Last week, the day came and went that Southwest had used as a day of change. April 17 was the day that Southwest said would see some dates, flights, routes, etc increasing in point requirements.

Southwest Changes

That day saw the changes occur, but without any comment from Southwest on where those changes would be seen. That left travelers to search on their own and make comparisons for the difference in points. Last year, Southwest had made the value of their points to be set at 70 points per dollar for redemptions. Of course, real-life redemption sees a few more cents per point in value because that 70 point number is tied to the base fare and the taxes are absorbed in an award reservation as well.

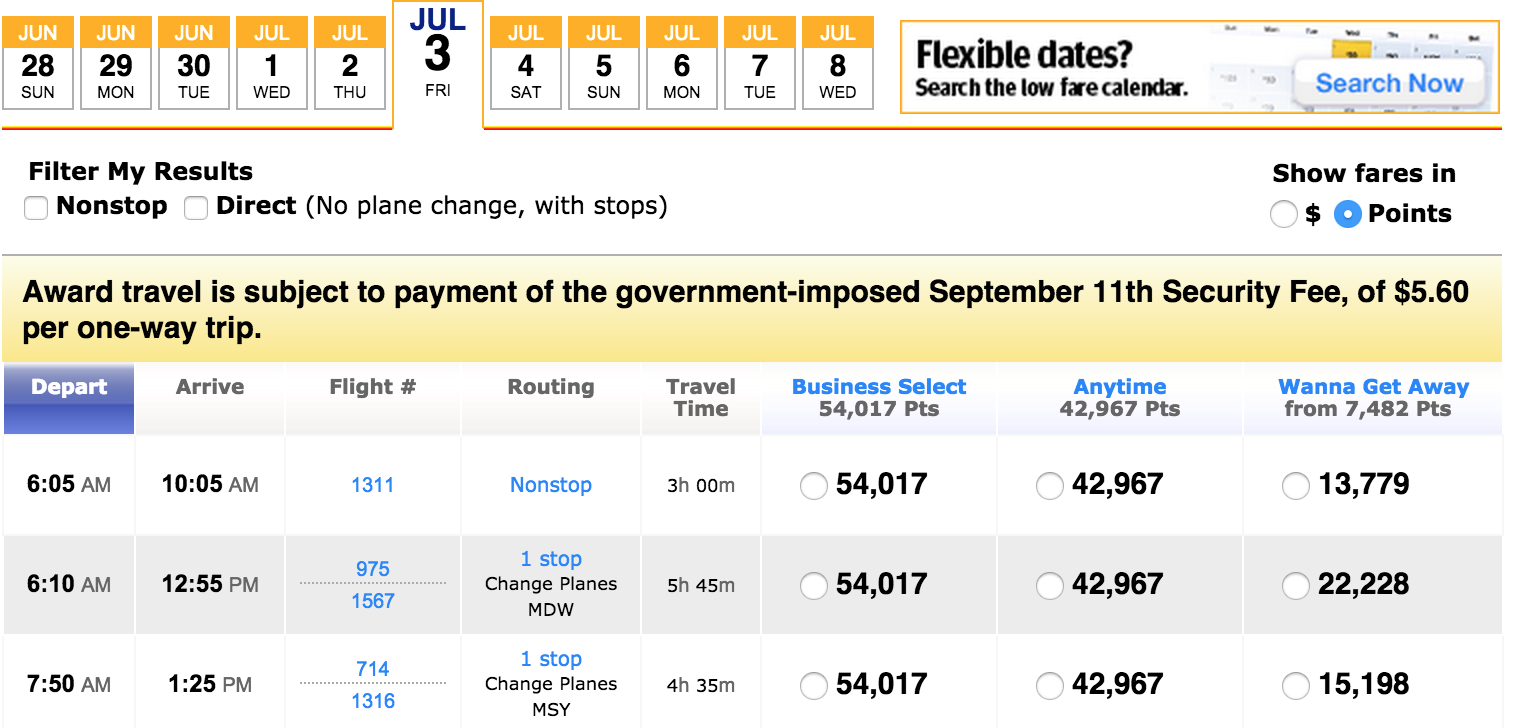

Now, several flights have changed and are now requiring 74 points per dollar and higher. The routes I have been checking were popular routes, vacation routes, and big travel days/weekends. On those routes and days, these tickets did increase in the required amount of points required.

The Loss Of An Important Feature

The important feature that Southwest lost last week was the knowledge of the fixed point redemption. With variable pricing based on parameters that only Southwest knows (at this point), there is no longer an assurance of the amount of value you are getting from your points.

Before April 17, you knew you were getting 1.43 cents per point (plus the taxes, so around 1.6 cents per point) on all of your redemptions. That made redeeming for award trips very easy. Now, we actually have to do the work of looking at the dollar cost of a flight and then subtracting the security fee ($5.60 per segment) and dividing by the required points to see what value you are receiving from the points. Of course, you don’t have to do that, but if you want to know if you are getting your best bang for your point, you will need to do the math.

Southwest used to have a great selling point in their fixed point system. You always knew what value you are getting. With this vague and still undefined change now in the system, you have no idea what your redemption value is. What is to stop them from making broader changes in the redemption value since they have no list on what has been increased? They have lost a lot of trust.

Summary

So, what does this mean for us? If these keep watering down the redemption value of their points, it may start making more sense to redeem the Ultimate Reward points through the travel redemption side with Chase for flights on Southwest. Since your UR points get 1.25 cents per point in redemption for travel, it may start making more sense depending on how much Southwest plays with the redemption value.

Not only would you be able to redeem points for a similar price, but you would also be able to earn points for your flights. Personally, I cannot see Southwest decreasing the value much more because it will begin to crowd into the Ultimate Reward travel redemption zone and Southwest wants you to use points with them, not keep them with Chase and use them for paid travel.

Did any of your flights go up in the amount of required points?

Mine went up by 15% for my common redemptions. Not happy. My card was due for renewal and I called to cancel. They tossed a few thousand bonus points my way and I took them for now….bet we will see worse devaluation within a year then I’m ditching it for good.

It is always better to get 2c cash back on everything.

Go with

Citi Double Cash

Fidelity Amex

Discover Miles

Amex Blue Cash

If you can not, then a Chase Freedom or an Amex Everyday will be next.

Ongoing Spend on Rewards cards is for Dummies