Things have really changed for the credit cards with heavy emphasis on travel – since travel has been mostly non-existent and banks want to keep customers. Chase has been at the front of adjusting to the changing landscape by providing some great benefits for Sapphire card holders. Here is why I am using one of those benefits to pay for future travel.

Using Chase Ultimate Reward Points for Groceries – For Travel

Using Chase Ultimate Reward Points for Travel

First of all, prior to the coronavirus halt on travel, Chase Ultimate Reward points could be used directly for travel at 1.25 cents per point (for certain Chase business cards and the Chase Sapphire Preferred) or 1.5 cents per point (with the Chase Sapphire Reserve). This was a great way to pay for travel, with points, while also being able to earn miles on those flights.

I used this a lot, especially on certain Turkish Airlines routes in business. I could “buy” the one way ticket for $900 and earn a bunch of miles, using 60,000 Chase Ultimate Reward points (since I have the Chase Sapphire Reserve) or I could have transferred 70,000 Chase UR points to United to redeem for an award ticket – is there any question which way I went with that? 🙂

It also worked for cheaper flights that I could throw 4,000 – 7,000 Ultimate Reward points at. Seriously, this perk was a major reason we kept the Chase Sapphire Reserve.

Using Chase Ultimate Reward Points for Groceries

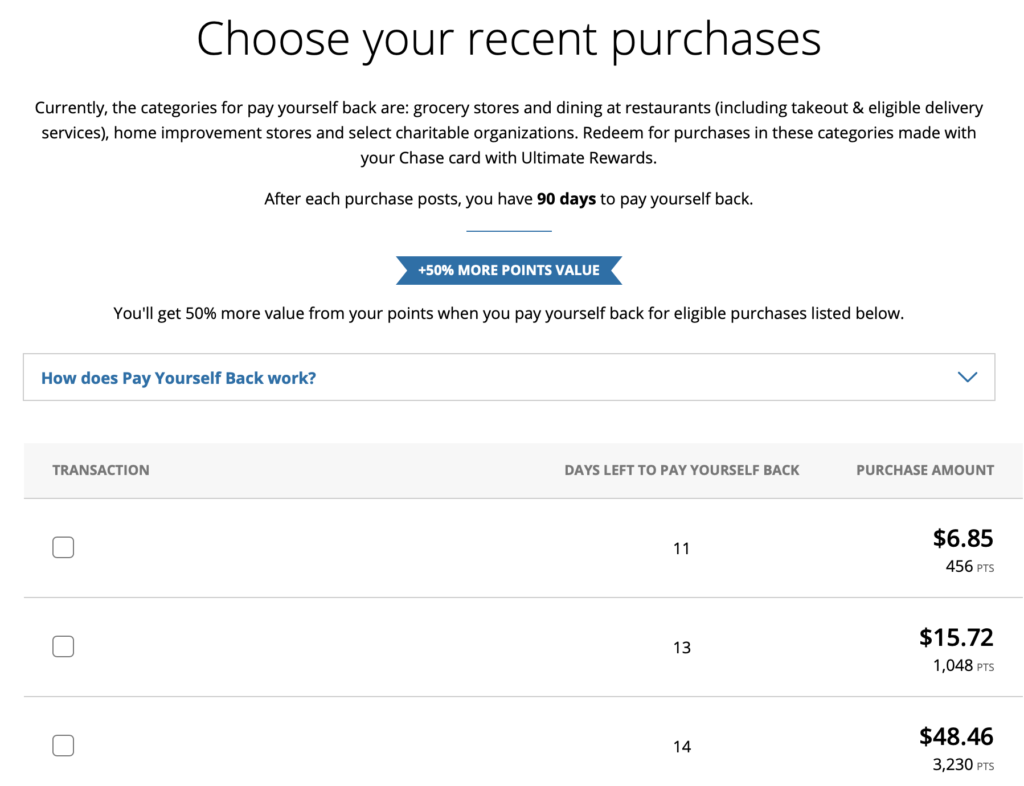

Earlier this year, Chase opened up that awesome benefit to let your Pay Yourself Back on dining, grocery store purchases and hardware purchases. This meant that I could redeem my points at 1.5 cents per point (only for Reserve cardholders – for all others, it is 1.25 cents per point) to cover purchases made in those categories – up to 90 days after the purchase was made.

All of a sudden, this new math made it a bit harder to think about transferring Chase Ultimate Reward points over to United, let’s say, for a business class ticket that required 70,000 miles. Those same 70,000 miles could cover $1,050 in grocery store spend and let us not pay for those groceries. So, is that 9 hour flight really worth $1,050 in “free” groceries to me?

