Before I get started, let me make sure I am clear – I have no affiliate links for this card (in fact, as of today, I have no affiliate links, period!). 🙂

The (Potentially) Bad News That Sets This Up

Frequent Miler said last night that one of his Chase contacts dropped word that there may be a huge negative change to cards in the Chase family.

That change would eliminate the transfer option from cards like Chase Freedom, Chase Freedom Unlimited, and the Chase Ink Cash to the powerful Ultimate Reward earning cards (like the Chase Sapphire Preferred, Chase Sapphire Reserve, and Chase Ink Business Preferred).

This may not be possible soon!

This reason this would be devastating news is that those first cards I mentioned all have native cash back features – meaning they are not actually earning Ultimate Reward points but are earning a percentage of cash back.

However, if you transfer that cash back (which accumulates similar to points) to a Ultimate Reward earning card, you have the full power of Ultimate Rewards to transfer to travel partners or to use at a rate of 1.25 or 1.5 (if you have the Chase Sapphire Reserve) points per dollar on travel through Chase.

Why Now May Be a Great Time to Apply for the Chase Ink Cash

Link: Chase Ink Business Cash Card

Now we get to the main point of the post! First of all, with a $500 bonus (which can convert to 50,000 Ultimate Reward points) with no annual-fee, this card should be at the top of any (small business owner) list! This is certainly a great card and retains the fantastic 5X bonus on office supply store purchases and telecommunication purchases that the Chase Ink Business Preferred cut.

But, there may be a time soon when the $500 earned with this card will not be able to convert to Ultimate Reward points. Undoubtedly, those 50K points are much more valuable as cash as Ultimate Reward points than cash! Since Chase may soon eliminate that transferrability, this card should be at the top of your application list!

What To Know

- Earn $500 after spending $3,000 in the first 3 months of card opening (can be 50,000 UR points if transferred to a UR-earning card)

- 0% intro APR on purchases and balance transfers for the first 12 months

- Earn 5% cash back on the first $25,000 spent in combined purchases each account anniversary year

- At office supply stores

- On internet, cable and phone services

- Earn 2% cash back on the first $25,000 spent in combined purchases each account anniversary year

- At gas stations

- At restaurants

- This card is subject to the Chase 5/24 rule (but will not count towards that total for you since it is a business card)

If you have anything that would qualify as a small business (it can be something very small), I would definitely consider applying for this credit card! There is no word yet if this bad news may become reality and if so, when, but I think this is a good opportunity to jump for this card.

By the way, if you have the Chase Ink Business Cash card, feel free to get your referral link at this Chase website and then leave it below. I will cycle it through the above public link so everyone can help each other out!

Just got this card and halfway through the MSR. Have it set up under a separate account from my other cards. So to transfer points they have to be under one account?

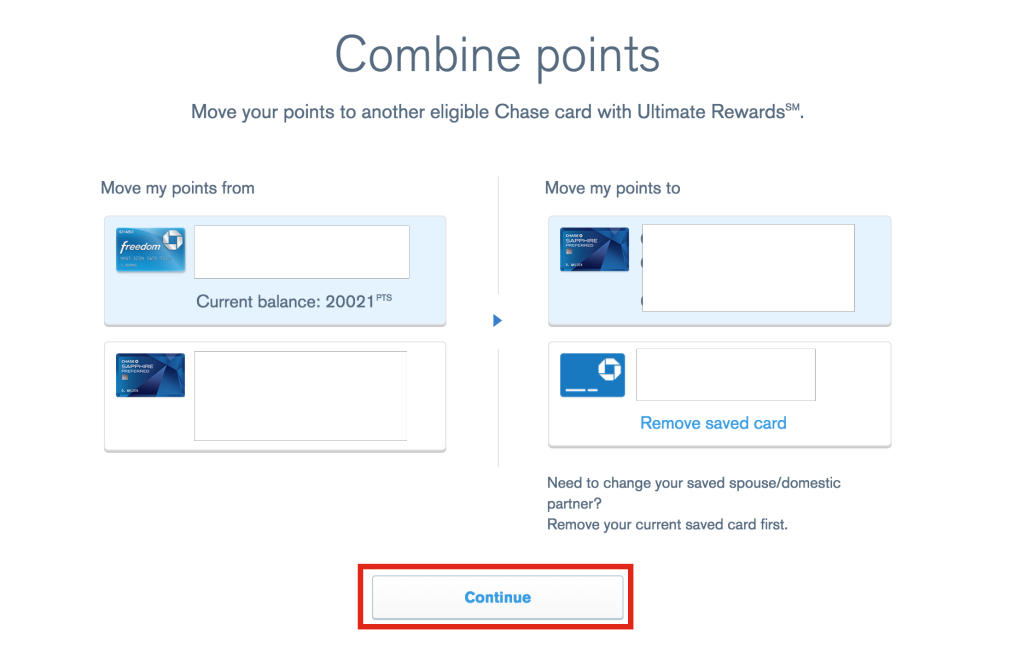

Nope! You can just add a card to transfer to under the Combine Points option. Then you can move it to any card registered to your name or that of an authorized user linked to you.

My guide on this is a couple of years old so I will be updating it shortly to make sure people know how to do this in case the hammer drops soon.

Thanks for that.

Thanks for the post! I have been hunting for information on the referrals for this card; are there none available right now? It looks like there usually are?

There normally are but they may have removed them to be able to offer this higher offer (the higher offer is likely offset by removing the affiliate payout).

Thanks Charlie! That totally makes sense; I will keep an eye on the sign up offer for hopefully getting a referral link 🙂