally require (“normal” is relative since there is no award chart!).

United Airlines

New in 2019

- The removal of award charts for United flights

- The removal of close-in booking fee

- The replacement of the close-in booking fee with a mileage surcharge

- The overhaul of their elite program to require spending more than flying

Next up was the announcement from United that they would be removing their award charts for their flights on November 15. However, they promised that the close-in booking fees would also be waived (yet, this was not completely an honest promise).

Before November 15 even arrived, however, United went ahead and took their own frequent flyer program to the “frequent flyer” garbage bin to be replaced by a “big spender” program instead. To earn elite status with United flights, you will have to spend a lot of money going forward! Again, this is no longer about frequently flying as United has pointed out that you could earn their top tier status by just paying $24,000 in pre-tax tickets and just flying 4 times with United!

The new United “frequent flyer” program for 2020 and beyond

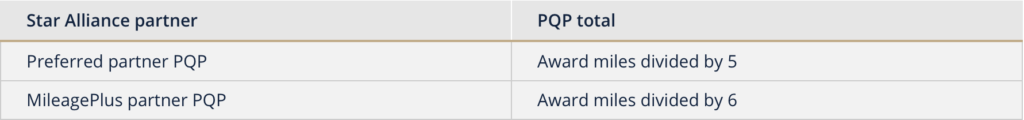

They didn’t stop there, however. They also devalued some of their partners for earning rates toward the PQP (premier qualifying points) as well. Sure, some of it had to do with their closer relationships with certain airline groups over mere partners but still a hit regardless.

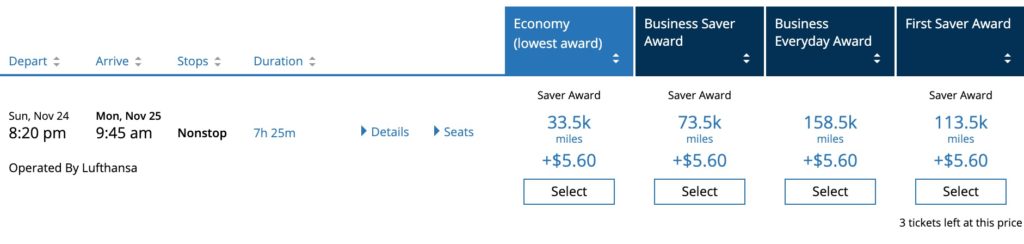

Next, since they replaced their close-in booking fee with a mileage surcharge, this has made partner awards to cost more miles – even though they said they would not charge more for pure partner award flights. This has made an automatic increase on all Lufthansa First Class awards since those only open up 2 weeks before departure.

First class partner awards also went up 3,500 miles one way

Lastly, they made their new spending requirements as a requirement for all United Mileage Plus members – no more waiver for foreign customers.

Upsides?

Fortunately, for those that still want elite status with United, it is still possible to earn the status you want without paying what United wants you to pay. This is thanks to the fact that they have to maintain an earning relationship with partners.

American Airlines

New for 2019

- Loss of the 10% rebate on AA cards

- Web Special Awards

- Web Special Awards for Business class

- Higher Award Rates that fluctuate a lot

- Account shutdowns

Last on the list of the major programs is American Airlines. While they have not made major changes to the process by which you earn elite status, they have been going at it a different way.

Loss of 10% Rebate

This is a change that hurt many AA credit card holders. They removed the 10% rebate on award redemptions which had a cap of 10,000 miles per year. For many, this was a great way to offset the annual fee on those cards and to look at awards as costing less than they would otherwise.

