With the news coming out and everyone saying apply for the “new” Barclay Avitor Red card, I am saying slow down. There are a couple of reasons I think you should wait for Barclay Aviator Red card.

Why you may want to wait for the Barclay Aviator Red Card

Card Breakdown:

This is not a card review, but I can definitely do one, or compare it to the Citi cards if you would like. Let me know in the comments. This is quick breakdown :-).

The first thing that catches your eye about the Barclay Aviator Red card is the the 40,000 mile sign up bonus after your first purchase. That can be enough for 2 RT tickets for short haul flights, or good for a saver coach ticket, with miles to spare.

This is great for someone who wants an easy spending requirement. I mean you can go to the grocery store, buy a pack of gum (for what a buck?) and BOOM you earned 40,000 miles.

In addition, you do have to pay the $95 yearly fee up front. But in the big picure of things you’ll pay $96 for 40,000 miles. Essentially buying miles at 0.24 cents a piece. A very low price to pay for them.

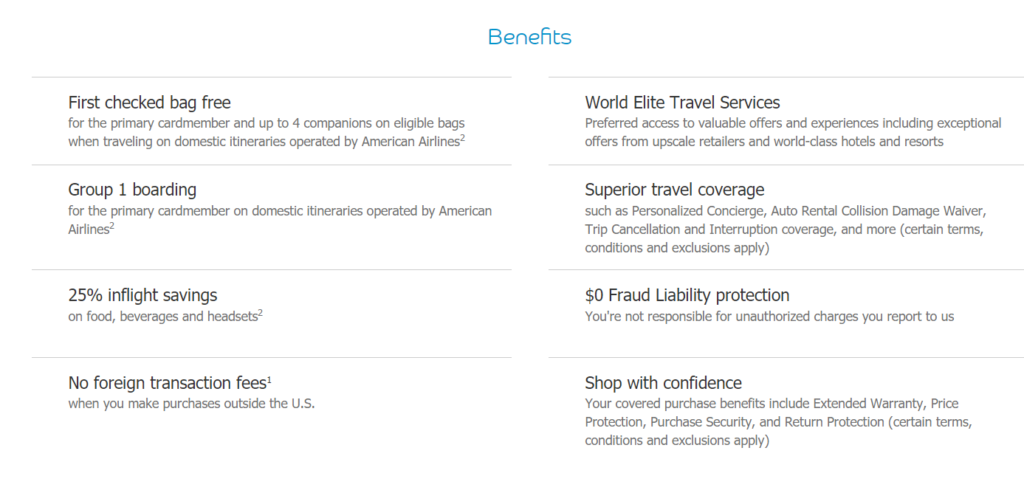

Other benefits include:

I think the key ones are no foreign transaction fees and free checked bag.

All of these things sound great, but here is why I think you should wait on the Barclay Aviator Red Card

The bonus:

Currently the bonus is 40,000 miles, but Barclay is competing with Citi for customers to sign up and use their cards. Currently, Citi offers 50,000 miles, but it does come with a $3,000 spend requirement. I don’t think the spend requirement scares most people, but I could be wrong.

In order to be more competitive, I think we will see Barclay raise it’s bonus up to 50,000 miles, just like they did with the US Airways card to gain more customers before pulling the application

I have no knowledge of any increase bonus or if it’ll stay at 40,000, but my gut tells me we will see a 50,000 mile bonus sometime in January/February.

Unless you absolutely need American Airline miles, I would say sit back and wait a little bit. There is another reason and probably more important reason to wait for the Barclay Aviator Red Card, especially if you had it…

T&C Verbiage:

Now I will be first to tell you, I am not a lawyer and can only explain this to the best of my knowledge.

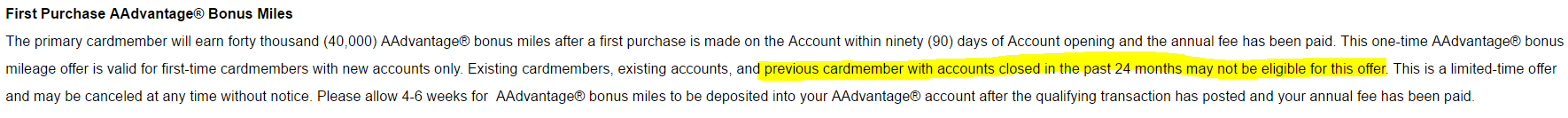

I highlighted the part of the terms and conditions that catches my eye. It specifically states, “Previous cardmembers with accounts closed in the past 24 months may not be eligible for this offer.”

The way I read this, is if you did convert your US Airways credit card to the Aviator Red card when you were offered way back when, you might not be eligible for the bonus. This will matter if you have closed it within the last 24 months.

If you didn’t convert it or never had it I don’t think this is an issue. This definitely could prevent some of us from getting the card who kept it for the spending bonuses or any other reasons. You will definitely want to check

I have seen many people already apply and be instantly approved for their cards. I see no reason why Barclay wouldn’t approve you, they could actually benefit from this, especially if they actually enforce the 24 months from closure.

I personally and going to wait until I see if these people had the card within 24 months and if they actually receive their miles.

Conclusion:

I think another card to earn miles is great. This might actually be a card I pick up at some point as American Airlines flies from Bangor. As great as it is to see this card released early (originally to be released in January), I think there are some reasons to pump the brakes and wait.

I think waiting for some data points on people receiving the miles if they have closed the card within the last 24 months is the largest question mark. I think we will see some information in the next few weeks on this.

If you aren’t in a rush for AA miles, I think you should hold off a little longer. This card isn’t going anywhere.

Are you going to apply for the Barclay Aviator Red Card? Did you have it previously?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Wait? The application is live. I was approved today.

Hey Grant,

I saw the application is live and congrats on being approved. I’m saying wait, because I think the bonus will increase. Also if you closed this card within 24 months you might not get the bonus.

Thanks for reading,

Dustin

Yea, just saying I didn’t think about that logic beforehand. Wish I had given it a second thought.

Still I have a redemption in mind so hopefully they can be burned in short order. Love the blog Dustin!

I have the Aviator Red now; the annual fee is due, but I have a letter saying to give them a call for options or whatever. What should I ask for?

Hey JRG,

I’d definitely look at flyer talk and see what retention offers people have been getting for it. I’d think you’ll get offered miles and/or statement credit

I’d also make it know that Citi is offering t 50k to sign up and it offers similar benefits.

Let me know how it works out!

Thanks for reading!

They offered me nothing, even after I got transferred. Except: no interest charges for a year (nope) and downgrading me to a card that earns 1 mile per $2 (nope).

Guess I should look at getting rid of it.

If I still have a live Red Aviator, do we think it’s possible to get the bonus? it specifically mentions accounts closed in last 24 months. Both me and SO have this card still open…Could use an 80k points infusion.

Hey EGM,

I would say you wouldn’t, but as with many things in this game YMMV. It also mentions existing accounts, which you have.

Hope that helps!

Thanks for reading

[…] else to consider brought up by Running with Miles is that if you converted a card within the past 24 months to the Aviator Red, then you might be […]