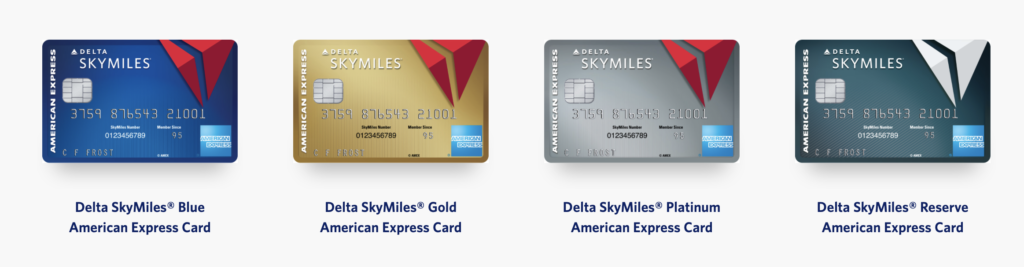

Yesterday, many blogs had the news that Delta and American Express had announced changes that will be coming to their family of cards on January 30, 2020. While Delta and Amex are making new benefits, they are also raising the annual fees. So, is all of this a net positive or net negative?

The New American Express Delta Card Changes in 2020

Link: New American Express and Delta Changes

American Express and Delta tried to address a chief problem with airline co-branded credit cards – they stink for everyday use. In fact, they generally stink for even purchases with that airline as there are other cards that offer better rewards.

The main reason people hold onto airline credit cards is to take advantage of the benefits the cards give them with the airline – things like lounge passes or access, free checked bags, earning elite miles, etc. So, American Express and Delta carved up their 2020 versions of the cards with many changes to try and make them more important to consumers for daily use. Largely, it is a fail on their part. There are a couple of nice new benefits on the more expensive cards and we will get to those.

The Bad News About the American Express Delta Changes

Of course, American Express was not going to give any new improvements at no cost – there are higher fees coming. The good news on the fee side is that if you apply for the cards before the new fees kick in (on January 30, 2020), you will be locked in for one year at the current annual fee.

- Delta Skymiles® Blue American Express Card – No fee and it will remain that way

- Delta Skymiles® Gold American Express Card – Annual fee is $95 now and will go to $99

- There will be no more MQD waiver with this card which means you will need to spend a certain amount of money with Delta each year, in addition to flying, if you used to spend $25,000.

- Delta Skymiles® Gold Business American Express Card – Annual fee is $95 and will go to $99

- The MQD waiver ends on this card as well – December 31, 2019

- Delta Skymiles® Platinum American Express Card – Annual fee is $195 and will go to $250

- Delta Skymiles® Platinum Business American Express Card – Annual fee is $195 and will go to $250

- Delta Skymiles® Reserve American Express Card – Annual fee is $450 and will go to $550

- Delta Skymiles® Reserve Business American Express Card – Annual fee is $450 and will go to $550

The Worst News on the Cards

While the annual fees are bad, American Express’s removal of the MQD waiver on the Gold cards pretty much is the signal to everyone to never spend on this card again.

It does not stop with the Gold cards, however. The Platinum and Reserve cards will stop awarding threshold Skymiles. How that works is that, at present, if you spent a certain amount of money ($25,000 with the Platinum cards and $30,000 with the Reserve cards), you would receive a elite mile (MQM) boost and the same number of bonus Delta Skymiles. This is how it works:

- Spend $30,000 on the Delta Reserve card in a calendar year and receive 15,000 elite miles and 15,000 Delta Skymiles

- Spend $25,000 on the Delta Platinum card in a calendar year and receive 10,000 elite miles and 10,000 Delta Skymiles

No more Bonus Skymiles with Spending!

While the elite mileage boost will stay (more on that below), the bonus Skymiles will be gone with the new card version. If you value your Skymiles at 1 cent per mile (which would be the lowest amount you should value them at), that is like losing $100 or $150 on your big spending each year on those cards. That is a painful cut, especially when Amex is raising the fees by $55 and $100 on the Platinum and Reserve cards, respectively.

Obviously, they don’t want to mint more miles than they feel they have to but I think it is an extremely petty move by Amex to cut that boost benefit while making cardholders pay even more in annual fees.

The Good-ish News

On the good news front, there isn’t a whole lot that will make the majority of people keep the cards. In fact, some of these new benefits are ones that may not be that game changing to many travelers.

