There is a new transfer bonus out and it creates an interesting way to convert Ultimate Reward points into AA miles. But, should you do this?

How to Convert Ultimate Reward Points to AA Miles

Last month, AA and SPG had a transfer bonus (like they do every year) to convert with a 20% bonus on transferred points. Because SPG gives a 5,000 mile bonus on blocks of 20,000 points anyway, this was a very decent deal.

But, other hotel transfer point options are not so lucrative. Still, when a bonus comes, it is always worth taking a look to see if it works for your situation. This new AA – hotel point transfer promo actually lets you convert Ultimate Reward points to AA miles as a result.

The Transfer Promo

Link: Hyatt Promo on AA Transfer

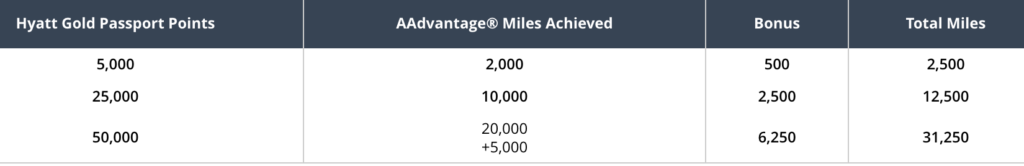

First of all, the promo that makes this better than normal is on transferring Hyatt points to AA miles. Hyatt is giving a 25% bonus plus a 5,000 mile bonus when you transfer 50,000 points. Here is how it works out:

This promo is running from September 15 – October 14, 2016. View this page for all the terms and conditions.

Convert Ultimate Reward Points to AA Miles

So, with this above promo in mind, let’s look at the part about how to convert Ultimate Reward points to AA miles. Since Hyatt is a transfer partner of the Ultimate Rewards program, you can instantly transfer your Ultimate Reward points to Hyatt in 1,000 point increments at a rate of 1:1.

If you were to maximize the transfer promo, you would want to transfer 50,000 Ultimate Reward points to your Hyatt account. Then, transfer those 50,000 Hyatt points to AA for a total of 31,250 AA miles. This works out to a rate of 1:0.625 for Ultimate Rewards to AA miles. Yes, you will be losing out on the transfer to AA but it is possible to use this to convert Ultimate Reward points to AA miles at the best rate available right now.

Is It A Good Deal?

This really depends on your needs. For most people, I would say NO, it is not a good deal. Hyatt points are incredibly valuable and 50,000 Hyatt points would give you 2 nights at a Category 6 hotel or 10 nights at a Category 1. Or you could transfer those Ultimate Reward points to United and get 2 roundtrip US tickets.

Also, AA has devalued their premium redemptions so their program is not as good as it once was. Having an extra 31,000 AA miles is good but does not go as far as it used to.

On the other hand, Citi has cracked down on their bonuses for cards so that you can only get one card in each family per 24 months. Also, no other bank program transfers into AA miles. The only program that does is SPG. While they are 1:1 (with a 5,000 mile bonus when transferring a block of 20,000 points), SPG Starpoints are harder to come by than Ultimate Reward points.

It is incredibly easy to accrue Ultimate Reward points thanks to great sign-up bonuses and heavy earning rates on their cards (like the 5X on the Chase Ink cards at office supply stores). At those levels, it would put them more on par with SPG points when it comes to their value by ease of earning them. In that case, it could make sense to convert your Ultimate Reward points to AA miles if you value your miles more than hotel points.

In the end, look at your own situation to see what is best. The transfer rate is not optimum at all but it is still a way to transfer UR points to AA miles at the best rate available right now.

I was thinking about transferring UR to your Marriott account, then, since you’ve linked your Marriott and SPG accounts, you transfer them to SPG. Then, from SPG to AA. But I believe your path through Hyatt is better.

For example, 104,000 UR points from signup bonus plus minimum spend of Chase Sapphire Reserve, transferred to Marriott. It’s 3 to 1 ratio from Marriott to SPG, so 34,000 SPG points. Tranferring to AA with the 5,000 point bonus gives you 39,000 AA miles.

If I did my math correctly, going through Hyatt with that same 104,000 UR points gives you 55,600 AA miles.

AActually:

Hyatt Passsport: 104,000 / 2.5 = 41,600 AA Miles

AA Mile 5,000 bump: 41,600 + 10,000 = 51,600 AA Miles

AA Mile Bonus: 51,600 * 1.25 = 64500 AA Miles

Tax law about businesses in the USA is ever changing. As with everything else, it is only the mindset of the entrepreneur that dictates the success and failure of a company.

Typically, this works well if we are involved in a solid networking and we reciprocate, by referring clients to those other

businesses.

Then send the postcard to all of the addresses in your area, and try

to draw customers in. Without enough traffic, you will never have enough

customers and this means you won’t be making enough money.

When travelling, for instance, it would be possible to login to your accounting database and enter transactions on the road.