Yesterday, I wrote about a new, updated offer out on the United MileagePlus Explorer card (the personal United card). The new offer gives a 50,000 mile sign-up bonus and an additional 5,000 miles when you add an authorized user and that user makes a single purchase.

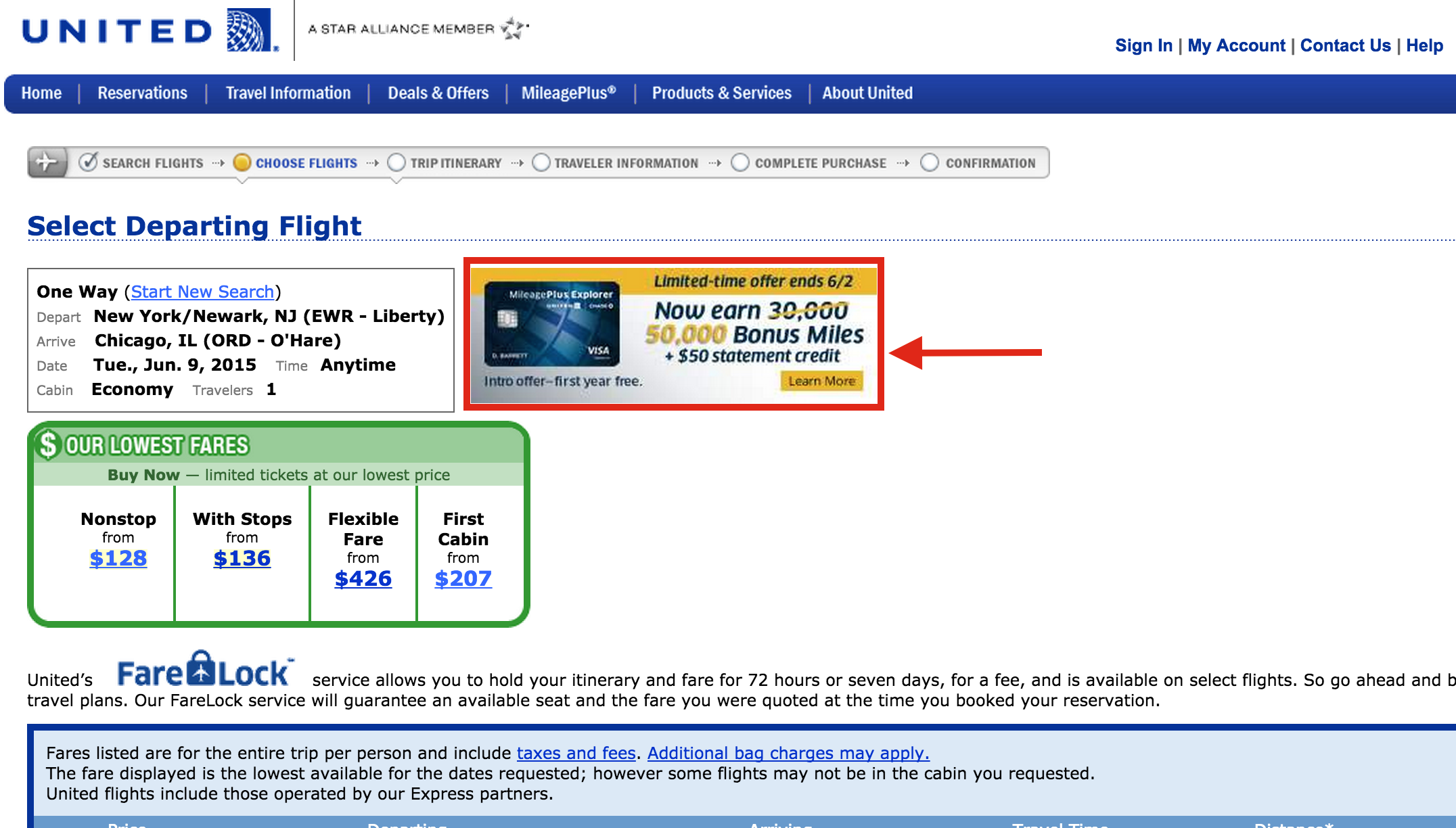

Reader Brent mentioned to me that there was actually a better offer available (mentioned by Frequent Miler) – this is the same with the miles but it gives a $50 statement credit! The only problem is that there is no direct link for it. You have to take a simple, extra step to apply for it, but it is absolutely worth it.

How To Get The 55,000 Mile + $50 Credit Offer

Step 1 – Go To United.com

This offer can only be seen/applied for when searching for a flight so head over to united.com

Step 2 – Search For Any Trip

Just start searching for a ticket – to make it simple, just use something like your home airport to Chicago (ORD). It can really be any airport, though.

Step 3 – Click On The Improved Offer

Before you even select a flight (so you are not even making a reservation), you will see the offer for the miles and statement credit. Click on it and apply!

Why Two Offers?

It can be confusing sometimes given the amount of different offers for the same exact card (look at the Marriott card – 4 different offers!). Why do issuers, especially Chase, do this? Part of it has to do with marketing/advertising dollars. In this case, the general offer of miles (no statement credit) is largely available as an affiliate link that bloggers/websites with affiliate relationships with the issuers are compensated for when you apply with their links.

This offer, the $50 statement credit, is an offer that is made only available through United’s website. In this case, the savings of not paying a commission to an affiliate is partially made available to you, the applicant, in the form of a statement credit. Even offering a $50 credit still allows the issuer to save more money since the affiliate payout is greater than that.

So, when you see separate offers, sometimes it may be because they are targeted at elite members, but most of the time, it has to do with where the issuer is putting their marketing/advertising money. Of course, as a former Chase affiliate, I liked that money coming to me. 🙂 But, as an applicant, I like it coming to me as well and that is largely better for the applicants as a whole. Still, if you do not want to go through the (simple) process of getting the statement credit, I would ask you to consider applying through Frequent Miler’s affiliate link – here. It is not easy to make known an offer that does not compensate, believe me! But, I always appreciate when both offers are mentioned. Frequent Miler does that consistently.