In this game, there is very little premium put on store credit cards. That’s probably because they often come with little to no sign up bonus and their everyday rates are pretty bad. There is one card we have had and we plan to keep, because we use it so much.

Target Redcard: The One Store Card I Keep

We do most of our shopping online, since we can stack savings with portals and our credit cards. Even with doing most of our shopping online there are plenty of things we purchase in store as well.

We find ourselves doing most of our in-store shopping at Target for these items. Target allows some pretty awesome stacking of coupons, deals, and their Target Redcard credit card gives you 5% off so many items! We have been using Target more for our grocery shopping as well, which could potentially be a replacement for your Blue Cash Preferred (If you primarily grocery shop at Target).

The Benefits:

For a store card to be in your rotation, it better have some pretty decent benefits. The top benefit would be the discount the card gives you. The Target Redcard Credit Card, gives you 5% off all your purchases (yes, there are some exclusions).

Outside of the ongoing benefit of the 5% discount which is definitely great benefit, there are some other benefits worth mentioning:

- Free shipping on most items on Target.com

- An extra 30 days for returns.

- That could be a big benefit for the resellers out there that use Target to purchase products.

- Target Mobile purchases and Purchases with a fixed return date are excluded from the extended return program.

Not too long ago, Target offered a 10% one time use coupon if you opened a Redcard Credit/Debit card. Which was actually a pretty solid offer if you had some electronics to purchase. There were some exclusions, but overall if you shop at Target a lot, you can make that one time 10% coupon worth it.

Exclusions:

There are some exclusions to the 5% discount:

- Prescriptions, over the count items behind the pharmacy count, and clinical services at Target

- Target Optical eye exams

- Target gift card and prepaid cards, Stockpile, and Gift of College Gift Cards

- Certain restaurant Merchants in Target Stores

- Target credit account payments

- Gift wrap and shipping and handling charges on Target.com purchases

- Wireless protection program purchases and deposits required by mobile carrier

The list of exclusions are pretty straight forward and I don’t think too extensive. The 5% discount will extend to their Starbucks in the Target stores. Although I prefer to use gift cards loaded onto my Starbucks account for my stars :-).

The cell phone protections really isn’t an issue, since you can have cell phone protection with the credit card you pay your bill with.

Why the Credit and not the Debit:

We actually had the Target Debit card for a couple of years. I was never a fan of linking my debit account to my bank account. If someone was able to hack my Debit Redcard, then they would essentially have access to my bank account.

After Target’s huge breach a few years back, I really felt it was best to get rid of the Debit Redcard for the Credit Redcard. This move was worth the hard pull and gave me peace of mind.

If you look at the terms and conditions, you’ll see there is less to worry about when using the credit card over the debit card as well

Redcard Credit Card Liability:

In Target’s credit card agreement, they have this:

“You are not liable for unauthorized use of the Account. You agree to assist us in determining the facts relating to any theft or possible unauthorized use of your Account and to comply with the procedures we may require for our investigation. All Cards are issued by us to you and you must return or destroy your Card if we request you to do so.”

Redcard Debit Card Liablilty:

There are some protections for the Target Debit Redcard as well:

“You will not be held responsible for unauthorized use of your Card, Card number, or PIN if you have exercised reasonable care in safeguarding your Card, Card number, and PIN from loss or theft. If you did not exercise such reasonable care, the following liability limitations for unauthorized use apply:

If you tell us within four business days after you learn of the loss or theft of your Card, Card number, or PIN, you can lose no more than $50 if someone used your Card, Card number, or PIN without your permission.

If you do NOT tell us within four business days after you learn of the loss or theft of your Card, Card number, or PIN, and we can prove that we could have stopped someone from using your Card, Card number, or PIN without your permission if you had told us, you could lose as much as $500.”

I think the credit card protection is better overall vs the Debit protection. Not to mention the loss of up to $500, if you report after 4 business days of losing or theft of your Debit Redcard. That is a lot of money!

The Redcard Debit card transactions post a few days after the purchases have been made. Remember, this comes from your linked bank account. Although, you might not be liable, for these charges you’ll probably have to wait until your claim is complete before your money is returned.

I don’t know about you, but I would prefer to keep my money in my bank account and dispute a credit card charge. Instead of fighting to get the money back to my bank account.

Stacking Savings:

One of my favorite apps to use at Target is their Cartwheel app. This is great money saver for in-store purchases and will stack with the 5% off savings of the Redcard Credit Card.

This definitely helps save us money on groceries, as well as many other things (like clothes). These savings can be up to 50% off.

I read a while ago that Target was in a beta stage of using Cartwheel for online purchases. This could lead to huge savings when you start to stack with a shopping portal.

At this time though, Target does not have this option. I will keep my fingers crossed though!

