Southwest credit card offers are pretty easy to assign value too. Since Southwest has a revenue based redemption system, one Southwest point is worth roughly 1.5 cents each. That means when we see an offer of 75,000 points, it is easy to get excited since it translates to over $1,000 in travel!

Southwest Personal Cards Each Offering 75,000 Points

Link: Southwest Personal Cards at 75,000 Points (this is a referral offer that will credit a reader 10,000 points if you are approved)

Now, you don’t have to pick one personal card because it has a better offer even if you would prefer another card for the other benefits or lower annual fee – they are all at 75,000 points each.

Rules First – Can You Get One?

Before we get started, remember that all of these cards are covered under Chase’s 5/24 rule (you will not be able to get the card if you have 5 or more new accounts with any banks in the last 24 months) and you cannot get one of these if you have had a personal Southwest card bonus offer in the last 24 months.

The Southwest Offer on the Personal Cards – 75,000 Points Each!

Since they are all the same when it comes to the bonus offer, I will just put the details for each of them here. This offer is a tiered offer meaning you will have to meet two spending thresholds to get the whole bundle.

- Earn 40,000 points after you spend $1,000 on purchases in the first 3 months of account opening

- Earn 35,000 additional points after you spend $5,000 on purchases within the first 6 months of account opening

Put simply, spend $5,000 in the first 6 months with the first $1,000 of spending happening in the first 3 months and you will get 75,000 bonus points plus the 5,000 points from your spending for a total haul of 80,000 Southwest points. Not bad! Now, let’s dive into each of the cards.

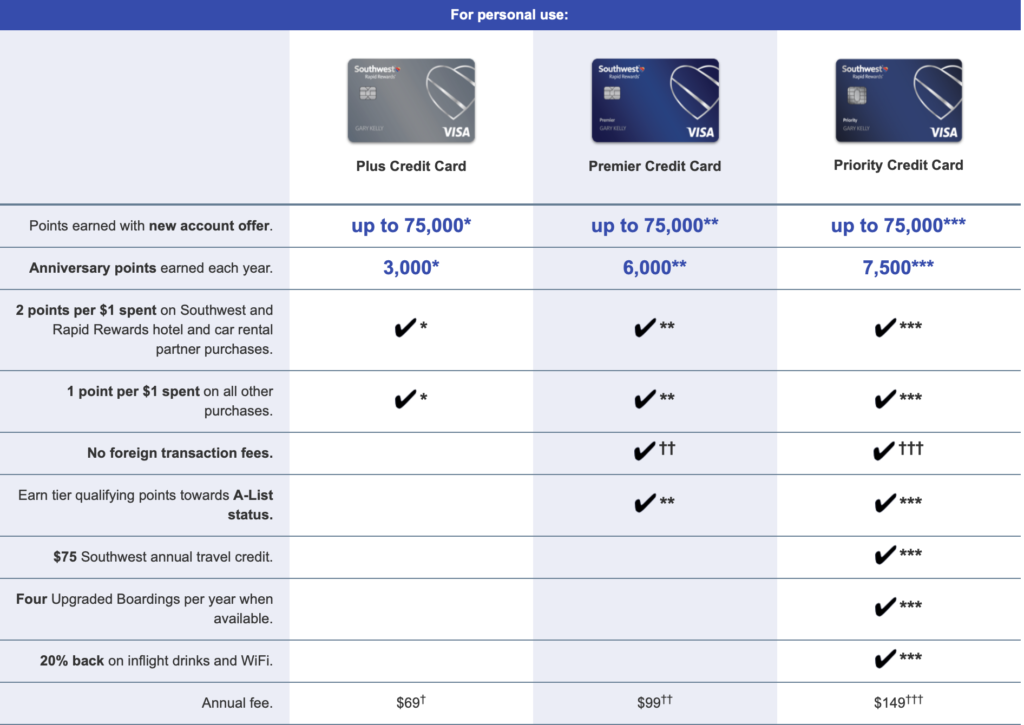

The Southwest Plus Card

This is the “cheapest” Southwest card in terms of annual fee – just $69 each year (including the first year). To help offset that, you will receive 3,000 Southwest points each year you hold the card.

The card itself is not that great in the earning department where it earns just 2 points per $1 on Southwest and Rapid Reward hotel and car rental partner purchases. You can do better with several other cards for those things.

All other spending earns just 1 point per dollar – again, there are better cards than that.

But, if you want to hold a Southwest card for generating referral offers (like this offer is), paying just $69 is an easy way to do that. You can receive up to 50,000 points per year from referrals and those count toward the Companion Pass!

Southwest Premier Card

This card is right in the middle with a $99 annual fee but also waived foreign transaction fees and the ability to earn tier qualifying points towards A-List status. In addition, the anniversary bonus is bumped up to 6,000 points each year. The earnings are the same as the Plus card.

The Southwest Priority Card

In my opinion, this is the Southwest personal card that offers the most value. It does come with a $149 annual fee but you get 7,500 anniversary points as well as a $75 Southwest travel credit each year and 4 upgraded boarding offers per year. Those could be worth up to a total of $200 by themselves and are perfect for those longer flights where you want to make sure you get the seat you want.

If you are a Southwest flyer, this would be the card I would recommend and I would hold it. The points are worth about $105 and you get the $75 travel credit as well so you are in great shape against the $149 fee – before even talking the upgraded passes.

Southwest Companion Pass

Remember that, this year, the Southwest Companion Pass requires 125,000 points in a calendar year. Fortunately, getting the bonus on any of these cards will put you at 80,000 points – just 45,000 points away. If you can get a business card before the end of the year, you are there! Otherwise, you can refer friends and family when you get your personal card and get even closer. To finish it off, use the card for daily spending. I know I said it is not good for that but if it gets you the Companion Pass, it is a great deal!

Bottom Line

If you want Southwest travel at a huge discount, any of these cards will work! Just pick the card that you feel offers you the most for the annual fee it comes with. Having all the Southwest personal cards at 75,000 points each is a nice way to pick the card for you!

I thought you were eligible for the Priority Card even if you had another personal card. Same rules with the Business Performance card.