Even better was that Chase was letting Reserve cardholders earn 5x points on those same groceries, through June 30! And when I pay myself back for those groceries, I do not lose that bonus! So, let’s say I spent $100 on groceries. I would earn 500 points, worth $7.50 when I pay myself back for those groceries – an easy 7.5% discount on grocery purchases I was already going to make!

Combining for Future Travel

Now, here is how I am paying myself back on groceries to pay for future travel. I am no longer using Chase Ultimate Reward points to pay for travel through Chase – it just does not make sense for a couple of reasons.

One is that I do not want to deal with a middle man on airline tickets anymore, I want to book directly with the airline. The other is that I can earn 3X points on the outright travel purchase while paying myself back on past grocery store purchases!

So, we have some upcoming travel later this year. I purchased the tickets with my Chase Sapphire Reserve card – earning 3X points per dollar. After, I went back into my Pay Yourself Back part of my Chase app and began to select the grocery store/dining purchases I made in the past 90 days until I selected enough to pay for the travel I just booked.

Looking at the Math

Let’s take an example of spending $700 on groceries in April-May and let’s say the trip costs $1,000. Here is how this works for me:

- $1,00 on groceries x 5X points = 5,000 Ultimate Reward points

- Buy $1,000 in airline travel x 3X points = 3,000 Ultimate Reward points

- Redeem 66,000 Ultimate Reward points on the groceries = $1,000 statement credit

- I earn 8,000 Ultimate Reward points on those original purchases

- I will earn 10,000 airline miles on the flight (need 55,000 for business class USA-Europe)

Win-win!

How to Use Chase Pay Yourself Back

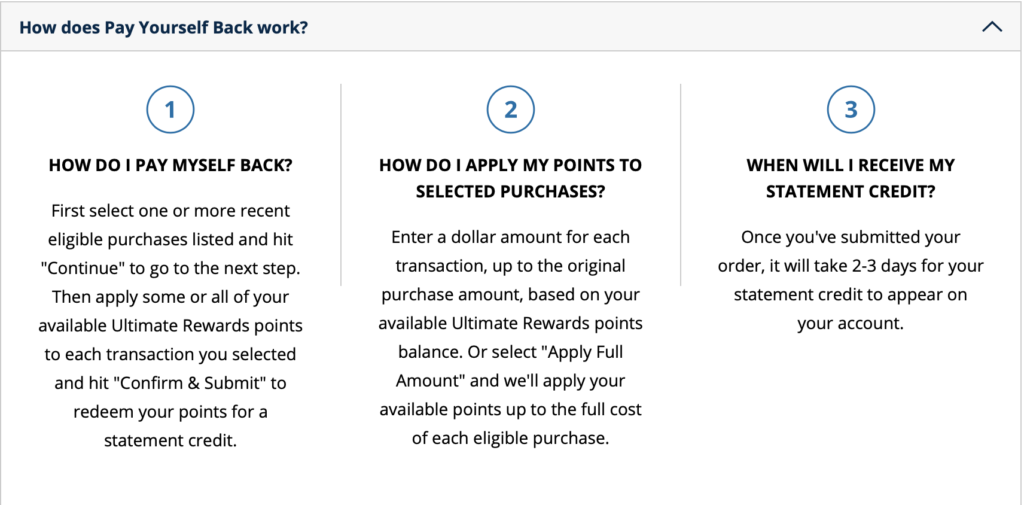

They have made this very easy to use! First, login to your Chase account, either on a computer or on your smartphone app. There you will see the option to Pay Yourself Back. This will show you the list of eligible purchases. Just go through and select each one you want to receive a statement credit for.

They have made this even easier by showing you the exact cost and the exact amount of points required to get the credit. Then you select if you want to refund it in full or partial for each amount. Then go ahead and submit it! In most cases, I get the statement credit the next day, if not, the day after that.

Bottom Line

This is a great way that Chase had adjusted to the current situation to continue to provide value to their cardholders. For me, it works awesome and I am happy to keep using my Chase Sapphire Reserve card for all kinds of spending, even some spending I may have put on other cards.

While I know that not everyone will use this benefit this way (or at all), for me, it has worked perfectly to still let me get “free” travel while earning even more along the way.

I’m doing the same… The math/logic works for me!

Now eventually, when all the crazy is over… I’ll probably go back to using some of my UR points on Hotel stays. However, I’ll most likely stick with purchasing my airline tickets directly with United.

Me too

My wife was not pleased that I took a $1000 grocery credit off our CSR instead of saving all our UR points for somewhat distant future airfare and hotels. The quick easy cash in hand is more my preference in Covid world. Perhaps my wife will see your approach as a better compromise where these points we saved for travel get used for travel.

In cashing out all my UR points. This is the best thing to happen in the miles world in a while. By the time travel returns to normal, my UR stash should be replenished.