If you are traveling abroad and need to grab some local currency from an ATM, you always want to make sure you aren’t paying excessive fees – whether at the ATM or with your bank – to make it a bad deal. Well, in some countries, there is an ATM scam you definitely want to watch out for!

The Dynamic Currency Conversion Scam with ATMs

What Is Dynamic Currency Conversion?

If you have traveled abroad from the US, no doubt you are familiar with dynamic currency conversion – the process if not the name. How this typically happens is a vendor may ask if you want to be charged in the local currency or a fixed amount in US dollars. The idea is to “help” you by knowing exactly how much that purchase will cost you in your home currency.

However, this system is not a nice way to help you out but more of a way to uncharge currency conversions and making some extra money on tourists. This is why it is always a good idea to ask to be charged in the local currency instead of your home currency when on the road. And, of course, always use a credit card that does not have foreign transaction fees to save even more on fees!

To read more about Dynamic Currency Conversion, check out this page.

Why the Dynamic Currency Conversion Scam Can Be Very Bad with ATMs

With credit cards, the rate of currency may vary a bit from when you actually make the purchase due to the length of time it takes for the charge to actually go through. While most major currencies do not fluctuate strongly enough to make that big of a difference, when you do check your statement, you may find that the final charge is different from what you thought it would be.

However, with ATMs, it can be much more unfriendly. That is because when you withdraw your money, it is taken from your bank account immediately. Some banks may charge fees for this while others may not. Even for those banks that do, it really may not be that bad and actually could be better than even converting dollars to Euros at a place like Western Union.

At ATMs in Europe, specifically, the banks use dynamic currency conversion to try and “help” you know what amount you will actually be charged when it hits your bank. They tout “0% commission” which makes it sound like a deal but it is actually just a legal way to try and scam tourists and travelers.

