Recently, Chase Ultimate Rewards lost Korean Air as a transfer partner, to the disappointment of many people who enjoyed transferring points for premium cabin redemptions on Korean and other Skyteam partners. Today, that loss has been replaced with a new airline – JetBlue. But, I find this addition to be a little on the “meh” side, depending on what Chase cards you have.

Chase Ultimate Rewards Adds JetBlue As a Transfer Partner

As with other Chase Ultimate Reward transfer partners, JetBlue is a 1:1 partner at a floor of 1,000 points as the minimum amount.

JetBlue has a co-branded card by Barclays but is also a transfer partner of both Citi and American Express. The American Express transfer ratio normally puts JetBlue at a disadvantage, except when they run transfer promos like they have going on now. My guess will be that this rate from Amex will be the new rate going forward, thanks to pressure from Chase being a 1:1 partner.

Transfers from Chase Ultimate Rewards to JetBlue can happen starting today, so if you need to top up an account for an award, this is a good way to do it quickly and easily.

The “Meh” Part

JetBlue points are a revenue-based currency. This means you are pretty much always going to get about 1.5 cents per point for your JetBlue points. If a trip costs $100, you will pay about 6,300 points (plus the $5.60 for a non-stop) for that award.

Use points to offset the cost

If you have the Chase Sapphire Reserve, you already can redeem your points with JetBlue (or any airline) at a rate of 1.5 cents per point. This means you can do the same thing you would do by transferring them – but you would actually earn JetBlue points if you go this route (since it counts as a revenue ticket).

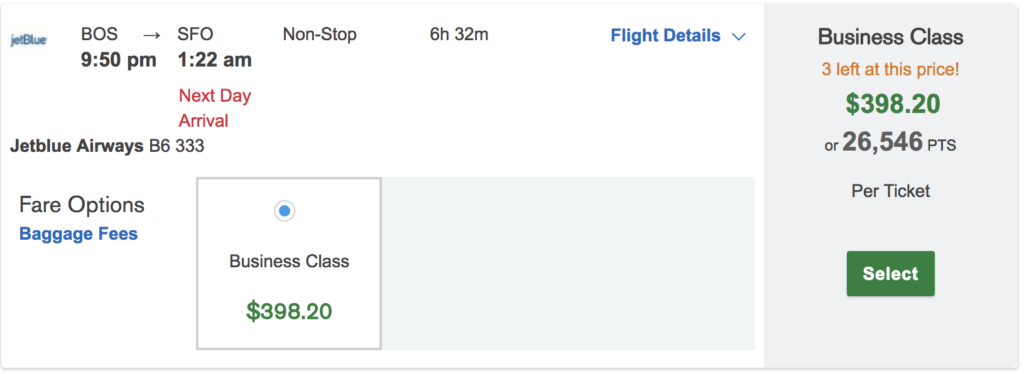

In fact, if you wanted to redeem for JetBlue Mint (their business class), you are better off using Chase Ultimate Reward points to book that directly (via a Sapphire Reserve account) as you will save points over booking it with JetBlue points. This is because JetBlue gives a poorer redemption value when you redeem for JetBlue Mint.

Personally, I like the addition of JetBlue to the Chase stable of transfer partners because it gives an easy way to add points for an award (since buying JetBlue points is just ridiculous) and it would allow me and others to save our Amex points for redemptions on one of their many other partners. But, I still look at the addition as a bit on the weak side, if it was meant to replace Korean Air.

The only times I would advise someone to use Chase points for a JetBlue award over redeeming Chase points directly is if a) they don’t have a Sapphire Reserve card (because other cards only have a 1.25 cents redemption rate) or b) if they need to top up for an award.

Correct me if you think of other good uses on that! I had hoped there would be a new partner and expected one – just kind of disappointed it is JetBlue.

Featured image courtesy of Chris Parypa Photography via Shutterstock

Wouldn’t it be better value through the portal because you would earn miles on those tickets where awards book on the B6 website would not?

While adding jetBlue as a Chase UR partner isn’t a home run, per se, it does position Chase (more than ever) as the “go to” credit card provider in the USA for travel rewards. As mentioned, this doesn’t really help CSR (Chase Sapphire Reserve) card holders, but CSP (Sapphire Preferred) holders will benefit.

TrueBlue points can be redeemed for flights on Hawaiian Airlines, which is also a benefit.

This move by Chase will increase the number of credit card holders who can/will transfer points to jetBlue and, as mentioned, also pressure/force Amex to match the 1:1 transfer ratio. Both of which are wins for jetBlue. So Chase and jetBlue gain, while Amex loses. This move also diminishes the Barclay JetBlue Plus MasterCard, which I got earlier this year. Aside from the 10%-back on award redemptions, I see no reason to keep the Barclay card any longer. So Chase gains while Barclay loses.