Whenever credit card offers hit new bonus levels (and sometimes even when they don’t), you will find many blog posts about the card offers – and for good reasons. Increased bonus offers are the best ways to up your point and mileage totals quickly.

Do Not Apply For These 5 Credit Card Offers & Why

But at the same time, there are some regular offers that you should really never apply for but sometimes people miss that. Most of the advertisements you will find on the internet for travel cards will be at these lower levels as will offers that you find on airports. Sometimes, these low offers will even be pushed by certain blogs and if you are a newcomer to miles and points, it may seem like a good deal, especially since the site author is recommending it.

So, I thought I would make it easier for you by showing you 5 credit card offers you should absolutely not apply for and why.

Delta Skymiles Personal Cards – Gold & Platinum

Delta has really done a number on their award program but they still have value in the redemption of their miles. Sure, it is not like it used to be but there are still great ways to get where you need to go and do it with Delta miles.

But because their mileage requirements have gone up and will continue to go up, you should be extra cautious with which Delta offers you go for. You will need more Delta miles than you did in the old days so you should always be on the lookout for better mileage offers.

The normal offer on the Delta Skymiles Gold card is for 30,000 miles or 35,000 miles (with a $50 statement credit thrown in from time to time). For the Delta Skymiles Platinum card, it is 35,000 award miles and 5,000 elite miles

This is bad because American Express currently (though hopefully will change soon) only allows you to get one bonus per lifetime on a personal card. That means if you apply for that card offer, you are foregoing future opportunities with better offers. And there are definitely better offers that become available!

The good offer to wait for is one offering at least 50,000 miles. There have been some offers up to 100,000 miles but those have been targeted. You should wait until at least the 50,000 mile offer before you apply. For the Delta Platinum card, that one does go up to 15,000 elite miles and 40,000-50,000 award miles. If elite miles are important to you, wait until it offers at least 15,000 elite miles before you sign-up.

The better offers normally pop up around the summer time and last through early September. They have been known to pop up for a week or two during the year as well. With the award redemption changes coming again June 1, I would expect to not see an increased offer until after that.

The exception is if you absolutely need the miles right now and cannot do a lot of spending. BUT, if at all possible, I encourage you to apply for the business version instead, though, since you can get that bonus again after not holding the card for 12 months.

American Express Premier Rewards Gold

This card has a lot of value, from the airline credit to the spending categories. But, it has a miserable normal offer and should be avoided until it picks up.

The normal offer is 25,000 Membership Reward points after meeting the minimum spending. I would never encourage someone to apply for an airline card that only has a 25,000 mile bonus (except the Alaska Air card) and this should be viewed the same way – it is a terrible offer for a really good card.

This is bad because American Express currently (though hopefully will change soon) only allows you to get one bonus per lifetime on a personal card. That means if you apply for that card offer, you are foregoing future opportunities with better offers. And there are definitely better offers that become available!

The good offer is for 50,000 Membership Reward points. That is double the bonus and it pops up quite frequently. With 50,000 Membership Reward points, a lot more travel doors are opened to you and should definitely be an offer you wait for. There are also rare or targeted offers for 75,000 points and even some for 100,000 (though quite rare).

The better offers pop up throughout the year. You can check this post for information about that (though it has taken longer for the offers to appear). They have gone public a few times in the spring as well so better to wait until at least then.

The exception is if you absolutely need points right now and cannot get a business card. If you can get a business card, the Business Gold Rewards card will get you points as well and you can get this card and the bonus again after not having the card for 12 months.