Web Special Awards

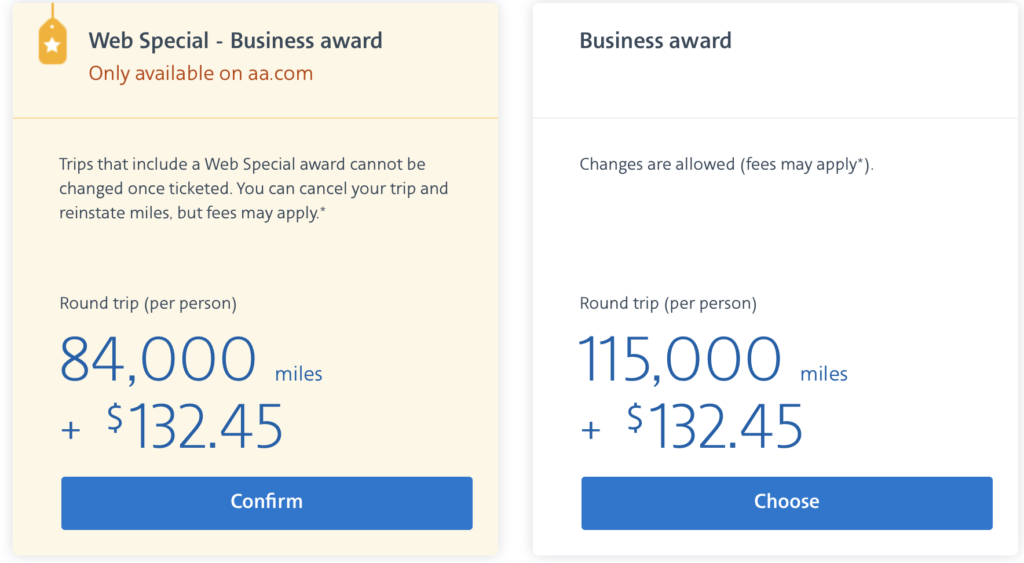

This year, they introduced Web Special awards which offer incredible rates (like 5,000 miles anywhere in the US or even 10,000 miles to New Zealand) in exchange for the customer losing the ability to change that award at all without paying the redeposit fee. Normal awards can have date changes for free as long as it is more than 21 days from the day of departure.

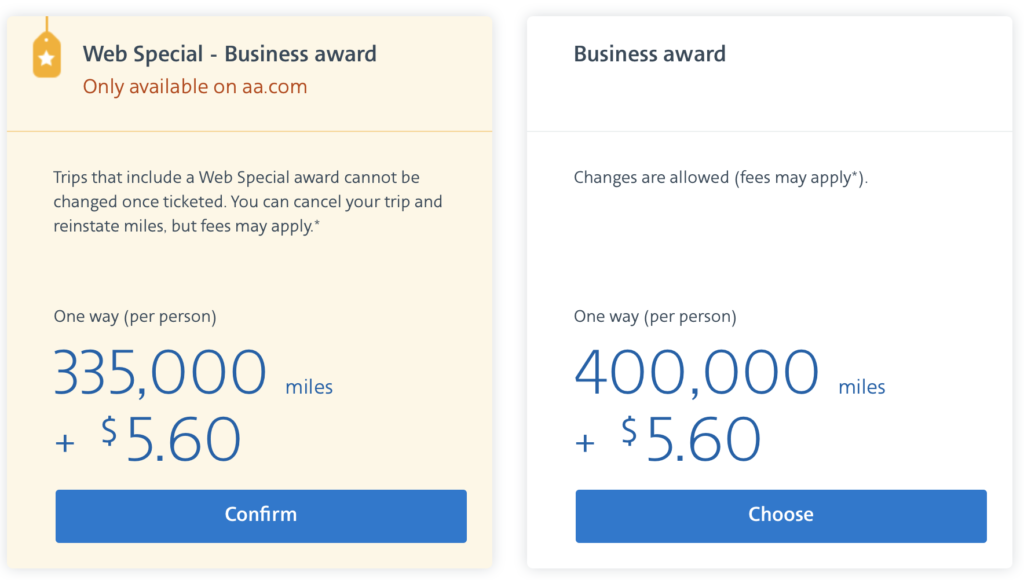

They recently moved those Web Special awards to business class awards and there have been some great ones! Like 84,000 miles roundtrip to Europe, 106,000 miles roundtrip to New Zealand and even great first class rates to Hong Kong.

Massive Award Requirements – With No Award Chart Removal

However, they have also caused the fluctuation of their regular award chart to get hit hard. I mean, like 400,000 miles one way for a mere US-Europe business class flight! That is just insane and while they have not gotten rid of their award chart, they are certainly stretching it to the extreme with some of their new rates.

Of course, this is nothing new for AA anyway – as far as being restrictive with saver awards. Try finding a saver award for travel during peak season – it is very hard to do (in business class). However, they do have their occasional award dumps where they make them available and it seems they are doing this with the Web Special awards as well.