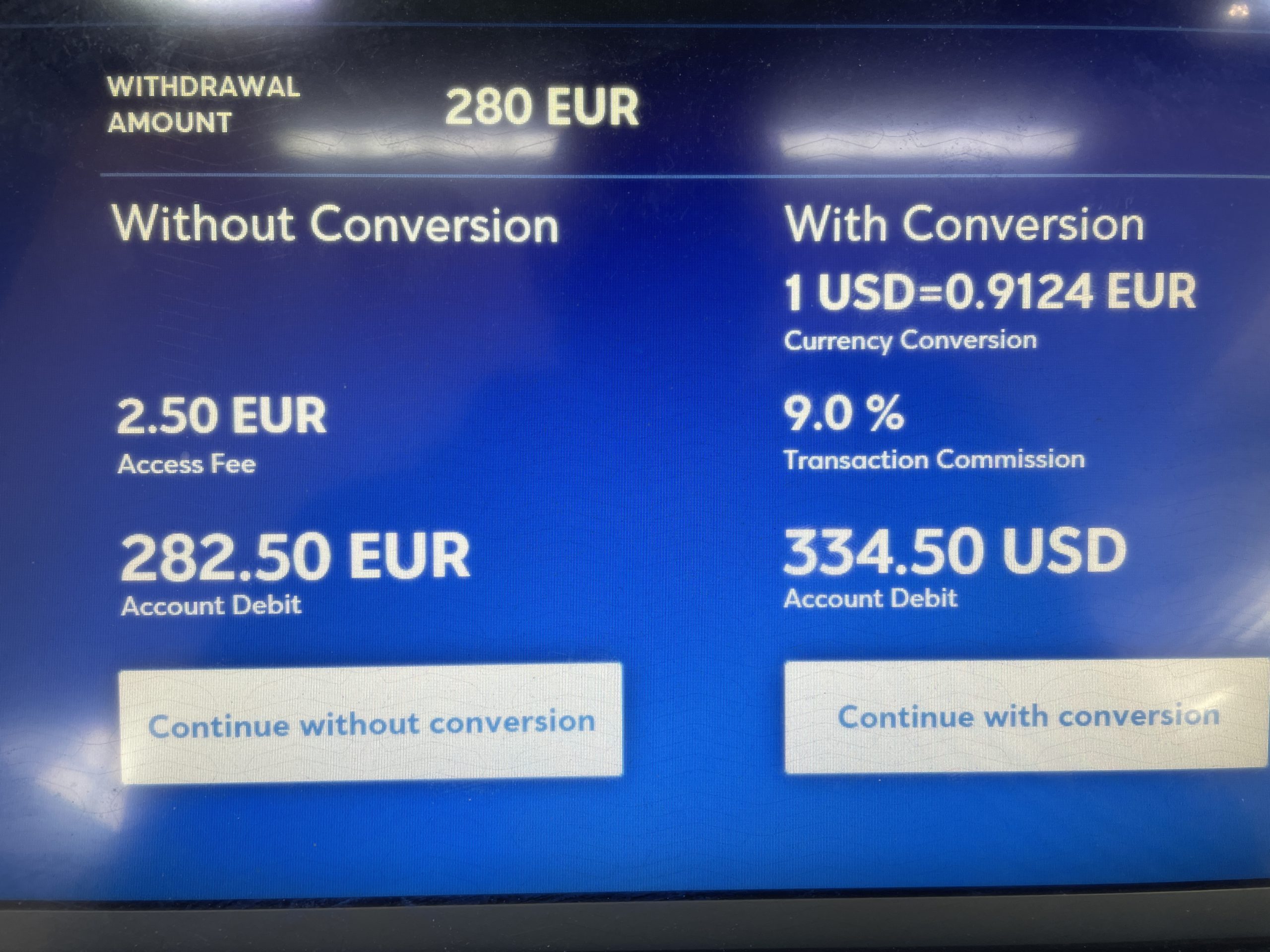

The reason is that the ATM is actually going to charge you something like a 8-12% fee to “help” you in giving you the total of your withdrawal in what it will be in your home currency. That is a huge fee when it isn’t doing anything more than using the current mid-market rate you would have the withdrawal at anyway and then charging you to show you the amount in dollars.

With the US dollar and the Euro right near parity, this is a great time to buy things in Europe (even with inflation hikes, there are still many good deals to be had). But, when you go to withdraw cash, if you opt for the dynamic currency conversion, you will end up paying a lot more for whatever you buy, thanks to the dynamic currency conversion fee.

