Today, Chase and Hyatt revealed their new business card. This is something that has been rumored and wished for – for a while now. While there are still many that would like to see Hyatt release a premium card, it makes sense for them to go with a card for their business travelers. This is especially true as hotels start welcoming more and more business travelers to their locations. So, what does this new Chase Hyatt business card bring to the table?

New Chase Hyatt Business Card

Link: Chase Hyatt Business Card (this is a personal referral link that pays me points, too)

So, what does this new Chase Hyatt Business card bring to all of us travel fans? First of all, remember that it is a business card so there are parts of it that will cater more to a business than leisure traveler. Also know that you can have the regular Hyatt credit card and the Hyatt business card and there is a reason for that (more below).

Details for the New Chase Hyatt Business Card

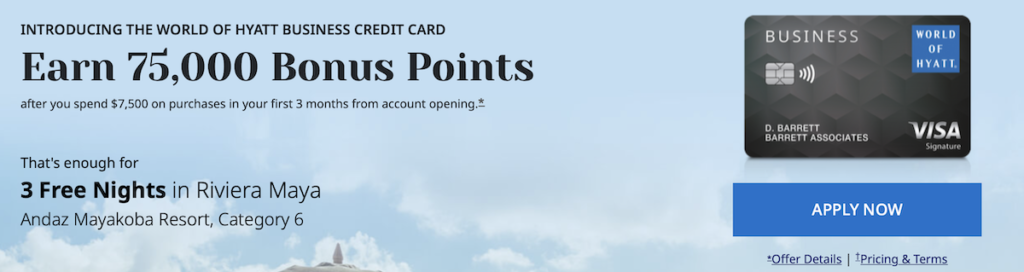

- Earn 75,000 bonus points after spending $7,500 in the first 3 months

- Earn 4X points at Hyatt hotels (including SLH properties, participating Exhale locations and eligible Lindblad Expeditions)

- Earn 2X points on your top three spending categories each quarter through 12/31/2022

- Dining

- Shipping

- Airline tickets when purchased directly with the airline

- Local transit and commuting

- Social media and search engine advertising

- Car rental agencies

- Gas stations

- Internet, cable and phone services

- Earn 2X on fitness club and gym memberships

- $100 in Hyatt credits each anniversary year (spend $50 or more at any Hyatt property and earn $50 statement credits up to two times each year)

- 10% redemption bonus (spending $50,000 in a calendar year and get 10% of your redeemed points back for the rest of the year)

- Receive Discoverist status and gift it up to 5 employees

- Earn 5 elite nights with every $10,000 you spend

- Annual fee: $199 (not waived)

So, that is a nice long list and now we will break down the 3 key perks/benefits to this card.

Easier to Earn Hyatt Globalist Status

This is the part where having the personal and business Hyatt card can come in handy. You will receive 5 elite nights each calendar year with the consumer card and earn 2 nights with $5,000 in spending.

With the business card, the elite night earning is even better – spend $10,000 and earn 5 elite nights! Remember, this is a business card so if you shoot for hitting the $50,000 amount (more on that later), you will earn 25 elite nights (there is no cap on elite night earning). If you also have the consumer card and put $15,000 in spending on that (for the free Category 1-4 night), you will earn 6 nights (plus the 5 for just having the card).

Put altogether, you wind up with 36 elite nights – just 24 nights shy of having Globalist status and definitely puts you over the Explorist level which comes with another Category 1-4 night!

So, if you can do the spending, this is a great way to bridge the gap between nights you spend on the road and that Globalist status that comes with awesome benefits – definitely more than Explorist.

The 10% Redemption Bonus

I love cards that give you points back on your points redeemed! It is a great way to encourage using the points while also improving the overall math in the favor of the traveler.

For this perk, you are capped at 20,000 points back each year (which would mean you redeem 200,000 points in a year). To activate this perk, you need to spend $50,000. Once you do that, all the points you redeem for the rest of that year will come with the 10% bonus on the redemptions you make.

There are two important things to note about this benefit – one is that you are capped at receiving 20,000 points back and the other is that you only get the bonus activated after you spend the $50,000.

So, if you can hit this spending early in the year, you will enjoy the redemption bonus for the rest of that year. I know – it may seem really like a lot to have, let alone spend, 200,000 points in a year. But, if you are spending $50,000, especially in any of the 2X categories, you will get 100,000 Hyatt points just out of that spending.

Adaptive Accelerator

This is a new feature for Chase and this is the part that targets your spending categories for that 2X area. Rather than give you 2X spending on most of the areas where businesses do spend, Chase chooses to offer more categories and then reward you based on the top 3 categories you do the most spend on each quarter.

Note that this will slip to the top 2 categories come January 1, 2023. But, for now, you can use this card as your go-to for these 8 categories and earn 2X points on the top 3 spending ones each quarter.

But, do note that even Chase has cards that offer better point earnings in some of these categories. That means that you may be better off with some of the other Chase business cards if you want to maximize your point earnings in some of those categories. However, if you are trying to get to the $50,000 spending to activate the redemption bonus, it is nice that you can earn 2X on the top 3 categories.

Gift Status

While Hyatt Discoverist status is not really a hugely valuable status (it does give you some perks but the most meaningful is the late checkout), any status is better than not having status!

This benefit lets you gift Discoverist status up to 5 people. This is a nice way to help any employees get a feel for it on those occasions they need to travel. Again, it is better than nothing and maybe a nice preview of something that would be awesome on a Hyatt premium card? (like gift Explorist to someone like an authorized user?!).

This isn’t hugely valuable but is key for Hyatt fans to be able to help out employees. Remember this is a business card so there are going to be ways it appeals more to businesses than a consumer!

The $100 Hyatt Credits

This is a $199 annual fee card that does not come with an annual free night. So, any way to offset that annual fee is nice! This is a different kind of perk where you get a $50 credit twice in a calendar year after your cardmember anniversary. This can be great for any times you want to book a Hyatt and it even works at restaurants in the Hyatt (I would imagine you need to charge it to your room for it to trigger the credit).

If you are getting a Hyatt credit card, you are staying at Hyatt hotels. So, while I would not look at these credits the same as cash, I would put something like a $90 value on them in total. That gets your annual fee down to almost $100.

Bottom Line

This is Hyatt’s first business credit card and it comes with some nice features. However, many Hyatt fans may balk at spending $199 on an annual fee that does not offer a free night. Also, the bonus categories can be on other cards with better earning rates than this one – some cards that even earn Ultimate Reward points that transfer over to Hyatt anyway.

However, if you are a Hyatt fan that wants to go to Globalist status and you need some extra help getting there, this card can definitely help you with that. There are some nice new perks to a Hyatt card – and new cardmembers get a huge 75,000 bonus point sign-up offer! That is huge and worth at least $1,300 in redemption value for many!

This card is a miss for me. I understand Chase’s theory with this card, but it will only attract a niche market without some of the key features of the personal card. In fact, excluding the elite nights for each $10K in spend, the ink preferred and Freedom Unlimited offer better earning rates. Then there’s the omission of an annual free night.