Account Shutdowns

Also this year, we have had an airline initiate account shutdowns based on credit card activity – for the first time. This credit card activity appears to be mostly related to unusual behavior (like opening various accounts to get credit card mailers that circumvent the 48 month Citi rule) but they also may have caught some innocents in their shutdown sweeps as well.

Upsides?

The new Web Special awards are certainly a great deal – if you have the flexibility to fly when they are offered. They appear to pop up for flights within a couple of months of booking for business class. The coach awards are more common for domestic travel and really great deals!

Other US Airline Frequent Flyer Programs

The other programs were not immune from changes this year, however. While Alaska remains a great program for both earning and redeeming, they do things like this every so often that just frustrate award seekers to the max – a change with no notice and immediate effect.

Southwest made many customers upset this year when they announced that earning the valuable Southwest Companion Pass would require even more points going forward. It will require 15,000 more points to earn it in 2020 and this change was announced after many customers got the Southwest credit cards with the strategy to earn the bonus (which counts towards the pass) in early 2020.

JetBlue also announced Basic Economy fares that hit their single elite level, Mosaic members, in a bad way as well since it restricts them from most of their benefits when buying these fares.

Bottom Line

Frequent flyer programs change and devalue – it is how business works. But, in 2019, we saw the actual “frequent flyer” part of the program really take a deep dive as the major airlines will start rewarding much more based on the spending amount versus amount they have flown.

Thankfully, there are still great credit card bonuses out there as well as foreign programs that we can take advantage of for our various use cases. However, even those programs are not immune from the worst kind of devaluation (the unannounced and immediate).

Airlines are making it much more difficult for customers to be loyal to them. With bank reward programs allowing good redemption amounts for their points directly on travel, it may not make a lot of sense to show loyalty to a particular airline going forward. I mean, if American Airlines wants to charge 800,000 for a roundtrip award from NYC to Paris, why not just use 120,000 Chase points to buy that ticket instead? Plus, you would be able to credit the miles earned on that flight to an airline to earn more miles!

However, there are still nice uses of frequent flyer programs and I still use them for some awards. Likewise, the US programs are trying to improve some benefits for their top tier members so that does work for some big spenders. It is just a shame to see how they have transformed from rewarding actual flyers to just the big spenders. Yes, it has been moving this way for a while but it has gotten progressively worse this year.

How have the elite changes in 2019 affected your loyalty for the 2020 year?

What United has done is shameful. After 30 years with them, I’m done. They’ve made 1K status unobtainable and only for the wealthy elites. Shame on them.

This is good news. Stratifying the program like this is good for everyone. The rich deserve all the luxury while the majority of poor should be thankful that they are not made to stand in the flight. One half of the country votes similarly. Make the rich, richer, while voting to stay poor themselves. (Hint republicans) Any republican complaining about this should be given the Dao treatment.

Stop complaining about this. You only deserve what you are given.

Hey, this isn’t a political blog. Ok, want to make it political? The Democrats are the party of the rich because they refuse to tax the rich. If you have lots of frequent flyer miles, you should be taxed by having a significant chunk of the miles taken away from you.

The Republicans are also a party of the rich because they don’t support Mileage Welfare, which is giving miles to those who don’t have enough miles.

If they keep this going, I will lose all loyalty completely. Right now, I have loose loyalty, which is a slight preference for certain airlines.

I have no time but I want to burn miles. (Burn as in use them, not destroy them)

[…] Links-Who you WONT be flying ever again.-Frequent Flyer programs. Extinct?-2020 Vacation Trends and what we’ve said about some of […]

The banks and their credit cards began this trip down the slippery slope and elite status and their higher flight mileage earnings have become the domain of corporate fliers vs we individuals who don’t have that largesse. Of course this has inflated the mileage supply by overly generous sign up cc bonuses and thus increased hugely the mileage required for awards. Those of us who’ve been there since the beginning (and earned our miles from flying) remember a pair of r/t Europe or Asia business or first class seats at 120K plus a week of a car rental and hotel suite! Today we can barely squeak out a single r/t business award for that without the car/hotel trimmings!

My loyalty has been switched to the Chase Ultimate Reward program. Miles are next to useless.

[…] must read post is this one: 2019: The Year That Major US Frequent Flyer Programs Died. I agree, […]