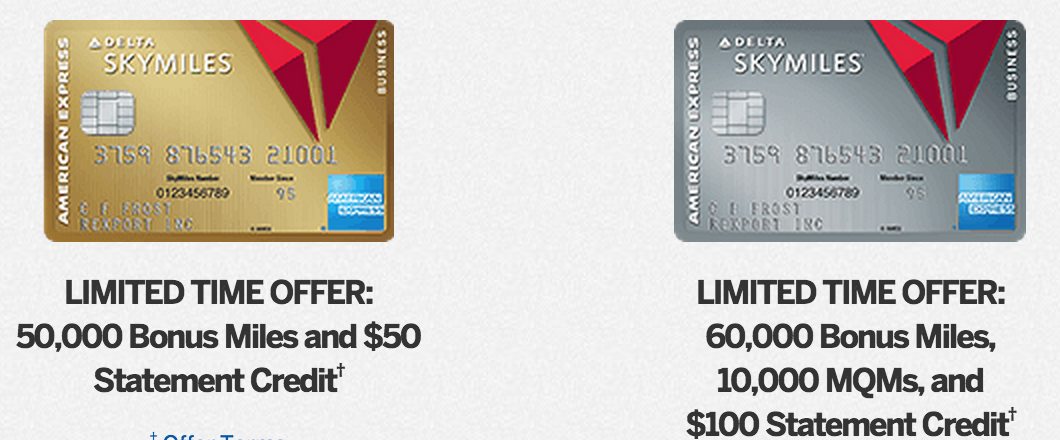

American Express has hiked up the offers on both the Delta Gold card and the Delta Platinum card (and the same offers exist on the business versions as well). I think the winner on this one is the Delta Platinum card as it now gives 60,000 miles, a $100 statement credit, and 10,000 elite miles (MQMs), but the annual fee of $195 is not waived on that one. Here are the details about the cards.

Increased Delta Amex Offer: Delta Platinum Cards

Disclaimer: I do NOT receive a commission for these links.

This offer is the same for both the business and personal card. The biggest difference between the two is this – if you have before received a bonus on the Delta Platinum personal card, you are not eligible for a bonus on it again. With the business card, as long as you have not had the card in 12 months, you are free to get the bonus again.

Offer Details

The offer is the same for both the business and personal cards.

– American Express Delta Personal Platinum Link

– American Express Delta Platinum Business Link

- Spend $2,000 on your card in 3 months and receive 60,000 Skymiles (for award travel) and 10,000 MQMs (which count towards elite status – 25,000 MQMs needed in a calendar year for the entry level, Silver Elite status).

- Receive a $100 statement credit when you make a Delta purchase with the card within the first 3 months (in the past, purchasing gift cards from Delta has triggered this as well if you do not currently have travel planned)

- Annual Fee – $195 (not waived the first year)

- Card bonus not available on the personal card for those customers who have ever received it on the Delta Platinum card before.

- Offer expires June 30, 2015

Value Of The Delta Platinum Card Offer

The Delta Platinum card is probably the best card for many Delta flyers as it does give you elite miles (MQMs) for spending thresholds – receive 10,000 MQMs for spending $25,000 in a year and receive another 10,000 MQMs for spending an additional $50,000 in a year. Not only that, but this is the Delta card with the lower fee that gives you a companion ticket each anniversary. These tickets are only available on domestic tickets but can still possess a lot of value. I just used two of mine for friends to save each of them $450 on their tickets!

Probably the best move if you are new to both of these cards (and Delta cards in general) is to apply for both the business and personal card. After spending $4,000 in 3 months across the two cards, you will receive 120,000 Skymiles and 20,000 elite miles. If you were to use Delta’s Pay-With-Miles feature (which lets you use your miles to pay for a ticket at a value of 1 cent per mile), you would get $1,200 in value out of this for paying a total of $390 in annual fees. However, if you use them for award travel, you are going to get a lot more in value out of it.

Delta Gold Cards Increased Offer

The Delta Gold cards will typically see an increase from time to time or be available to customers who are purchasing tickets on Delta.com. But, still it is nice to see another pop in the bonus in case you are interested.

Offer Details

– American Express Delta Personal Gold Link

– American Express Delta Business Gold Link

- Spend $2,000 on your card in 3 months and receive 50,000 Skymiles (for award travel)

- Receive a $50 statement credit when you make a Delta purchase with the card within the first 3 months (in the past, purchasing gift cards from Delta has triggered this as well if you do not currently have travel planned)

- Annual Fee – $95 (waived the first year)

- Card bonus not available on the personal card for those customers who have ever received it on the Delta Platinum card before.

- Offer expires June 30, 2015

Value Of The Delta Gold Card Offer

The only thing that makes this offer better than the Platinum offer is that it comes with no annual fee for the first year. This way, you are saving $195 over the Platinum card. With the 50,000 miles, you can redeem them for the same Pay-With-Miles at a rate of 1 cent per mile making for a combined value with the business and personal Gold cards of $1,000 in value at the very minimum. That is more in value than the Platinum cards when you take the annual fee into account.

Which Card To Apply For?

Given the difference on the award mile side of 10,000 miles (60,000 miles for the Platinum card and 50,000 miles for the Gold card), it comes down to the fact that you are paying $195 for those extra 10,000 miles – if you do not value the elite miles. If your goal is to qualify for or more up the elite levels, those MQMs are very valuable and getting 10,000 from a single application is fantastic.

The Elite Mile Angle

If you are interested in elite status, by all means you should plan on getting both the personal and business Delta Platinum cards and putting at least $25,000 on one of them before the end of the year. That will allow you to earn an additional 10,000 elite miles making for a total of 30,000 elite miles. That is enough to give you Delta Silver Medallion status and take care of the required spending ($25,000 in a calendar year) to wipe out the revenue requirement to maintain/earn status on Delta. So, without stepping foot on a plane, you can earn elite status or move up another level by applying for these two cards and doing the spending.

If you were able to max out the spending thresholds on both cards by the end of the year (a tall order), you would receive the following in elite miles:

- 10,000 MQMs for the sign-up bonus x2 (if you apply for both Platinum cards) = 20,000 miles

- Spend $25,000 on both cards before the end of the year = 20,000 miles

- Spend another $25,000 on both cards before the end of the year = 20,000 miles

- You would have spent a total of $104,000 in purchases across these two cards and earned a total of 60,000 elite miles, only 15,000 miles shy of earning Delta Platinum Medallion status!

No Elite Interest?

If you have no interest in elite status, I would opt for the Delta Gold cards. Sure, you will be giving up an additional $50 in a statement credit but you will not have to pay an annual fee for the first year.

Is this the best offer Amex have put out for Delta Plantinum card? As Amex got strict lately and is offering these offers who never had this personal card before, I would like to get the best offer not just settle with anything.

It is the best offer on the Delta Plat card. The Gold has had targeted offers before of 100,000 miles, though.

Great post- thanks.

Will they approve me for either of these cards if i already have the Amex Plat and the Delta Reserve? anybody know?

Yes, the three Delta cards are separate products (as are the business versions) so you can absolutely apply for these. That is as long as you are referring to the regular Amex Plat and not the Delta Plat card.

Great question @ AndyD I was wondering the same thing…?

I already have a personal Reserve card and was approved for the Platinum business card.

Why could I found the language of “Card bonus not available on the personal card for those customers who have ever received it on the Delta Platinum card before.” I used to hold Delta Options card, and cancelled 3 years ago, will that prohibit from earning the bonus from this one?