The Barclaycard Arrival Plus has been a favorite of many travelers since it was introduced. It was the card that let you knock off travel costs after you paid for them, and it even worked months after a charge had been made! The scope of travel that would qualify was broad and was a great way to take off things like fuel surcharges, rental car costs, resort fees, rail, etc. that regular travel cards would not really touch.

The Strength of the Barclaycard Arrival Plus

But, since the product was launched (as well as its little brother, the simply named Arrival card, which had more of a stripped down bonus and feature set), there were some cashback cards that have hit the scene or began being used by people that really put some competition on the Arrival Plus as a card to hold and use. With cards offering 2% cashback, the Arrival Plus card offering 2 miles per dollar spent for travel redemption really wasn’t a winner. It remained in people’s wallets, however, because it had the 10% rebate on points redeemed, making it a 2.2% earning card. Not only that, but it had some nice perks like TripIt Pro membership as well.

But, instead of adding features to compete with the other cards, Barclaycard chose to go the other way and introduce “enhancements” – card changes that favor the issuer and not the customer. There had been rumors swirling about these changes but I had not wanted to put a post out on it until there was some confirmation about what was changing and View from the Wing wrote about those confirmed changes last night, so here they are.

The Devaluation of the Barclaycard Arrival Plus

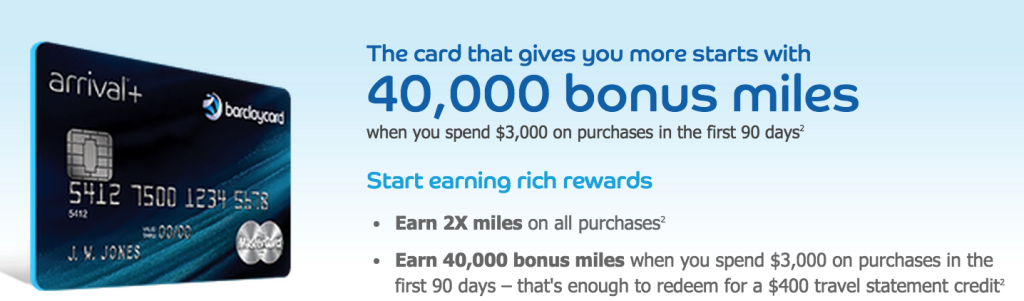

First things first – the sign-up bonus is not changing. People will still get the 40,000 miles (redeemable for $400 towards travel) after meeting the required minimum spending. That stays the same and really keeps the card as a great card to get for the bonus (but not to keep).

No More 10% Rebate – The New 5%

What is changing does affect the sign-up bonus in a way, however. They are taking away the 10% rebate and replacing it with a 5% rebate. The way they are enhancing this is that the rebate is now available on all redemptions, not just travel. That is still not good because redeeming for other redemptions cuts the value of the miles in half over travel redemptions. So, a definite devaluation – a loss of at least $21.50 (based on the 5% lost on the sign-up bonus and required minimum spending).

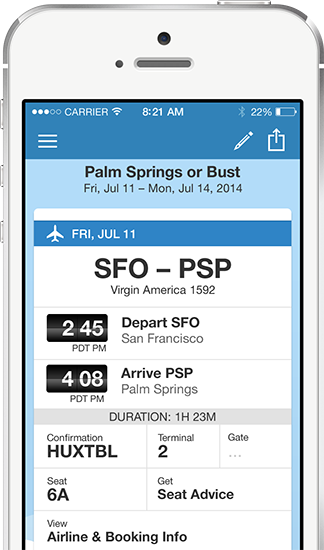

No More TripIt Pro

I really like TripIt Pro and find it to be a great way to organize my travel. Even though there are other alternatives out there, for me, it has just been one of those set-and-forget things that handles my travel plans very well. With the annual fee at $50, the inclusion of TripIt Pro as a perk of the Arrival Plus, it was a nice way to justify keeping the card. Well, that benefit is going away now also – no more TripIt Pro. Another devaluation – a loss of $50.

Increased Redemption Threshold

One of the nice things about this card was the fact that you could make a redemption at the 2,500 mile level ($25). That is a nice low threshold for redemption but now that is being increased to the 10,000 mile level ($100). That is a big blow to many travelers who would like to redeem for the smaller travel or those that may only have about 4,000 miles in the account (worth $40). Now, they need to spend more to get the miles needed to redeem for that specific travel if they have a small amount. Another devaluation as it takes away the power of a broad range of redemption amounts.

Removal of “Tourist Attraction” From Redemption List

Like I said, the Barclaycard Arrival has an incredible breadth of travel items that the redemptions work on. One of those had been Tourist Attractions. Barclay said that many were confusing that with amusement parks so they decided to get rid of the redemption item altogether to avoid confusion. A real loss for those that used their miles to help with tourist attractions, but not that big if you used the miles for some of the larger travel items like ticket fees, car rentals, hotels, etc.

When Do The Changes Occur?

The application form for the Barclaycard Arrival products is currently offline as they prep it for a relaunch with these items on the list. So, when it comes back, these changes will be in effect for all new cardmembers. For current cardholders, the card changes will go into effect in November for those who had the card before September 30, 2014 and will go into affect August 2016 for those who received the card after October 1, 2015.

Is The Card Worth It?

As a sign-up bonus, the Barclaycard Arrival Plus is still an excellent card to get. Sure the benefits of the card are changing, and not for the good, but the sign-up bonus is still worth at least $400. In my scale of what I consider worth applying for, a $400 bonus wins everytime. So, when the application link comes back online, definitely consider it for all of your travel redemption needs.

Is it worthwhile keeping the card or putting spend on it after meeting the minimum spending? I would say no, it is not worth keeping. Many people had made great arguments before all this why it was not a good card to keep (if you had to pay the annual fee of $89, which many cardholders got waived), so these changes just seal those arguments as good sense. If you like the card itself or do not want to give up a Barclay credit card, just downgrade it to the no-fee Arrival card (not Plus).

Is the Arrival+ churnable, and if so, do you know the time period when you can get the bonus again? The $100 redemption level would be the killer for me. Once the changes hit, I’ll likely cancel and move on to the Citi Double Cash Card or similar.option.