Last year, American Express started using a pop up for card applicants to advise them that they were not eligible for the sign-up bonus and forcing the applicant to acknowledge that they would not get the bonus if they wanted to continue.

Chase Starting to Show an “Eligibility” Pop-Up

That was a nice move but it has not been flawless (some cardmembers found that they were told later they were ineligible even after being told they were eligible). Still, for an issuer that has a “once-per-lifetime” policy on card bonuses, it is a nice way to know if you are going to get a bonus or not.

Now, according to Doctor of Credit, Chase is showing a similar eligibility popup for the Marriott Business card. It lets the applicant know that, per the terms, they are ineligible for the sign-up bonus and do they want to continue with the application.

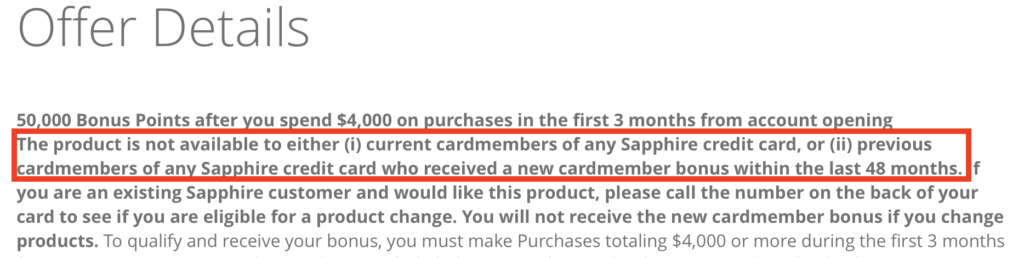

Chase uses a 24 month eligibility rule (or 48 months with the Chase Sapphire family of products) so you must not have received a sign-up bonus on that card (or, with some cards, the family of the card) for 24 months and you cannot currently hold the card. They also impose their dreaded 5/24 rule that prohibits applicants from getting a card if they have opened 5 or more new accounts (with any bank) in the last 24 months.

Why This Could Be Good News

Why This Could Be Good News

The reason this could be good news, besides the nicety of being informed before you apply if you are eligible or not, is that Chase had been behind Amex in a key way. American Express will let you get the card if you are ineligible for the bonus, which is good news since some of their cards are valuable enough without a bonus. Chase had not allowed that. If you were ineligible, you weren’t getting the card.

That can be unfortunate now that they determine eligibility for a card to include bonuses on cards in that same card family (if you have had a bonus on a personal Southwest card, you cannot get the very nice Southwest Priority card, even just for the features).

If Chase is going to start using a pop-up and allowing customers to proceed even without the bonus, that will be a nice perk for customers that want a specific Chase card just for the ongoing value.

HT: Doctor of Credit

Where and when do you see this pop up? After you hit “submit”?

According to what I have read, it is.

So if y hit submit they you are appling whether you are getting the bonus or not?

So if y hit submit they you are applying whether you are getting the bonus or not?

[…] I predict this will expand, sad! Chase Starting to Show an “Eligibility” Pop-Up – Why This Could Be Good News. […]