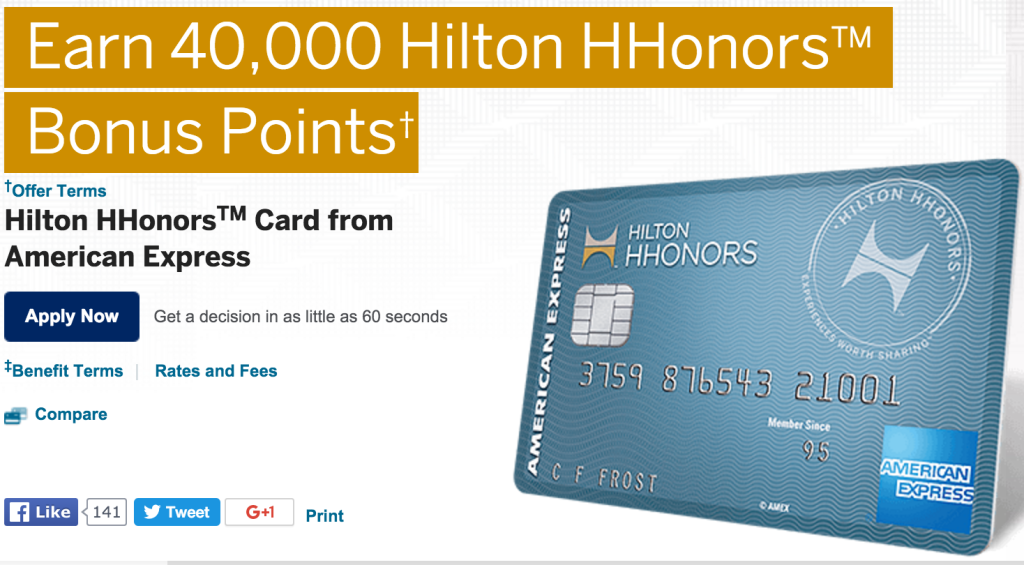

American Express Hilton Card

This is the no-fee Hilton card from American Express and is a really good card to get because of the points and the fact that there is no fee with it.

The normal offer is 40,000 points. With Hilton, that is not really enough to get with just one card application.

This is bad because American Express currently (though hopefully will change soon) only allows you to get one bonus per lifetime on a personal card. That means if you apply for that card offer, you are foregoing future opportunities with better offers. And there are definitely better offers that become available!

The good offer is 60,000 points. This offer is around a lot and definitely the better offer since it increases the offer by 50%. Another good offer is for 50,000 points and $50. See this post

The better offer is commonly available but not through the regular American Express landing page for the card. I always publish a post when it is available and where you can find it. The most recent post can be found here.

The exception is that there really is no exception. The better offers are out there almost all the time and even if they are not, you can easily get Hilton points through any of the other cards that are offered.

Chase United MileagePlus Explorer

I still value United miles pretty highly as they are a great way to get to and from Europe without putting fuel surcharges on the award tickets (try that with many options with AA and Delta – ex-Europe). Plus, there are still some great things about them as a whole.

The normal offer is 30,000 miles. There is also an offer when you search for tickets that will give you a $50 statement credit as well.

This is bad because Chase has been getting worse with tightening the reins on new card applications with their now-famous 5 x 24 rule – 5 new accounts or more in 24 months being a roadblock to getting new cards with Chase. For a long time, this did not affect co-branded cards (like this one) but there have been more reports of it happening with co-branded cards now as well. Either way, you probably don’t want one of those 5 new accounts being this one for only 30,000 miles.

The good offer is 50,000 miles. That same offer with the $50 statement credit also pops up from time to time.

The better offer has always been available as a targeted offer. But now that targeted audience seems to be pretty wide. Check this post. Either way, each spring and sometimes late fall/early winter normally sees this card go up.

The exception is if you need the miles now. No restrictions on only getting this card once in a lifetime, just one bonus every 24 months according to the terms.

Chase Southwest Premier

Getting the Southwest Companion Pass using just credit card bonuses is fantastic! Plus, you get the miles to use as well.

The normal offer is 25,000 points.

This is bad because Chase has been getting worse with tightening the reins on new card applications with their now-famous 5 x 24 rule – 5 new accounts or more in 24 months being a roadblock to getting new cards with Chase. For a long time, this did not affect co-branded cards (like this one) but there have been more reports of it happening with co-branded cards now as well. Either way, you probably don’t want one of those 5 new accounts being this one for only 25,000 points.

The good offer is 50,000 points. Actually, this should be the regular offer since it is literally around all the time. But, it is not always as easy to find as the normal offer and the normal offer is the one that earns that affiliate dollars and advertising dollars so that is the one you will see more often.

The better offer is available pretty much all the time.

The exception is that there is no exception at all. If you cannot find the 50,000 point offer right now, just wait a couple of weeks because it will come out.

Bonus! The American Express Platinum

This is our bonus card for today. I listed it separate because, by itself, it does have a ton of features before you even figure the bonus in. So you may choose to get the card for any of those reasons (in which case you should apply for this version with no annual fee the first year). But, do not apply for this card for the points right now because it is only at 40,000 points and it will get to 50,000 and sometimes even 75,000 or 100,000 points! Definitely worth waiting for!

Summary

Here is how advertising and affiliate marketing works for credit cards – the credit card company pays the advertiser/affiliate and gives the bonus to the new customer. If the credit card company has to offer the higher bonus and pay the advertiser/affiliate, that is less money for them. So, you will sometimes find a better offer than is available through affiliate/advertiser channels.

This is why you should always check to make sure you are getting the best offer for you. In this case, these are 5 credit card offers I would never recommend someone get, yet you will still likely see them in your browser ads and maybe even “suggested” by some bloggers. Now you know why you should stay away from these offers and what to look for.

Sound advice, thank you!