Last week, I wrote about (my wife) Rachel’s application round and thought I would take this opportunity to post an update about it since the verdicts are all in!

Rachel’s Application Round – Update

Background

It had been a couple of months since Rachel’s last credit card application and many months since she had applied for more than one card at once. Due to our family’s move this summer, I thought we would go all out with her applications and see what we could get by having her apply for the most cards that she has ever applied for in a single application round.

Important Note: In order to participate in multiple credit card application rounds, you need to make certain of a few things: 1) That you can keep track of your finances in a responsible manner 2) That you can hit the minimum spending amounts without having to carry a balance of any kind or be late on your payments (as those fees will erode the value of the points you are receiving and have a long-term negative effect on your credit score) 3) That your credit score is high enough to sustain multiple applications at once as many lenders will want you to have a high score when applying for cards and multiple applications may cause your score to dip a couple of points with each application 4) BE ORGANIZED This goes back to 1 and 2 but it cannot be said enough – you need to be able to maintain proper organization when applying for multiple cards as there are many bad things that can happen if you are not organized. One of the least of the bad things would be for you not to get any points out of your applications for bad organization.

Here was our strategy with her applications

- Try to get cards from different major banks (Citibank, Chase, American Express, Barclay, US Bank) – when applying for cards, you can be approved for multiple cards as long as they are from different banks. The exceptions are with business and personal cards with some of the banks – they will allow you to apply for one of each but you may need to call in to get one or both approved

- Get a variety of hotel and airline points

- Try to keep overall spend low (did not keep with this, but will explain why in a bit)

The original applications had been for (if you apply using the Barclay or American Express links and are approved, I will get a commission for that):

- Barclay Arrival World Mastercard – DECLINED – Application Link

- Citi Platinum Select AAdvantage Visa Signature (American Airlines) – APPROVED – Application Link

- Gold Delta American Express – APPROVED

- Club Carlson Credit Card – APPROVED – Application Link

- Chase INK Plus – APPROVED – Application Link

All in all, this was an excellent application round! We have been putting off the phone call to Barclay as we wanted to see what their reason for denial was. Sure enough, it was that they had already given her sufficient credit. They had not even pulled her credit for that application. Rachel really dislikes having to make these phone calls, but we will make it anyway 🙂 since I am fairly positive that we can get it approved by shifting credit over from one card to that card. However, that is still in the declined column until we call.

YESTERDAY

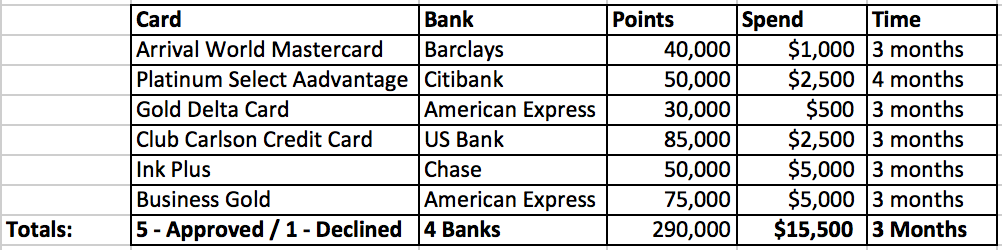

Normally, you would make an application round and then wait 3 months before doing it again. However, there was a deal for the American Express Business Gold Rewards card yesterday for 75,000 Membership Reward points after spending $5,000 in 3 months (the card is normally 0 points but has been at 50,000 for a little while now). I already have one of those products, but thought I would try for my wife to see what would happen. It went into pending before being approved today! That made it a total of 6 cards in this week of applications with approvals on all of them but 1. Not bad! Here is the chart of what we will receive and what we need to spend over the next 3 months.

After meeting our spending requirements, we will have a total of 305,500 new points! That breaks down like this (including our spend in the point totals):

- 135,000 Flexible Reward points (Membership Rewards / Ultimate Rewards)

- 83,000 Airline Miles

- 87,500 Hotel Points

See why credit card applications are so fun and necessary for cheap travel?!

