If you have read any mile and point blogs over the weekend, you would have noticed that one of the bullet points for the Chase Sapphire Preferred is being eliminated. This is the 7% dividend that is earned on all Ultimate Reward points earned by the Chase Sapphire Preferred card over the course of the year. Is it a big deal to lose that or no?

The Disappearing Chase Sapphire Preferred Dividend

Details

According to Chase, new customers of the Chase Sapphire Preferred will no longer receive the 7% annual dividend on points earned. For current customers, that will continue to be a feature for earning year 2014 and 2015. This means that the dividend you receive in early 2016 will be the final one for the Chase Sapphire Preferred.

What Is The Value?

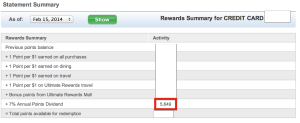

In the card’s early life, the 7% dividend was actually paid out on the bonus as well which made it really a great perk! However, that was really not supposed to be the case and that stopped a couple of years ago. Since then, it has only been on points earned by the Chase Sapphire Preferred card. That also means that it does not apply for points transferred to a Chase Sapphire Preferred account (from a Chase Ink card or Chase Freedom card, for example). But, it does include bonus categories, the UR shopping portal earning, and the refer-a-friend bonuses.

So, what is the real value of the 7% dividend? If you have read many mile and point blogs at all in the last couple of years, almost every mention of the card’s earning would include that 7%. So, if you were being told about the card’s travel bonus, it would mention that the card earned you 2.14 points per dollar spent. That was not an instant point total because that extra .14 would not come around until early the next year, but it was still nice to figure in. The question is, how much is that .xx really worth?

Dining

Let’s break it down a little to see if it really will be as much of a dealbreaker for you as you may have thought. If you used it for the monthly First Friday promotion by Chase for dining, you would have earned a total of 3.21 Ultimate Reward points per dollar. Assume that you did quite a bit of dining that day (or purchase of gift cards) and you spent about $100. That 7% dividend gave you a whopping 21 extra points! 🙂 Sure, they add up, but not if that is the earning you were doing!

Portal Shopping

But, what about portal shopping? If you signed into the Chase Ultimate Rewards shopping portal with your Chase Sapphire Preferred account, you would also get that dividend there. So, if you were regularly shopping at places that earned 7 points per dollar, that could really add up from that. Let’s assume that you spent $3,000 per year through the mall at retailers that gave 7 points per dollar. You would have earned a total of 21,000 Ultimate Reward points from those purchases and your dividend from that would have been 1,470 points. Better, but still not worth crying over losing.

Travel

Of course, the card also gives 2 points for travel and that word travel covers a lot of elements of the experience. So, let’s assume that you do a fair amount of travel and that amount comes in at $5,000 in a year. With the bonus category, that translates to 10,000 points and the dividend comes in at 700.

Everday

What if you use the card for everyday purchases? If that is the case, let’s assume that you do some extra spending for the sake of earning points (through the purchase of gift cards, Amazon Payments, etc) and your everyday spending. Putting it all together, we will assume you spent $1,500 per month on those types of purchases. That brings in 1,500 points per month with our dividend bringing in an extra 105 points.

Totaling it up

If we bring all of those amounts together, it shows that our annual 7% dividend is 2,500 Ultimate Reward points. If the value of your UR points is 2 cents per point, it means that the loss of that 7% dividend will cost you $50 in value each year. Obviously, the above numbers will vary greatly from your personal scenario, but it gives you an idea of what you may miss out on.

In my case, because I had some refer-a-friend bonuses last year as well as a good bit of high earning in the rewards mall, I got a bonus of 5,600 points. That is a nice little thing to have and had a value of around $100, which basically took care of the annual fee ($95).

The Trade-Off

At the same time as Chase announces that they will be taking away the 7% dividend, they also announced that the Chase Sapphire Preferred will begin to carry primary rental car insurance. As someone who dropped their United Explorer card last year (which did carry it), I am excited about it picking that up. Primary rental insurance means that if you are involved in an accident, your primary car insurance does not even need to know about it.

American Express offers their insurance for $19.95/$24.95 per rental that is pretty great and lets you not have any worries as well. If you are renting for longer than a 15 day period, you may want to consider that as the Chase Sapphire Preferred only covers for 15 days (Amex covers for 60 days).

Summary

So, is it really a dealbreaker for you to lose the dividend? I realize there are some of you who may be earning hundreds of thousands of UR points per year, and that will be huge for you. But for the majority, will it really be that bad? What do you think?

A BIG deal? Even if someone’s earning 200,000 points a year (and I’ll bet that’s on the high end) that’s only 14,000 points.

The primary car insurance coverage could be worth way more if you end up having to use it.

I absolutely agree.

And if you don’t really rent cars? I just lost 4-5k points a year and gained pretty much nothing. I rent maybe 2-3x a year for a few days each time, if not only a day.

I was already debating switching over to cash back primarily, this finally gives me a reason, so I have a year and a half to hit Chase hard and get a lot of UR points.

It is a disappointment for people like you. I would imagine that it could be enough of one to have you not renew when it disappears. Maybe if enough people do that, Chase will add something else back in to lure people back.

I agree with Pain; I never rent a car, so this is a net loss for me, and one that may have me thinking twice about renewing.

So just how ‘new’ of a customer do you have to be to have not made the cut off? I only ask because I just applied (and was approved) for CSP over the weekend. I remember seeing info about the 7% during the application process, but because it was during an app o rama thought that maybe I had misread something. Nope. I just got an email today stating that my card was on it’s way, and in my terms and conditions it goes into great detail about when, how, and on what type of points I will earn 7% back. Did I somehow make the cut off for customers who will still get the 7%?

I believe the cut-off date was July 20th. If you have that in your marketing material for the card, you should be fine. If it is in your cardmember agreement, you are definitely fine. Congrats on getting in under the wire!