Two Takes at Scamming You

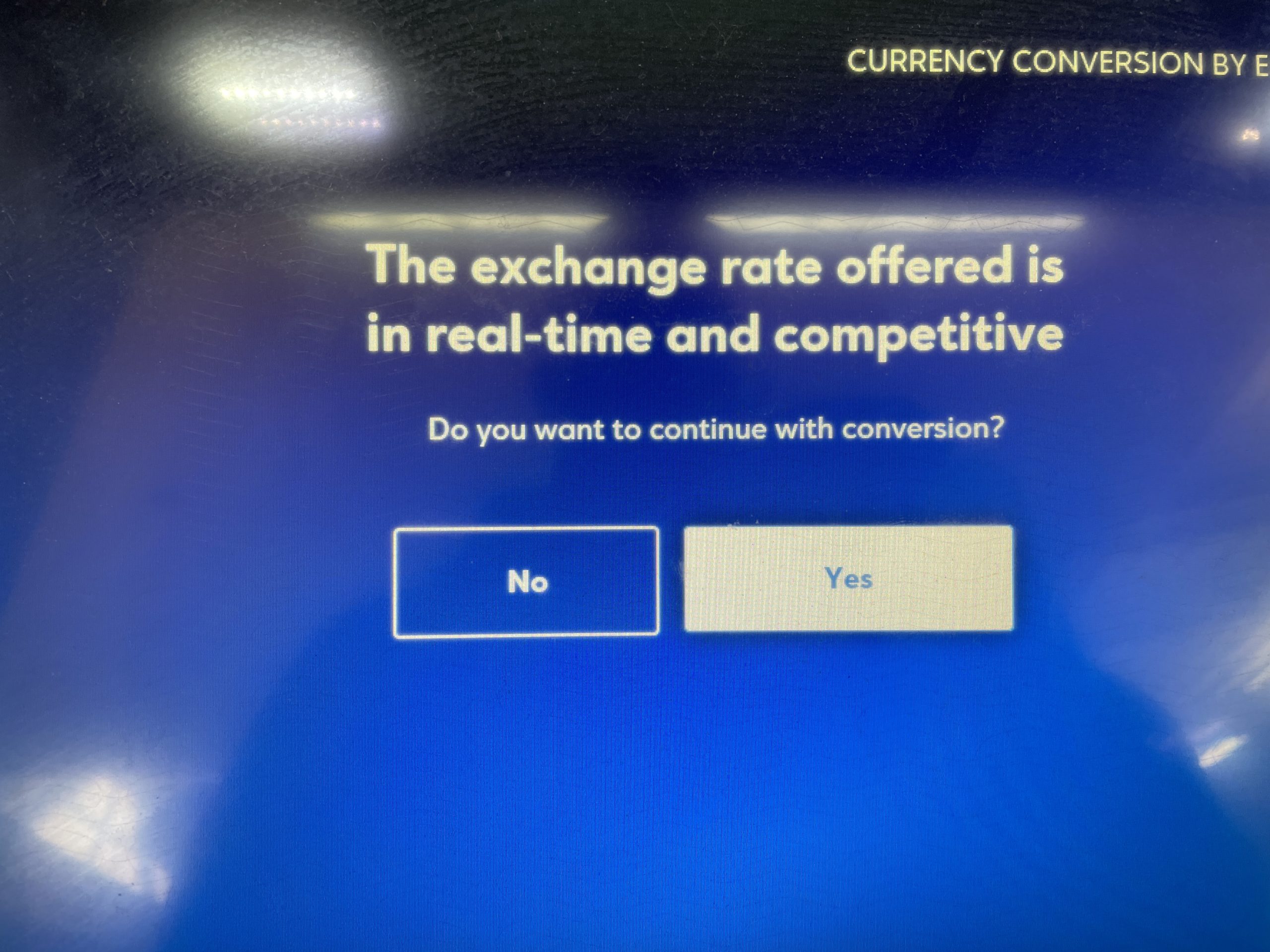

When I am withdrawing cash from ATMs in Greece, almost all of them try to scam you with the DCC fee twice. The first screen presents the “offer” to help you withdraw at a fixed and known rate. I always click the button to the left, “decline conversion” or “continue without conversion.” BUT, the next screen will say “The exchange rate offered is in real-time and competitive. Do you want to continue with conversion?” This time, the options are No and Yes – but the “YES” button is highlighted and larger than the “NO” button!

(sorry for the poor image) This is the first screen for dynamic currency conversion “offer”

The wording, button size and highlighting is all intended to make you click “YES” – even though you had already told the machine you wanted to decline the conversion. This is an outright scam and should be made illegal yet it continues all over the place.

The second screen – notice how they try to get you to hit YES on this one?

Just go with “Decline Conversion” or “Continue without conversion” and then hit “NO” on the next screen to make sure you aren’t hit with the big conversion fee.

Watch Out When Paying with Cards, Too!

It doesn’t get any better when using your card to pay for something. The credit card processing companies also use the dynamic currency conversion method so make sure you tell the cashier you want to pay in the local currency! Sometimes, they will not ask and just assume you want it in USD (or whatever your card’s currency is in). Tell them you want it in the local currency.

But, Make Sure You Use the Right Card!

Of course, if you are using a card that charges a foreign transaction fee, you are still paying a fee regardless of what you say! So, always make sure you are using a credit card that does not have a foreign transaction fee – like the Chase Sapphire Preferred, Chase Sapphire Reserve, or the Citi Premier, for some examples.

Bottom Line

Every one knows that dynamic currency conversion is a scam. The consumer organization of the EU calls it a scam (and they are partially funded by the EU). At the very least, the ATMs should no longer have the one-two punch at you and should accept your first decision.

But, just make sure you are aware of the ATMs messages and do not just go with the default choices which will hit you with the DCC fee. After all, we are in the miles and points game to save money and DCC is the opposite of that.

Great article! Thanks for sharing and making it very understandable!

Yes this is all true – and meant to catch unsuspecting travelers. In Portugal last April the ATM rate (Euros to Canadian dollars) was $1.55 but my bank charged $1.4353. That’s about 10% extra!

This just started happening in the last 2 years in Colombia as well. Although it’s just a single screen that offers the conversion.

Good advice! Happened to us in Mexico 🙁 it was the difference of 20.2 pesos to 1 dollar (via the bank) and 18.5 pesos to 1 dollar via ATM 🙁

Who would use a credit card to withdraw cash from an ATM? You use a debit card for that. Withdrawing cash from a credit card starts interest and fees immediately. But I’m glad you’re warning people about this conversion BS … some of us haven’t travelled for so long we might have forgotten about it. I use credit cards almost exclusively when travelling. I find it far easier to order some foreign currency from my bank before I leave so I don’t need to be bothered and so I don’t run into any oddities along the way.

I guess I didn’t make it clear enough – I was withdrawing with a debit card. I was only mentioning the credit card as in using it for purchases. You’re right – absolutely no way should anyone use a credit card to withdraw cash due to the cash advance fee alone!