A few weeks ago, this new card offer from United Airlines would have been one to interest many. Banks and airlines have these kinds of offers in the works for a long time and a release date set so it is expected that they follow through on those releases. But, the release schedule they had could not have come at a worst time – for the card and United.

United Airlines Picked the Worst Time for their Big 100,000 Mile Card Offer

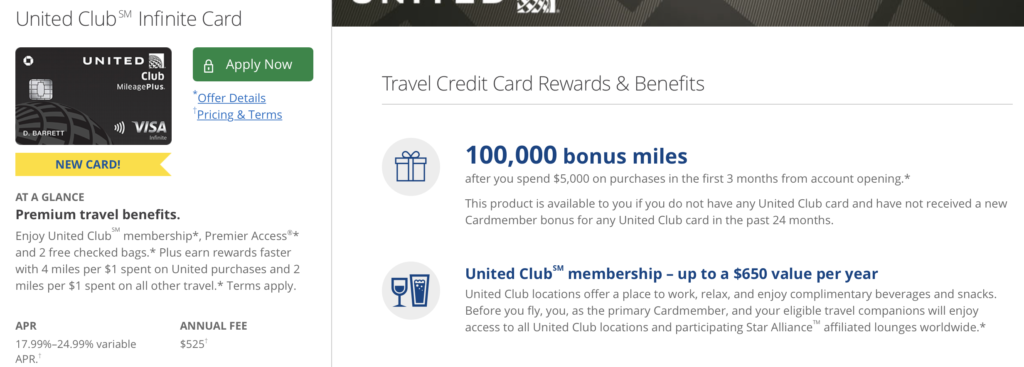

The new card is the United Infinite Club card that carries lounge access to the United Clubs with a Club membership – and 100,000 miles. On the face of it, this would be a good card for those that like United and want to rack up miles.

But, the timing was totally off with this release and United should really have held it back a bit (maybe they couldn’t? but they just extended their partnership with Chase so I am sure it is something they could of re-worked to hold off). Let’s go down the list of reasons why this is exactly the wrong time for a card like this – and, yes, I am an affiliate that would earn money if you sign up for the card but I just can’t even bring myself to include such a link in this post right now. 🙂

Airline Miles

Right now, travel is pretty much down to a halt all over the world. People are not planning trips and putting spend on a credit card that only earns airline miles isn’t the best strategy right now. United has shown themselves to not be a great travel partner for those who are stuck with reservations right now as they have changed their policy on things like flight schedule changes multiple times.

Flexible Points are King Right Now

Also, the points that are always the most valuable are flexible points and that is especially true right now (in spite of what United thought last year). That is points like Chase’s own Ultimate Reward points, American Express Membership Reward points, Citi ThankYou points, and CapitalOne Miles. Racking up airline miles isn’t nearly as good as racking up flexible points that can be used for flight, car rentals, hotels, or even cash back if you find yourself in a big pinch with the current crisis.

So, while I like to earn airline miles and will continue to, I would not think most people are comfortable spending $5,000 on a card that will only earn them airline miles. Yes, it is a 100,000 miles, but I would think that this is not the best time to go for that.

Let’s look at it this way – the Chase Sapphire Preferred currently offers 60,000 points. Those points can be transferred to United for 60,000 miles if you want or to Southwest, Hyatt, and other airlines and hotels. Plus, you have no annual fee the first year! Since this card has an annual fee of $525, you could basically take that money and buy United miles when they are on sale to get almost 30,000 of them!

Lounge Access

This is a big no right now! United has closed many of their lounges around the world in light of the coronavirus effect. This is definitely not the time to get a card that requires such a high annual fee ($525) to get lounge access – when there is no knowing when you may get to use those lounges in the first place!

Annual Fee

Did I mention that $525 annual fee? The only reason that is even close to being worth it is the lounge access. Well, with those lounges closed, this is not the time to take on an airline credit card with a whopping $525 annual fee up front – at least for many people.

They do have the ubiquitous Global Entry reimbursement but since those enrollment centers have been closed for now, that is not something anyone will be using right now either (and NYers definitely won’t be anyway).

That $525 annual fee could be used on a lot of other travel opportunities when travel starts up again that could be more beneficial than lounge access for one year.

Bottom Line

I am not telling anyone how to spend their money and I am certainly not trying to tell United’s marketing team what to do but I certainly think this was the worst possible time to introduce a card offer like this. In a few months? Maybe, but the offer only runs through May 18.

What do you think of this new card offer? Am I being too hard on it?

Timing is immaterial for a $500+ Club card that gives you access to just 45 clubs on the entire planet. You can travel for years and never see one, unless your base is a hub.

It’s still a United card. I wouldn’t pick it up even at 10 million miles.

Data point. My adult child just finished her qualification spend of 4k (with a littile help from the old folks…lol), and she was targeted with a 70k offer through the Credit Journey portal from within her Chase on-lie account.

The 70k just posted the other day – like clockwork – but for now, she realized she will not be traveling for the next couple of months.