Increased Bonus Categories

Earn more miles when using these cards for Delta purchases

This is the part I originally referred to about American Express and Delta trying to make these cards more everyday cards. They have added new bonus categories to try and earn that spending but, for most, that increase is negated by the increase in the annual fees.

- Delta Skymiles® Gold American Express Card

- 2x miles on restaurants and U.S. supermarkets

- Earn $100 Delta flight credit after spending $10,000 in a calendar year

- Delta Skymiles® Gold Business American Express Card

- 2x miles on restaurants, U.S shipping and U.S. advertising (select media)

- Earn $100 Delta flight credit after spending $10,000 in a calendar year

- Delta Skymiles® Platinum American Express Card

- 3x miles on Delta

- 3x miles on hotel purchases (direct with the hotel)

- 2x miles on restaurants

- 2x miles on U.S. supermarkets

- Delta Skymiles® Platinum Business American Express Card

- 3x miles on Delta

- 3 miles on hotel purchases (direct with the hotel)

- 1.5x miles on purchases of $5,000 or more

- Delta Skymiles® Reserve American Express Card

- 3x miles on Delta

- Delta Skymiles® Reserve Business American Express Card

- 3x miles on Delta

- Earn 1.5 miles per dollar after spending $150,000

So, there it is. In a nutshell, the more expensive cards are now giving more miles on Delta purchases (one more mile per dollar) while also adding various categories that users spend in on a regular basis. But, there are better options for each of those categories with other cards.

Lounge Access, Elites, and Upgrades

The Delta Reserve cards are the ones that were hiked the most in annual fees – a whole $100 per year! But, they are also the cards with the most new benefits.

To start, Reserve cardholders will not only be able to access the Delta Skyclubs for free but they will also be able to access the much nicer Centurion lounges when flying Delta. It is a bit of a surprise that they are doing this given how crowded some of those lounges are already. In addition, Reserve cardholders will receive 2 one time use club passes for the Delta Skyclubs that they can gift to a friend or co-worker.

Next up is the elite access part. In the past, it has always been possible to spend your way to elite access with Delta while never stepping on an airplane. This is because of the benefits on the Platinum and Reserve cards that give you elite miles when you hit certain spending thresholds.

The positive change is that, with the Reserve cards, you can earn up to 60,000 elite miles on a single card. Of course, that requires spending $120,000 in a single year but if you can hit that, you will have Delta Gold status without even stepping on an airplane. Certainly, status is worth nothing if you don’t fly but at least you can fly with status earlier on than you would otherwise.

For those that had both the personal and business Reserve cards before just to get those 60,000 elite miles, this could be the only place that having a higher annual fee makes sense. Instead of having two cards that each cost $450 per year, you can get those miles with one card that costs $550 per year.

Lastly is the upgrade part. This is something that literally cost Delta nothing to throw in there and I doubt this will happen much. But, for those flyers that have the Reserve card and don’t have elite status (which is probably not a big crowd), they will be able to be eligible for complimentary upgrades after all other upgrades have been processed. Since Delta has moved to a first class monetization model, there likely won’t be that many/any upgrades left but if there are and you have the card, you can get an upgrade. 🙂

Summary

I would say that these changes are a net negative for 90% of Delta customers. They are stripping benefits while trying to replace them with spending bonuses that will largely help only the customers that have no other credit cards. They are raising the annual fees while they are at it. For people that had been spending on the Delta Platinum cards, they are probably going to suffer the most.

The best news? If you apply before January 30, 2020, you will be locked in for a year at current annual fees and benefits. Plus, Amex is running higher bonuses for this month so if you have never had a particular card that interests you, now may be the time.

Good write up Charlie. These changes are crap. Delta is essentially admitting that their Reserve cards are now 100% for status chasing. Ironically, for those that MS at grocery stores the Platinum card is better given the 2X category. That should easily replace the removal of the spending threshold bonuses less 10K MQM’s unfortunately.

Thanks, Geoff, and I think you are exactly right on the other points.

Although Delta’s partnership with Marriott went by the wayside, they still found a way to bonvoy over their customers. There is surely more crap in these changes than on the streets of San Francisco.

But it’s not bad if you read some blogs… some of them call these enhancements, and not the way that United does!

I just don’t see how this is going to move the needle on spending patterns for me by adding value.

[…] are trying to get some momentum back from bank point earning cards. But they mostly fail again: Delta and Amex Attempt to Make Their Cards for Everyday Use – And Fail. Best honest review I read while most others are sweet talking the changes so they can sell more of […]