Over the last year or so, I have opened a few cards with long term benefits. I still open plenty for the bonus, but as the game changes, I am preparing for better daily return on my spending. I would hope you are as well! One of my more recent credit cards, is the USAA Cashback Rewards Plus. If you’re eligible, is this card worth a slot in your wallet?

Credit Card Review: USAA Cashback Rewards Plus

Credit Score Needed:

As I mention in many previous post to anyone pondering about entering this game…If your credit score is below 700, I would not apply for these rewards cards. You should work on improving your credit score first, then worry about the rewards.

According to Credit Pulls Database and forums I read, people who were approved for this card has credit scores that ranged between low 600’s to high 700’s. While people with low 600 scores were approved, I would still caution you on applying for these reward cards with a credit score less than 700.

Sign Up Bonus:

One of the big downfalls of the USAA Cashback Rewards Plus is the lack of a sign up bonus. This is pretty typical of USAA, although you might find a small bonus with a different USAA card. You definitely do not sign up for these cards for the bonus.

Annual Fee:

The USAA Cashback Rewards Plus does not have an annual fee. This is a card that you should keep for the long term, if you were to open it. It will increase the age of your credit history, which should be part of your long term strategy in this game.

Earning Rate:

A while back, this card made my list for top gas purchases. That is due in part to it’s amazing earning potential on gas purchases.

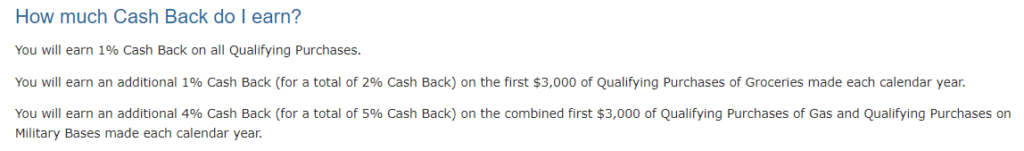

The USAA Cashback Rewards Plus earns an amazing 5% cash back on gas purchases and military base purchases. Military base purchases include the commissary, BX/PX, shoppette, and other purchases that would be made on the military base. This does max out at $3,000 per year, so you would need to keep that in mind.

The USAA Cashback Rewards Plus earns 2% cash back at supermarkets, up to $3,000 in purchases per year. This falls short of other cards, like the American Express Blue Cash. Earning 2% isn’t the end of the world, but this earning rate isn’t competitive with other cards.

All other purchases with the USAA Cashback Rewards Plus earns 1% cash back.

The real reason to get this card is for the outstanding 5% cash back earning on gas (and base purchases if you live on base). Cards like the Chase Freedom and Discover It, but those are typically for 1 quarter. Plus Chase and Discover continue to mirror each other on those categories (boo).

Foreign Transaction Fees:

This is another place where the USAA Cashback Rewards Plus shines. There are no foreign transaction fees with this card.

In my experience as well, American Express gives the best conversion rate when compared to MasterCard and Visa. It isn’t accepted everywhere, but if the earning rates are equal, American Express would give you the better conversion rate.

Another benefit to no foreign transaction fees, is the benefit of Chip and PIN.

Redemption:

This is another part where USAA is better than some of it’s competition. There isn’t a $20 or $25 minimum with the USAA Cashback Rewards Plus. Redemption start at $1, and must be made in $1 increments.

The options for redemption are in the form of a credit statement or you can deposit to your USAA account. I typically move the cash back to my “travel fund.”

One of the great features about USAA cash back is the fact the rewards are deposited once your transaction post. There is no waiting until the statement closes, or the dreaded month lag like cards issued directly from American Express.

Other Benefits:

This is an American Express card and while it won’t show up on your American Express log in, you can link this for Amex Offers. You would need to link it via Twitter or Facebook.

This would give you access to the public Amex Offers. Amex offers are one of my favorite perks of any credit card.

Other benefits include:

- Secondary Car Rental Insurance

- Identity Theft Resolution

- Price Protection- If you find a better price within 120 days of purchase, you can submit for reimbursement. This is limited to 4 claims per 12 months and up to $250 per claim.

- Extended Warranty- If your purchase has a warranty of 24 months or less, you will receive an extra year of warranty when you pay with your USAA Cashback Rewards Plus

- Concierge Service- Many cards have these

- Baggage Delay- You can be reimbursed up to $100 per day for 3 days. This benefit is only for purchase of essential items. There are better cards for this benefit

How this is better than other American Express Cards:

One of the the many complaints I have with American Express is their limited bonus categories when traveling abroad. The categories explicitly say “US” on their listing of their bonus categories.

I have looked through the T&C and there is no mention restricting this to only US Gas stations.

Not only making this one of the best cards for gas here in the US, but also one of the best cards to use internationally for gas purchases.

While cash back might not be everyone’s currency of choice, it is quite difficult to argue against 5% cash back domestically and internationally for gas purchases.

Areas for Improvement:

While this card will remain in my rotation for my gas purchases, there are areas where it can be improved.

There are a few gas stations I have visited, where the USAA Cashbackk Rewards Plus does not actually code as gas. While I understand it comes down to the coding, my American Express Blue Cash Preferred and my USAA Limitless, both code the merchant as fuel/gas.

I have reached out a few times and I am waiting for a response to why this is occurring. There happens to be at one particular gas station next to where I work which consistently codes as uncategorized. Big picture, I can get gas at another nearby gas station, but it should code correctly.

Conclusion

If you are eligible for the USAA Cashback Rewards Plus, this card should definitely be on your radar. You will need to look beyond the non-existent sign up bonus, but the daily return is very solid.

The fact this will earn 5% on both domestic and international gas charges, makes it one of the best cards available for gas purchases. Additionally, redeeming your rewards is very simple. The coding could be improved, but overall this card is fantastic.

Have you considered the USAA Cashback Rewards Plus? Which card is your go-to gas card?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

You do not have to “live on base” to use this card. Thanks.

I mean, to get the 5% back on base purchases.

Hey Jackie,

You don’t need to live on base to use this card. If you were to live on a military base, you would receive 5% at the base exchange and other locations. The gas is a separate 5% category the card offers.

Thanks for reading! I appreciate it!

Dustin