Chase has been making some changes to their cards this year. Most of the time, when airlines, hotels, and card issuers make changes, it is negative. This time, Chase replaced some benefits with other benefits. But, are they getting picky with the benefits?

Why Is Chase Getting Picky With Benefits Like This?

The Current Situation

On June 1, Chase rolled out the new United Explorer card. It is a slightly modified MileagePlus Explorer card and they have diminished or eliminated certain protection policies as they have done with other cards in the Chase portfolio.

At Issue

The single thing they eliminated that was not like other cards was the elimination of the 10,000 bonus miles after spending $25,000 in a year. For a while, this was actually a pretty nice benefit for people that valued United miles (before they devalued the premium awards especially) but over the last few years, Chase has released cards that made that kind of a spending on a card pointless.

For example, they released the Chase Freedom Unlimited that earns 1.5% on all spending (and can be transferred to an Ultimate Rewards earning card like the Chase Sapphire Preferred before transferring to United at a 1:1 ratio). The Chase Freedom Unlimited also comes with zero annual fee.

So, Who Cares It Is Gone?

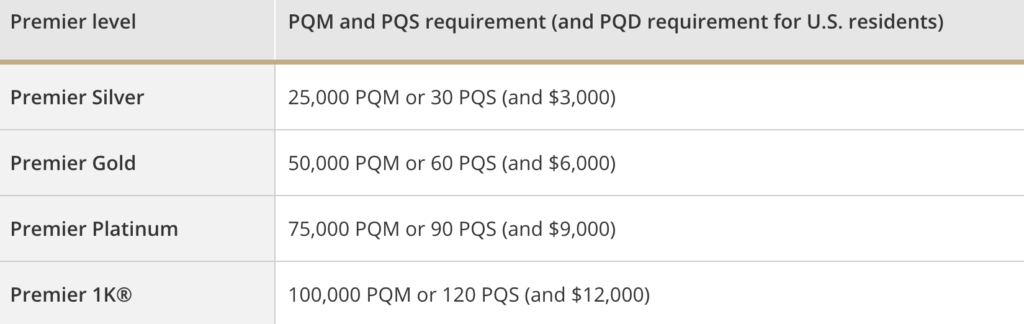

The reason it is a problem for some is that United has a spending requirement for those that earn status with them. That means that, in addition to flying a minimum amount of miles, customers with United must also spend a minimum amount on tickets. That minimum translates to spending that is more typical of business customers than the cost-saving travelers like us.

The spending requirements to earn elite status with United

So, United offers a waiver – that waiver requires customers spend $25,000 in a year on the United card to avoid having to spend a minimum on tickets with United and partners.

Those are the customers that are doing the $25,000 of spending per year on an otherwise pointless card for spending.

Is It Picky of Chase To Eliminate The 10,000 Mile Bonus?

Chase knew that they had those customers (they are likely the bulk of cardmembers who spend that much on the card) over a barrel – of course they will keep spending that money to get those waivers to retain their elite status!

So, Chase’s response to this card loyalty was to remove the one benefit that made this otherwise-pointless spending on the card worth it – the 10,000 mile bonus after spending $25,000 in a year. That bonus made such spending equal 1.25 United miles per dollar which was a nice little boost of recognition to go along with the spending waiver.

Customers Still Can Earn Those Miles Using Other Chase Cards – But Not with the Elite Waiver

The Chase United MileagePlus Explorer Business version is an option

Those customers could have earned 12,500 United miles if they were able to put that spending on a Chase Freedom Unlimited and then transfer to something like the Chase Sapphire Preferred (before transferring to United, should they want to). So, Chase would be doling out the points/cash back anyway to savvy travel customers – why eliminate the bonus on this card?

Global Entry Reimbursement Is NOT a Fair Replacement

Since United expects customers to trade 10,000 United miles for Global Entry, maybe they thought this benefit swap was fair?

They talked about the new benefit of Global Entry reimbursement (which is nice) but the truth is that this benefit is starting to become like saying that a card has no foreign transaction fee – that GE reimbursement is popping up cards everywhere now! But, that 10,000 mile bonus was something that was very applicable to the United elite customers that used their card for elite spending waivers – and the Global Entry reimbursement is only once every 4 years.

Best Option? The Chase United MileagePlus Explorer Business Card

Link: Chase United MileagePlus Explorer Business Card

Fortunately, there is an alternative – and it comes from Chase themselves!

“In 2018, the PQD requirement is waived for Premier Silver, Premier Gold and Premier Platinum qualification if you meet one of the following criteria:

- You spend at least $25,000 in Net Purchases during that calendar year on MileagePlus co-branded credit cards issued by Chase Bank USA, N.A.;

OR - You hold a United MileagePlus Presidential PlusSM Card”

The 10,000 mile bonus still exists on the business version

So, if you apply for the Chase business version of this card, you can use it to do your $25,000 in spending for both the waiver and the 10,000 bonus miles. The downside is that it is a business card and it is expected that it would be used for business expenses (since protections are different from the personal cards).

Takeaway

At the end of the day, I think Chase is getting unfairly picky with some of their benefits that have actual value to a core set of their customers. There is no question that more people use the personal card for the elite waiver spending than the business card and that is the card that Chase eliminated the 10,000 mileage bonus from.

I know from having heard from many United Airlines elite members already that they are going to be looking to do something different for next year. It is a waste of spending to put all of that money on that card without getting the bonus. The bonus could be worth as much as $200 each year – getting a $100 Global Entry reimbursement every 4 years (so $25 per year) doesn’t come close to matching that.

What are your thoughts on Chase’s benefits cut like this one?

[…] Why Is Chase Getting Picky with Benefits Like This? Running with Miles […]