Shopping Portal

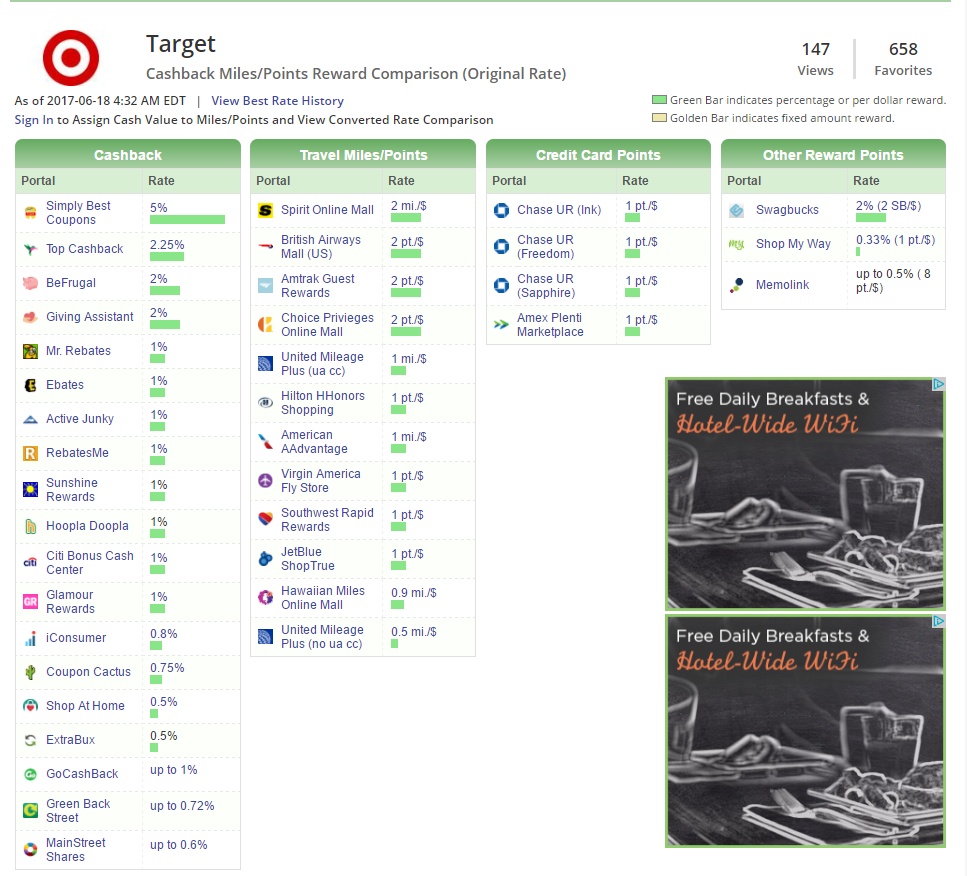

The current shopping portals offer up to 5% cash back at Target.com. If you prefer Ultimate Rewards, it offers 1 point per dollar. I think the 5% cash back is the better offer.

This could be one of the very few times purchasing items in-store could have a great return than online.

If someday, Target allows the Cartwheel savings to be used online, this could lead to huge savings!

Better than Blue Cash Preferred?

This is definitely subjective. We primarily grocery shop at Target, because we save a lot of money there. Plus, they have most (if not all) of what we need on a weekly basis.

If you spend enough on groceries, many will tell you the American Express Blue Cash Preferred is the top card for groceries. If you primarily shop at Target, the Target Redcard Credit card could actually be better.

If you max out the $6,000 spend on the Blue Cash Preferred, you’ll earn $360 in cash back. After you take into account the $95 annual fee, you walk away with a cool $265. But wait….

If you spend $6,000 at Target using the Target Redcard Credit Card, you’ll earn $300 in upfront discount. The upfront discount is pretty solid. This would be $35 more in savings than if you used the American Express Blue Cash Preferred.

Those savings don’t take into account the savings when you stack the Cartwheel App. For us, we have probably exceed 6% savings at Target instead of using the Blue Cash Preferred.

Conclusion:

There aren’t many store cards worth having, but I think the Target Redcard Credit Card is worth it. The savings of 5% is a huge upfront savings. When you take into the account the savings you can stack with the Cartwheel App, this card makes a great case to be in your rotation.

If you spend a lot on groceries, the Target Redcard Credit Card could lead to more savings than the American Express Blue Cash Preferred.

Do you have the Target Redcard Credit Card? What store cards are in your normal rotation?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

The prepaid redcard doesn’t involve a credit pull and gets most of the same benefits.

Hey Jeremy,

That is a good point. I never really got into the redbird (since I don’t MS), but I agree it is a solid option.

Thanks for reading! I appreciate it

Dustin

This card will be taken from my cold dead hands.

As someone who lives in a city without a car, I can order from Target, get 5% off their prices and have the items shipped directly to my door; and they ship very quickly. I usually get items I ordered over the weekend on Monday or Tuesday.

I’ve ordered things as small as a bag of sugar and the shipping is still free.

Hey Daniel,

I don’t think we will ever get rid of this card either. The fact we can save a lot of money upfront with it and it’s so easy, makes it hard to consider canceling.

Thanks for reading! I appreciate it!

I have both the Target credit and debit card. Why? You can get cash back against the Target debit card saving you a trip to the ATM and potential surcharges.

You can also do the cash over with a Discover Card at many grocery stores and now even Orchard Supply Hardware stores. Limits vary by store.

Hey Askmrlee,

We have the Discover card and we have withdrawn cash with it as well. It even earns cash back as a purchase (in my experience).

If the debit and credit Redcard work well for you, that’s awesome!

Thanks for reading! I appreciate it!

Dustin

[…] my mind: I have been a partisan for the Target Debit REDcard. Here’s a case for the credit card […]