Business Cards

Two of the cards my wife applied for were business cards (Chase Ink Plus and Amex Business Gold). She is a photographer that specializes with newborns, but she has not formally organized it as a business since it is small. So, it is operated as a sole-proprietorship. Her income last year through this was not that high (she is far too generous with people!) so she wasn’t going to put down some large amount of business income on these applications. It helps that one of the apps only asks for income in groups (ie. $0 – $49,999). Since she does not have a Employee Identification Number (EIN), in the EIN field, she entered her social security number (which is what you are to do if you do not have an EIN). If you are using your own name in the business name, you do not even need a DBA, so that makes it even easier. I was fully expecting to have to do a call-in with Chase but was surprised to find the card arrive today with no phone call needed! To read more about businesses and business cards, read this post.

Meeting Spend

Did you notice that very large figure in the Totals column above? That’s right – $15,500 of minimum spending required in the next 3 months to earn those points. That is a lot more than we spend in that timeframe! To find some ideas for meeting spending thresholds, check out this post. However, one of my favorite methods is to use Bluebird. You can load $5,000 per month onto your Bluebird account using Vanilla Reload cards that can be obtained at many CVS stores. By doing basic math, you can see that we could reach that $15,000 amount in just 3 months using only Bluebird reloading! However, we do want to be diversified in our spending, so we will do some buying for reselling as well. My favorite method is purchasing items open-box at stores and selling them on eBay or craigslist. This helps in meeting spend while also allowing me to earn store points (like at Best Buy) in the process.

What Can Be Done With Those Points?

That is a lot of points – what will we do with them? Note: this is obviously not a comprehensive list but a few of the things that our family might do to make use of the points.

75,000 Membership Reward Points

These points can be transferred to a variety of airlines, including Air France/KLM, Delta, and British Airways. If transferred to British Airways before June 7, this amount will result in 101,000 British Airways Avios. This is more than enough to use on a trip like my one-way from JFK – Sri Lanka in January. It is also enough for 11 round-trip tickets from Rochester – Chicago (which typically costs $300+ per ticket). If we transfer them to Delta (with no transfer bonus), it is 5,000 miles shy of an economy ticket anywhere in the world that Delta or its partners fly. If transferred to Air France/KLM (under current reservation requirements), you can get 3 one-way tickets from the US – Europe.

50,000 Ultimate Reward Points

These points can also be transferred to a variety of airlines as well as redeemed outright for travel at a value of $625. If transferred to United (my favorite Ultimate Reward redemption partner), it is enough for a one-way business class ticket to Europe, or it is 10,000 miles shy of a round-trip, economy ticket to Europe, or it is also enough two tickets anywhere in the US/Canada. If transferred to Southwest Airlines, it would be enough to fly four people to Florida under the type of promo we took advantage of back in March. If transferred to Hyatt, it is more than enough for two free nights at the best Hyatt hotels in the world.

85,000 Club Carlson Hotel Points

Because you will receive the last night of any award stay 2 nights or longer free, this works out exceptionally well! The Dubai hotel that I was sorry I could not stay at would be at the top of our list for our redemption with these points. With these points and the free night extended for having the card, we would be able to stay there for three nights (44,000 points per night, so 3,000 points shy) or stay for 9 nights at a Category 1! Pretty good offer!

30,000 Delta Skymiles

There are many uses with 30,000 Skymiles. They could be used to deduct $300 from the cost of a ticket using Pay With Miles, they could be used to secure cheap car rental reservations, or they could be used to obtain a low-availability award ticket anywhere in the US/Canada. Since this is the total amount of miles that Rachel has in her account (our Delta stash is in my account), one of the above uses will be what we do.

50,000 American Airlines AAdvantage Miles

There is so much that can be done with American Airline miles! You can use them during the off-peak season (October – May) for 40,000 mile tickets to Europe. It is almost enough for business class tickets to Asia using partners as well as AA. However, what we will probably do is to keep them and wait until we can combine them with Rachel’s US Airways stash.

Disclaimer: This content is not provided or commissioned by American Express. Opinions expressed here are author’s alone, not those of American Express, and have not been reviewed, approved or otherwise endorsed by American Express. This site may be compensated through American Express Affiliate Program.